The Weekly Hark - 6 May 2023

Debt Ceiling X date, Fed pause, ECB on a journey to restrictive....

Will the Fed cut this summer?

The market believes the Fed have paused, but JPow hasn't awoken the animal spirits just yet …. global growth concerns (US recession, China re-opening support for commodities fizzling out) keep the USD from finding the middle of the USD smile, especially as regional bank stocks saw a wave of liquidation. As soon as First Republic was rolled into JPM, PacWest became the next in focus. Furthermore, the Fed have not confirmed the end of their cycle, JPow was clear that he disagreed with the cuts priced into the curve (one full cut by July pre-NFP) and even emphasised the probability of more to come as sticky core inflation, historically tight labour market and absence of recessionary data (in the short term) will keep the Fed from cutting (and they may even need another hike) especially if the regional banks are successfully ring-fenced.

5 important pieces that captured the key narratives of last week... Debt Ceiling X date, Fed pause, ECB on a journey to restrictive....

Regional Bank Stress (FRC rolls into PacWest): Saxo Bank - Equity update: US banks, European earnings, and Apple earnings

Fed (pause but options still open for more): Pepperstone - Interest rates markets betting on a Fed pivot – rate cuts incoming?

ECB (On a journey continues): SEB - ECB hikes by 25bps hike, intends to cease APP reinvestments in July

NFP (still doesn’t pay to bet against the ): Mish Talk - Jobs Rise by 253,000 and the Unemployment Rate Dips to 3.4 Percent in April

Debt Ceiling (X date brought nearer by Yellen): JP Morgan - Global FX : Fearing fear itself

Focus turns to US CPI, Debt Ceiling meeting between Biden/McCarthy, BoE, Turkish Elections and of course, bearish May seasonals….

Timothy Ash: Turkey - critical election looms.

Pepperstone: Trading The May BoE Decision: More Hikes To Come From The Old Lady

Adam Mancini: Is "Sell In May" Already Done? May 8th Plan

The Bondbeat is an exceptionally consistent daily substack that focuses on what is driving the curve (2y to 30y) and filters the streets research into one concise piece. Looking for reasons behind the 5s30 inversion, what the Fed speakers have said, how did the auction impact prices and what data is the fixed income market focused upon . . . the Bondbeat is written by an ex-sellside independent rate strategist and macro enthusiast that consumes much of the streets research and synthesises it into one extraordinary daily piece.

Subscribe below or follow in the Harkster ‘Feed of the Week’ channel.

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

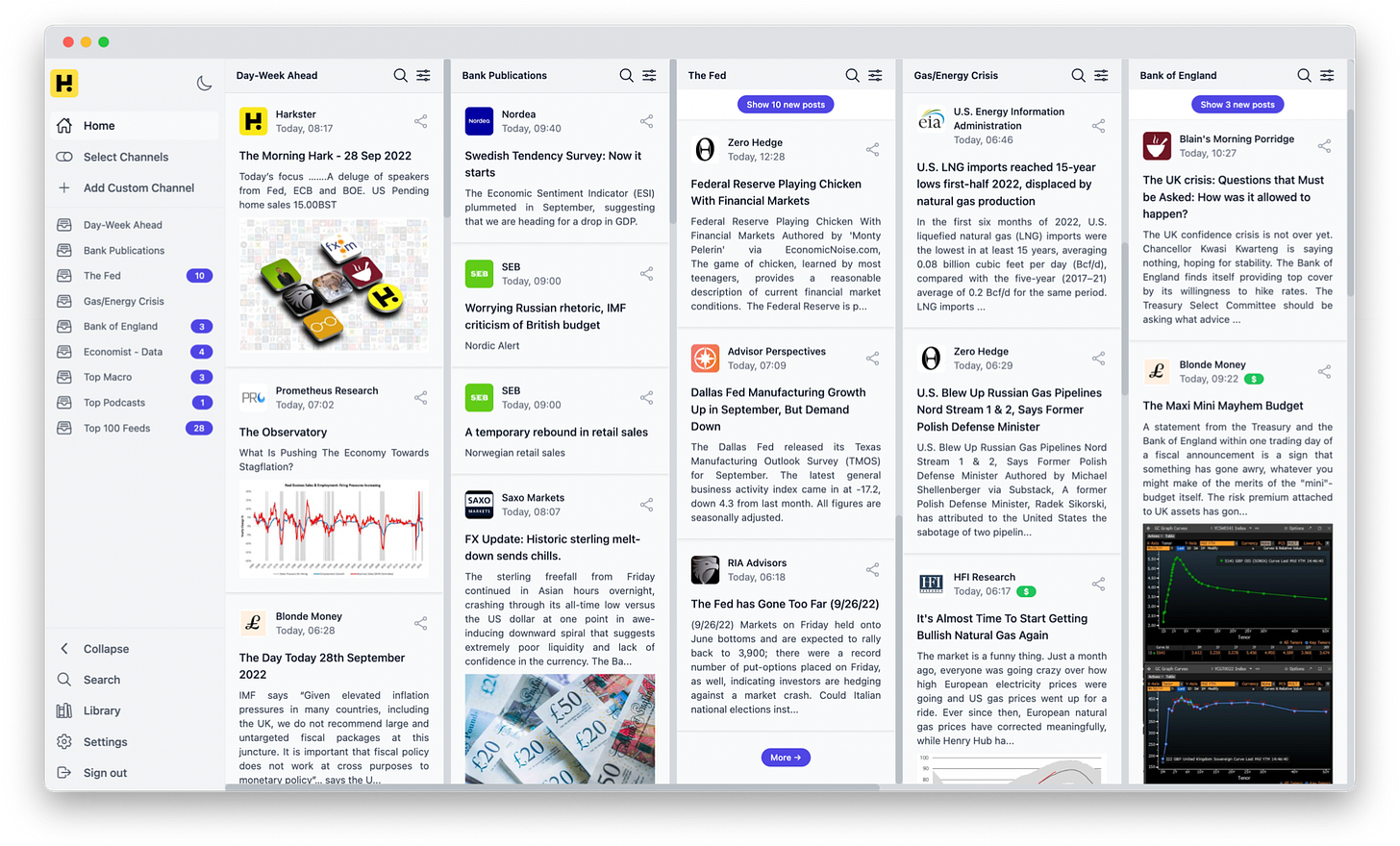

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.