The Weekly Hark - 6 Aug 2023

The US long end dominated last week's news cycle and price action.

The US long end dominated last week's news cycle and price action. Watching the fast-evolving narrative on Harkster.com, the following drivers have collided to force the aggressive steepening...

Funding the deficit = mkt was surprised by the quarterly report as well as increases in auction sizes.

US growth profile to outperform Rest of the World. Pricing out of the US recession = higher for longer = steeper curve.

BoJ Tweak has contributed to higher long-term global yields as well as increased potential volatility. Investors must now consider greater flexibility in the BoJ dampener that had been compressing global long ends.

Private and price sensitive buyer dominates once again as Fed commences QT, reducing their price compression on the long end.

Positioning was long duration in the US looking for the end of the Fed hiking cycle, 2024 cuts and a recession... a soft landing = higher rates for longer.

Major technical breaks in the belly of the curve, 10s, 30s and for want of a better word, aggressive steepening in 5s30s ..

Money flows into front-end bills, risk aversion sees unencumbered cash sit and clip the coupon in 6month bills of > 5% (just ask Bill and Warren BBG)... = steeper curve.

Seasonals point to August as being a good month for the USD, higher Vix and softer equities ... which aided the unwind in the carry trade (e.g. USDMXN, USDHUF, etc)

For a deeper dive and further reading from key sources that Harkster HQ follows within their Daily Reading and Top Podcast curated channels, this week's Hark Back is dominated by the Fixed Income sell off that sent shock waves through the streets VAR models. Thankfully, (for some) the NFP print showed sufficient deterioration to sooth the mkt into the weekend.

The key narratives that drove markets last week

Nordea Macro & Markets: Welcome back

JPM At Any Rate: EM Fixed Income Stepping Aside 🎧

JPM Global FX & US Rates: Spotlight on US rates and implications for the dollar 🎧

- : Weekly Observations

- : #252

- : Does inflation targeting need help from fiscal policy?

- : Big Fiscal, Big funding, and Buybacks

Looking forward to another MAJOR week ahead with US fixed income sitting on a precipice. The risk of a short-term bottom presides for CPI as well as key US auctions ... How much of a concession will the Bond mkt ask for?

Newsquawk: Week ahead highlights include US & China CPI, BoJ SoO and UK GDP

Marctomarket.com: Is the Dollar’s Run since Mid-July over?

- : Outlook for Week 32/2023

Recent pieces by Sam,

Chart of the Week: from BBG's The Weekly Fix

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

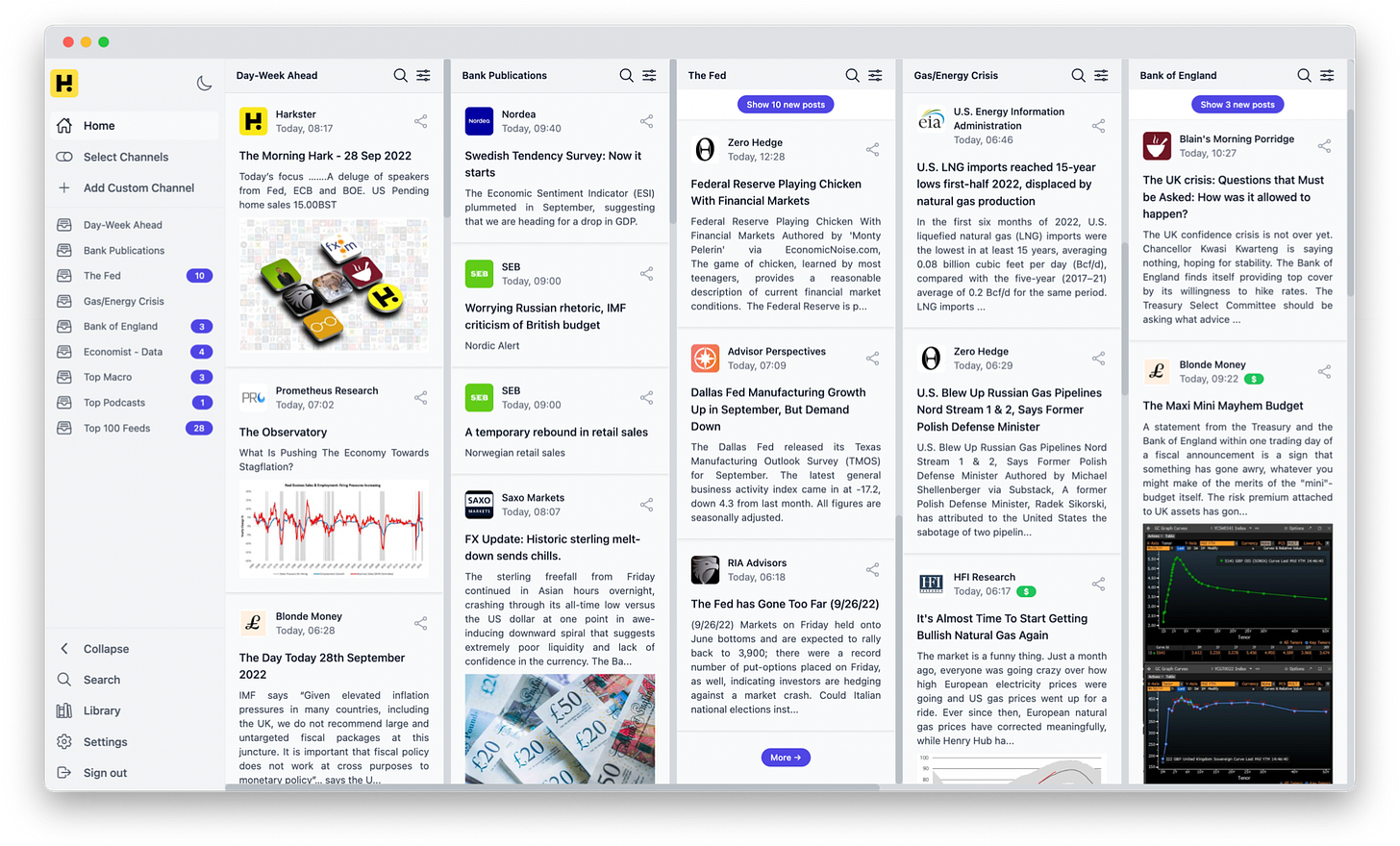

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

I appreciate that "Chart of the Week"...

Heard Left Wing Jamie Dimon at JPM, talking about how the US should just "Eliminate

the Debt Ceiling Process" and have No Limit....Do you think he'd do that for m Chase Credit Card ??

Of Course Not...No Sane Banker would....Yet he advocates for Insane Fiscal Policies, because

of his Political Ideology..even in the face of Common Sense.

Today, we live in a Society when a lot of Expert Elites...have become Idiots and Liars...

Here's a Question: we're at 32.5 T, how much is too much 50T, 60T, 100T....

Certainly, there's an amount of US Debt, that will make the Bond Market Uncomfortable.

We can debate what that number is.....but we are rapidly approaching it...whatever it is.

Thanks for the mention!