In the US, inflation is still running hot, the debt ceiling has been raised, regional banks have been ringfenced, and the labour market is still strong. NFP saw a solid headline (4 sigma) beat, but the underlying details were worrisome as accompanied by a rise in EUR. Headline has beaten 12 of the last 13 prints, but the losses came from the household survey. Are the Fed being too cute with a June pause and indicating a July hike?

With US issuance set to rise as TGA is rebuilt but investors still sitting short equities, it feels like we’re at a crossroads between holding cash over the summer or chasing the AI narrative. 5% yield with limited duration or credit risk has been the trade YTD, but with Nasdaq a keen benefactor of the AI narrative .. if everyone is long cash, standing on the sidelines, where is the bad news coming from . . . could we see a FOMO summer rally?

Key pieces that capture last week's defining narratives...

WSJ: Nick Timarios Fed pause in June

JPM Podcast: What the debt ceiling resolution means for rates markets

The Last Bear Standing: Re-Funding the Treasury

UniCredit US Jobs Report: Mixed and unlikely to stop the Fed pausing in June

Zerohedge: China Property Bailout Rumors Send Global Markets Higher

FT: Erdogan signals economic shift for Turkey as he revamps cabinet

ScotiaBank: Macklem's Chance to Prove He's Serious

Tic Toc Trading: Weekly Plan

Marc to Market: Australia and Canada Hawkish Holds, US bill issuance jumps

The MacroTourist: Maybe it’s just the fantastic gifs/memes that The MacroTourist opens with in each piece, but Harkster HQ always enjoy Kevin Muir's newsletter. His extremely honest approach is well defined by his favourite tagline... "all I bring to the party is 25 years of mistakes". He delivers a concise synopsis on cross-asset topics alongside open-minded analysis of current market conditions without a bearish or bullish slant. He also looks to highlight his best risk/reward trading and investing opportunities. Check out his latest below . . .

Follow in the Harkster ‘Feed of the Week’ channel.

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

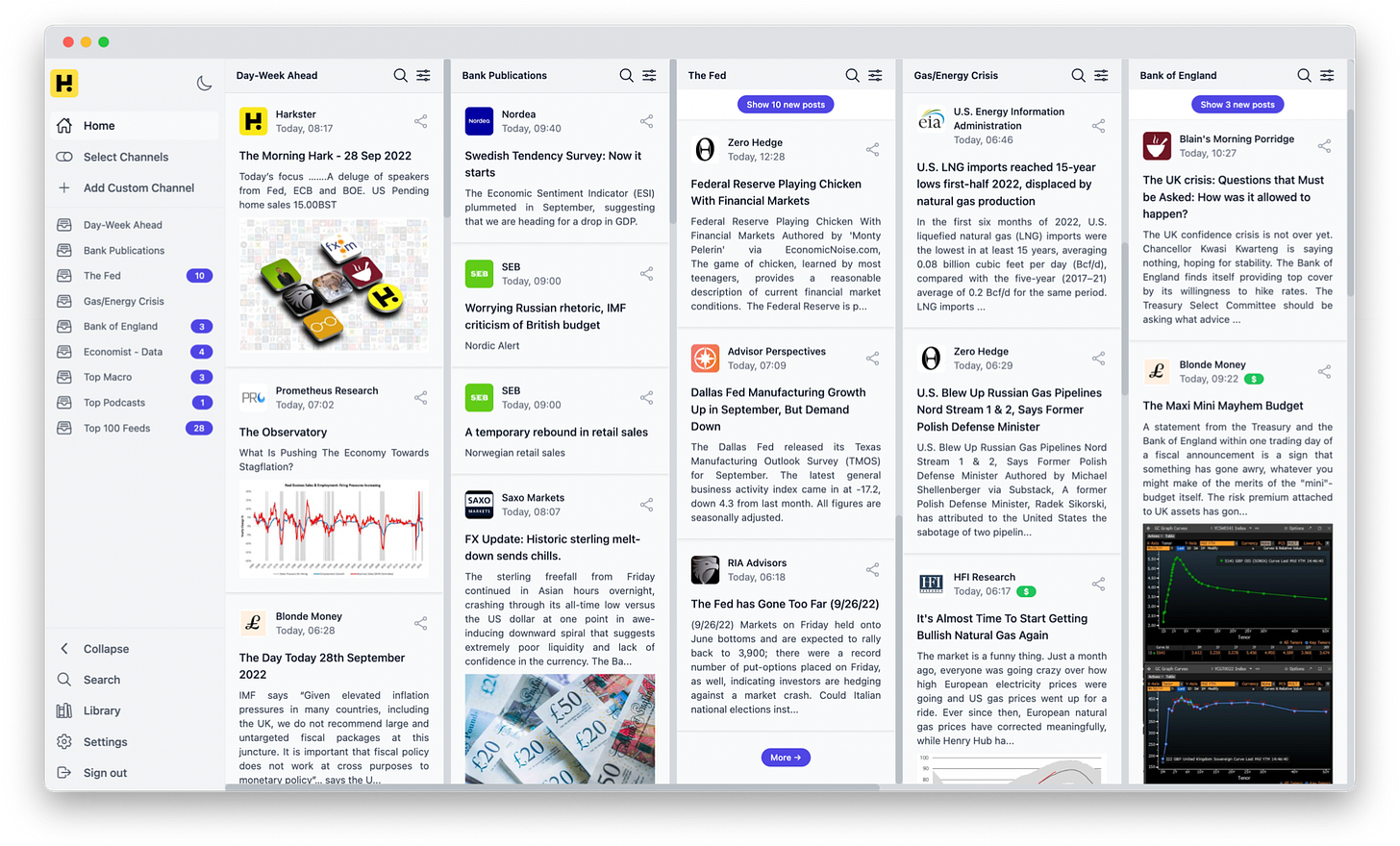

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

Thanks for the kind words. Much appreciated.

History for sure rhymes, doesn't it?

I'd like to know your sophisticated take on our opinion:

https://www.amazon.com/dp/B0C6V6J7KD