The Weekly Hark - 28 May 2023

Resilience in US data remains the defining theme of May

The market went looking for a June pause and deep cuts into H2, but the strength of the US consumer, historically tight labour market, Fed's Logan opening the risk of a June hike as well as consolidation in the Regional banking sector has led to US2s breaching 4.6%. A steady rise of over 70bps in May, that now represents one more hike split evenly across June and July, as well as unwinding the odds of a US recession in 2023.

With initial claims showing no signs of softening, inflation double target, why would the Fed June SEP not deliver one more hike to kill demand? If the labour market is not weakening towards their Dec 4.5% forecast, higher for longer is their only option as credit to the consumer has yet to slow or FCI tighten.

Key pieces that capture last week's defining narratives...

Debt Ceiling talks continue: Bloomberg Oddlots podcast

RBNZ paradigm shift: Westpac

Macro Hive: A big beat for UK inflation

Nvidia Smash Earnings: The Last Bear Standing

ING rates in play: The next steps for US interest rates

Marc to Market: June 2023 Monthly

Nomura Podcast: The Week Ahead

Adam Mancini: SPX is on the edge of a major breakout

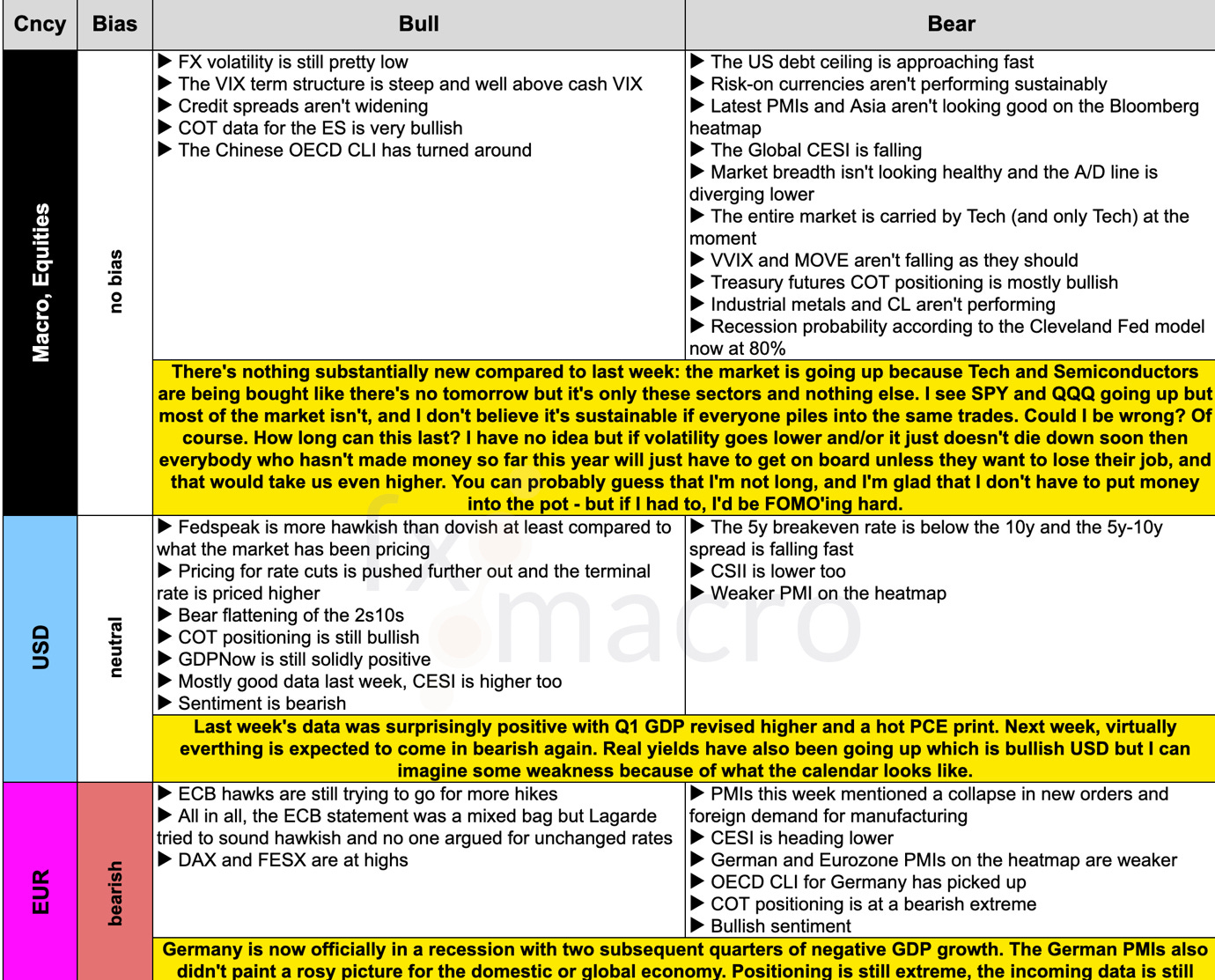

FX Macro's weekly is Harkster HQ's first port of call on a Sunday morning. It delivers an in-depth analysis of macro developments, CB comments, sentiment and cross-asset analysis. The summary section (chart of the week below) is an incredibly succinct snapshot of all the relevant macro drivers for each G10 currency.

Outlook for Week 22/2023:

Follow in the Harkster ‘Feed of the Week’ channel.

A snip of FX Macro's summary section.

Source:

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

Thanks for the shout-out!

I miss the daily Morning Hark for the great commentary and the useful links.

Looks like the Fed isn't done.....

I do see non-Gov't data that shows Inflation is coming done faster.........Truflation.

And I have read other reports, that the Economy is weaker, than the Gov't data shows.

Under the Biden Admin., I trust the Gov't data less and less. They've shown themselves

to be very dishonest, for Political Gain.