The Weekly Hark - 22 Apr 2023

It’s always darkest before the dawn…. Low vol chop but the next two weeks now covers BOJ, Fed and ECB

As realised vol drifts lower and conviction levels remain equally depressed, assets have consolidated within well-defined ranges.

Both sides of the RoW vs USofA equation found support, cancelling each other out and leaving the market directionless.

Chinese 2023 growth forecasts have been raised by the street after the better-than-expected GDP print but the RoW outperformance vs the US failed to develop any significant momentum.

With US2s selling off 25/30bps the US Unexceptionalism narrative has been squeezed.

85% of earnings have beaten low expectations, better US data (Empire / ISM), and Fed Speakers Bullard/Waller have reminded the market that more hikes may be needed post their May meeting.

4 important pieces that captured the key narratives of last week... Chinese GDP beat, Hawkish Fed Speak, Better than expected US data and the Debt Ceiling X date....

ING on China GDP: China’s GDP for 1Q23 is better than expected

Reuters Interview: Fed's Bullard discounts recession talk, favors more rate hikes ...

Saxo Bank: Difficult terrain for USD ahead on US debt ceiling crunch time.

Capital Spectator: Political Calculus, Debt-Ceiling Edition

BoJ, Riksbank and Month End

Adam Mancini: SPX Is Getting Very Close To Breaking Out It's Range. April 21st Plan

The Macro Compass: 5 Things Hedge Funds Are Watching

Heard on the Trading Floor delivers exceptional credit and options trading ideas. A team of talented traders led by a 17 year trading veteran produces insightful market analysis, comprehensive trade ideas and a biweekly portfolio update. Excellent pieces for macro traders that are looking for credit insight and how that market can drive other asset classes as the pain of higher real rates reverberates through the financial system.

Subscribe below or follow in the Harkster ‘Top Substack’ channel.

Philly Fed the worst since Lehman (Source Zerohedge)

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

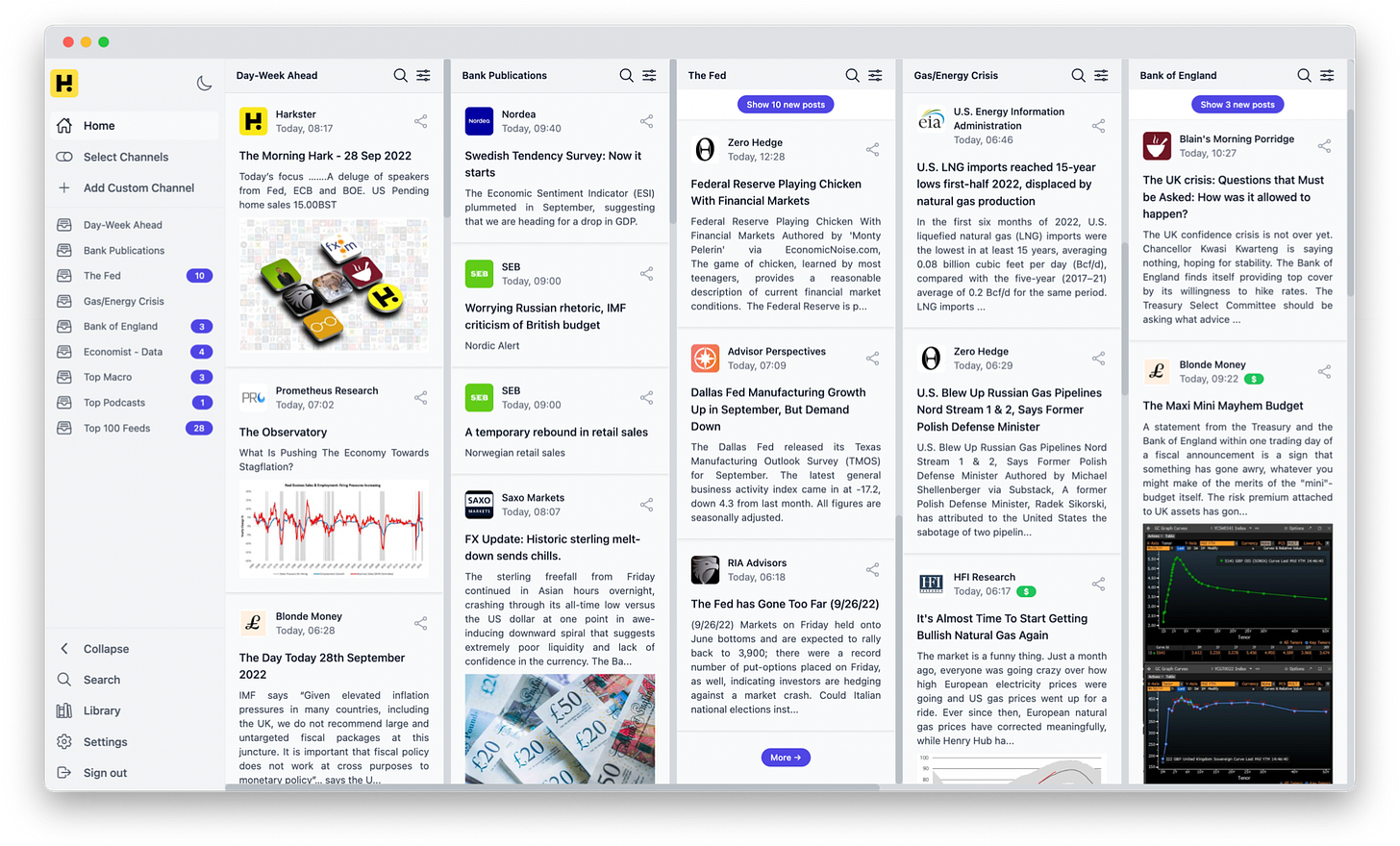

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

I can't tell if it's getting Darker or Lighter ???

I do believe the FED will stop in 2023.

Maybe 2024 will actually be a good year ???