The Weekly Hark - 20 May 2023

Markets let out a large sigh of relief this week with risk premium being unwound ...

#1. Debt Ceiling: despite a little brinkmanship into the weekend, the debt ceiling negotiations are heading in a positive direction, with McCarthy set to bring something to the house next week. Having an edge is quite difficult as everyone expects it to be raised, but what if it isn't... that 0.01% chance leaves little risk premium to fade the uncertainty and why US CDS was indicating a higher probability of default than Brazil over the past week.

#2. Global fixed income sold off: Terminal in NZ close to 6% as local banks raise their expectations for the RBNZ hiking cycle (despite lower inflation expectations), whilst better US data (#whatrecession) continues to defy low expectations. The retail sales control group (0.7 vs 0.4% exp), as well as lower initial claims, led to US2s selling off back to April highs of 4.3%. If the consumer is spending and credit is not an issue, then the Fed will need to do more. Fed's Logan also helped push the June odds to 50-50.

#3. KRE Consolidation: With Washington dominating the headlines, there has been a noticeable lack of tension around regional US banks... if the risks are ringfenced and contagion is limited, then the probability of cuts / recession priced into US fixed income needs to unravel and converge back towards the Fed's end of yr dot. #higherforlonger

#4. Global stocks breaking out: Japan (led by Buffett's boost), Dax and US indices all broke out of the top of their range. The breadth of the US equity rally is narrow/worrying some, but the 13f filings from the family offices of Druckenmillier, PTJ and Tepper saw increased exposure to companies (Nvidia, Apple, Alphabet and Microsoft) with AI products.

#5. Cross Asset Vol: Move Index, CVIX and Vix continued their drift lower and increased the market's appetite for beta…

Important pieces that captured the key narratives of last week...

Bloomberg: Stan Druckenmiller, David Tepper Lead Family Offices Betting on AI

Macro Tourist: Flat is a Position Too

Pepperstone: Run away moves in US equity ahead of debt ceiling vote

Pepperstone: Digesting The Drop in Volatility

RIA Advice: Monetary Support Suggests Bear Market Is Possibly Over

WSJ: Fed officials Suggest June Rate Rise Will Be Close Call

Nomura Podcast: The Week Ahead - FOMC Minutes, Flash PMIs, UK CPI, RBNZ, BI and BoK Meetings

JPM Podcast: EM alpha competes with beta for attention

Adam Mancini's daily SPX/ES technical analysis.. A fan favourite here at Harkster HQ, it's been impressive to watch the consistency of his equity future trading style, discipline, and core focus on process. Adam's concise daily newsletter offers accurate levels, actionable trading plans and insight into the art and science of trading from the perspective of a professional trader.

May 19th:

Follow in the Harkster ‘Feed of the Week’ channel.

PBoC easing, BoJ easing, Fed QT neutralised by their liquidity push to support regional banks .... there is still a lot of money flushing through the system which will only put pressure on terminal rates and global CB's to do more.

Source: RIA Advice

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

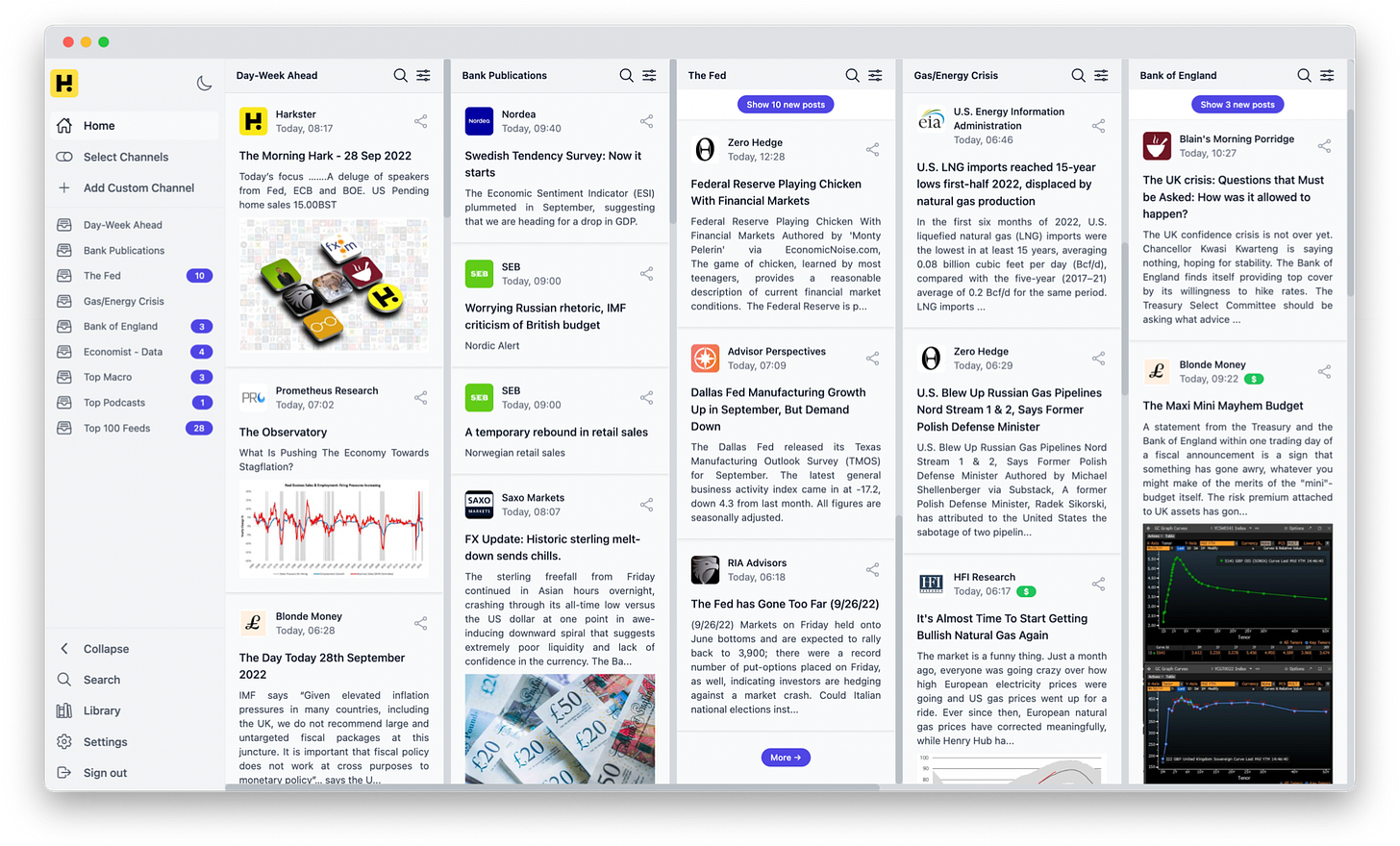

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

I guess I can understand why the Japanese stock market is doing well...

Japanese companies seem to be doing well and looser Monetary policy, but

why is the DAX in Germany doing so well ???

I thought Inflation and Interest Rates in Europe, were still going up ???