The Weekly Hark - 20 Aug 2023

Choppy, mean reverting week, with limited direction

Plenty of headlines but limited activity as the number of market participants still on the beach equals, if not outweighs, those left behind in the office making sense of the illiquid moves.

Peak USD / US yields printed on the very strong US retail sales report that was 0.5% better than expected for the Fed's control group (one of their GDP inputs). The devastating mean reversion after the stronger than expected US data most certainly took any sort of momentum out of the week. If you were going to add to the North America outperformance theme relative to APAC, this quick reversal most certainly dented confidence and only raised the already high bar to any further portfolio adjustments. The negative China headlines continued throughout the week as newspapers focused on a major credit event in China; Japan had an historic tail for the ages in a 20yr auction which kept pressure on global duration; crypto finally caught down to the US real yield sell off (helped by SpaceX liquidation of XBT) whilst the battle lines have been clearly drawn around 7.30 by the PBoC. Choppy, mean reverting week, with limited direction, limited follow through on the "just be long USDCNH narrative".

Scanning through the week ahead channel on Harkster.com, there is no top tier US data until JPow takes the podium at Jackson Hole. HarksterHQ is of the belief that he will repeat what he said at the last Fed meeting and remain firmly data dependent. We're only halfway through his infamous ECI, 2xNFP, 2xCPI data checklist, so why change the data dependent / higher for longer manta? Given the strength of the July data, will the mkt then try and test US2s above 5%, price in a higher probability of a Sept hike or will the steepness in the 2s10s curve remain. The money over the past year or so has been made following the US data trend, not Fed speak. Forward guidance is not working in this post Covid world, and I do find it interesting the markets inability to date to price a higher probability of a Sept hike. Mr price also knows Fed GDPNow is at 5.8%! Making 3-6 month investment decisions based on price action in mid-August can be a fool's errand. It does feel like we've had a capitulation this summer from US recessionista's. With US30yr mortgage rates firmly on a 7 handle and mixed signals from the US housing market, HarksterHQ has one eye on the leading economic indicators and year ahead trades to be plays on USD weakness, US recession, Fed 2023, sorry 2024 cuts.

The key narratives that drove markets last week:

China's Balance Sheet Recession / Lehman moment

The Last Bear Standing: Tremors in the East

FT: China set to cut lending rates as economic recovery drags

The Lead-Lag Report: Is The Credit Event upon Us?

ㅤ

5.8%! - The US is exceptional in Q3

SriKonomics: Treasury Yields - How High?

The Bondbeat: Weekly Observations from the Sell side

Nordea: Steeper for longer

ZeroHedge: Fed Warns Consumers Will Deplete Excess Savings by end Q3

ㅤ

Elsewhere... Europe (German Recession), Japan (YCC dampener removal) and of course Crypto (Musk liquidation, Real yields)

WSJ: As Rates Rise, Japan Is Wary About Silicon Valley Bank Sequel

ZeroHedge: Stocks are Overbought Relative To Bonds

FX Macro Guy: Week 34

The Bitcoin Layer: Bitcoin Pukes 15% and SpaceX Sells Its $373 Million Holdings

Looking forward to next week...

Nomura: The Week Ahead - Jackson Hole, BoK, Bank of Indonesia, Flash PMIs and Tokyo CPI

Scotiabank: The Global Week Ahead - Shifts Happen

Yardeni: The Economic Week Ahead

Newsquawk: Week ahead August 21-25

Top Podcasts this week:

JPM Global Data Weekender: Too Hot and too cold

MS Thoughts on the Market: The Positive Side of Higher Rates

Macro Hive: Denis Shull on Emotions as a Dataset and Avoiding Investment Mistakes

JPM Asset Management: Top Long-Term Risks for Investors

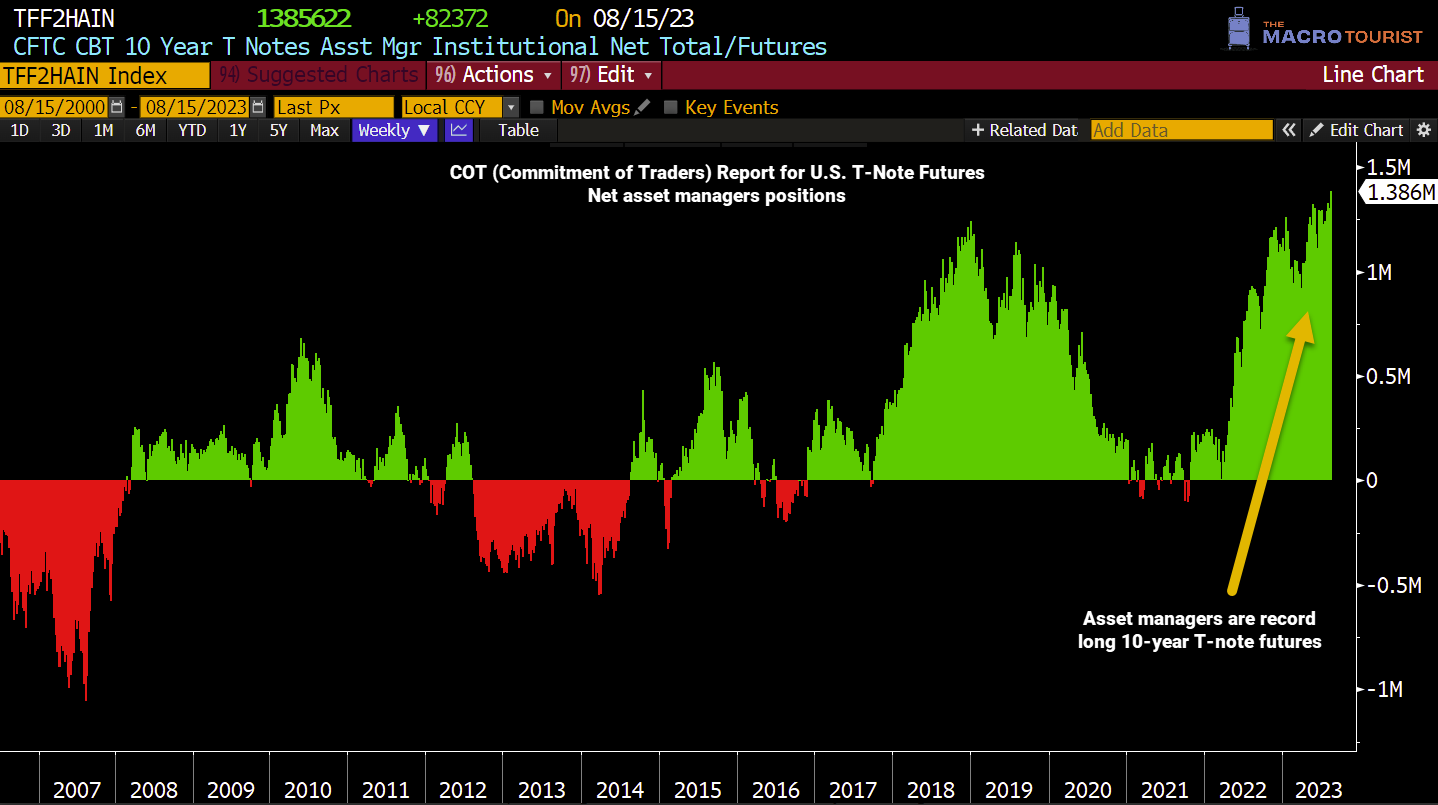

Asset managers are record long 10yr T-note futures

The MacroTourist Weekly Wrap explains what the bond bulls have been getting wrong, waiting for the weaker hand speculator/shorts to capitulate all year and why one should focus on the "small speculators" for the mkt's net position.

Source: Bloomberg via

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

While there are always two sides to each market scenario, I do not remember a period where the opinions have been seemingly so evenly split as well as vehemently held. when the recession finally arrives, or if growth clearly accelerates, the other side is in for a world of hurt and I expect market volatility will climb even higher

The Strength of the US Economy has surprised many Economist and Bond Bulls.

I certainly hope this quote is true," Bottom line: We may be at, or near, the peak of US Treasury yields for this cycle. Fundamentals do not support pessimists’ call for the 10-year yield to crest at a much higher level.

A higher yield may end up being its own undoing."

Dr. Komal Sri-Kumar

Thanks for your work