After a sleepy June, the market has sparked to life in July as the US real rates wrecking ball unnerved key carry trades due to different tenors across the curve breaking to multi year highs (2yr > 3%, 5yr > 2%). However, peak rates printed on the uber hot ADP and since the inline but below expectations NFP print and the good news from the inflation data (lower Chinese PPI, 3% YoY in US, lower US PPI, softer core etc), the market has spent the past week rushing back into the soft-landing story it lost in early July. Thus, we've seen lower bond yields (10s at 3.75%), lower USD (JPY 138.50, EUR 1.1225, GBPUSD 1.3100, USDMXN 16.75), lower vol (Vix at 14), stronger EM and higher Equities with CTA unwind particularly vicious in JPY crosses.

The RRP continues to reduce ($485bln), offsetting any market fears of summer liquidity drying up due to the TGA rebuild (Chart below, thanks to The MacroTourist).

Earning season started with resilient prints from JPM, with deposits remaining strong and credit tightening to the economy yet to appear. Student loan repayments, Crypto getting a court boost, mortgage refinancing slowing and of course all things inflation... these themes and more, are captured in the Hark Back, the key pieces that have been harvested over the past week from Harkster.com.

The key pieces that capture last week's defining narratives

WSJ: SEC’s Strategy for Regulating Crypto Stumbles in Ripple Case

MishTalk: A 5 Percent Pay Cut is Coming for 37 Million Student Loan Borrowers

Christophe Barraud: US 30-Year Mortgage Rates Around 7% Add Pressure on Refinancing

FX Macro Guy: Free Review of Week 28/2023

JPM: Global Commodities: US dollar is increasingly less important for oil prices. Implications for EM.

Brent Donnelly: Blowoff Bottom in USDJPY

SriKonomics: Lessons From Last Week

Mauldin Economics: Flip Side of the Inflation Coin

BCA Quick Takes Podcast: Inflation, The Fed, And The Treasury Market

Macro Hive Conversations With Bilal Hafeez: Peter Stella on Fed Losses, Backdoor Fiscal Stimulus and Credit Easing

Marc to Market: Week Ahead: For the Millionth Time, Markets Exaggerate

Scotiabank: The Global Week Ahead: Save Some of that Confetti

Nomura: The Week Ahead – US retail sales, GBP, JPY, NZD and CAD CPI, China GDP and German PPI

The AI Halo has caught the equity market by surprise, frustrating underweights placed on US recession fears, the impending real rates squeeze (2yr at 3%) and pressure on CRE. As a result, the market enters H2 on the back foot, feeling very underweight US equities and with CPI softening, potentially the last Fed hike fully priced for July, the risks are the market is stopped into a FOMO chase.

Turn on Harkster's latest AI curated channel to stay up to date on AI research, key regulatory developments and market drivers as a generational technology has now arrived to induce a regime change.

Harkster is far from an expert on AI and found Odd Lots interview with Bridgewater's Greg Jensen an excellent and balanced place to start. AI is a game changer, but for portfolio managers and traders, what advisory questions do we need to ask the AI model results before they can be implemented in our investment process?

Bridgewater's Greg Jensen on AI, Inflation and What Markets Are Getting Wrong

Follow in the Harkster ‘Artificial intelligence (AI)’ channel.

Liquidity neutral as RRP unwind offsets TGA rebuild.

Source: JPM via The MacroTourist

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

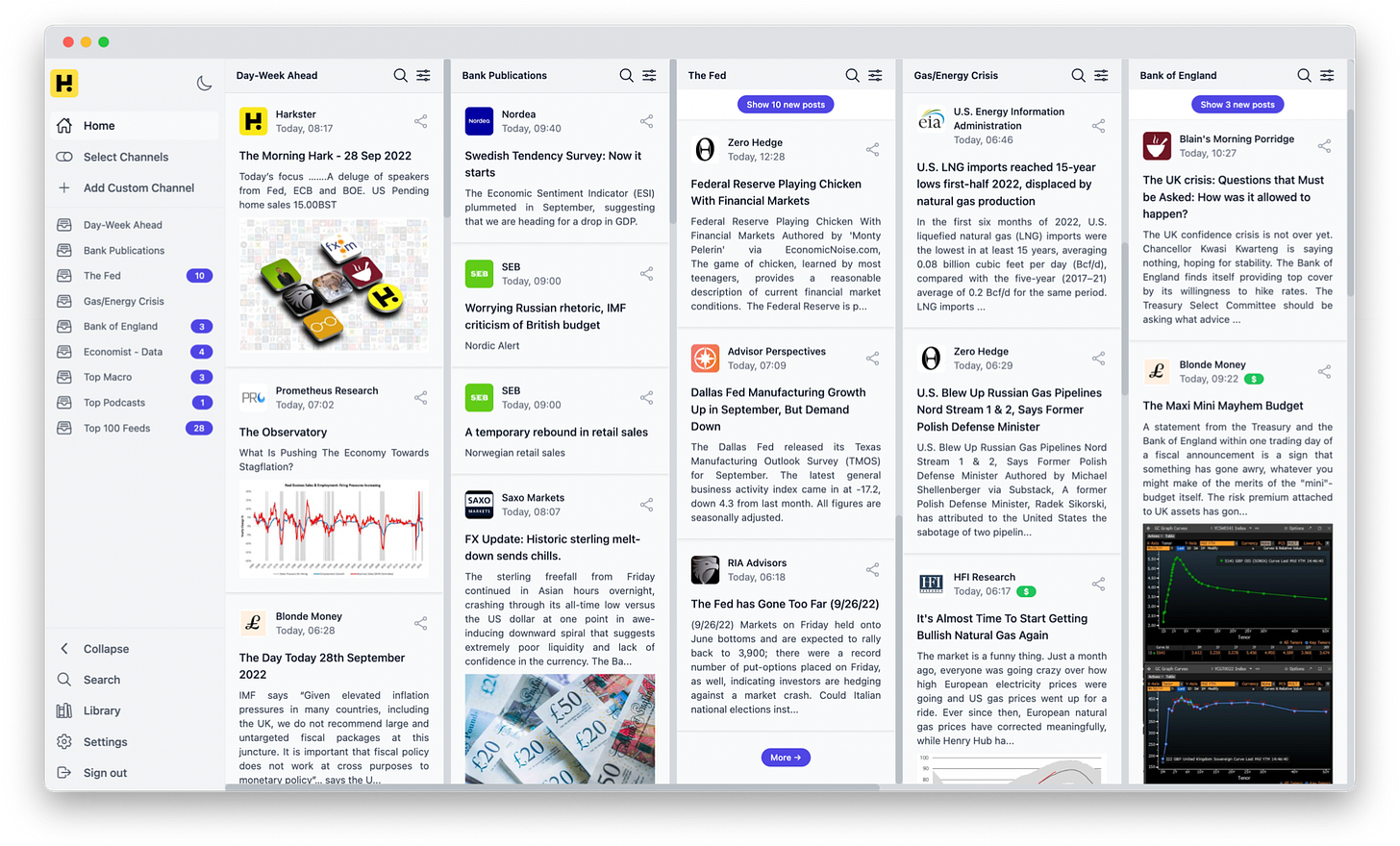

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.