The Weekly Hark - 13 May 2023

I still haven't found what i'm looking for....

The market has spent the past 6 weeks searching for the middle of the USD smile, with FX vols drifting lower, Fed set to pause, US regional bank risks ringfenced and SPX/Nasdaq recovering from their lows. Frustratingly for USD bears, we've remained confined to recent ranges despite US CPI printing inline with expectations and PPI softer... SPX 4000-4200, EURUSD 1.0800-1.1100, USDJPY 130.00-136.00, US2s 3.75-4.25 and Gold 1950-2050.

The USD has been receiving support from both sides of the smile (chart of the week below).

#1. The debt ceiling X date uncertainty has heightened risk aversion and is keeping everyone on edge. US CDS continues to widen but even though everyone believes they will raise the ceiling after some brinksmanship (given that’s what they always do), the uncertainty in Washington is making for some uncomfortable viewing.

#2. There is now an alternative, there is simply no reason to chase performance... (bearish) investors can park their cash in money markets, receive an annualised yield of 4/5% and wait for the recession to arrive in the data.

#3. Chinese data, what reopening? service sector and tourism are heating up but the commodity boom that many forecast is not occurring as construction/property mkt has yet to reignite. CPI was close to deflation and even if the PBoC respond with fresh targeted easing, the lack of loan demand will limit its impact.

#4. Weaker German retail sales and mfg leaves the mkt questioning the two key RoW growth engines relative to the US Unexceptionalism narrative.

#5. Higher for longer... the US labour mkt is still historically strong (although initial claims are starting to tick higher), CPI double target and regional banks ringfenced .... JPow, Bowman and others will continue to push back on the premium priced between SFRZ3 and the Fed dot.

#6. Pain: lazy USD shorts have been squeezed as momentum fades in key themes (ECB nears terminal, BoJ are not normalizing anytime soon, SA accused of arms exports to Russia). If USDCNH is drifting towards 7.00 its very difficult to see a structural USD softer trend in G10 or ADXY.

#7. Navigating the end of cycle playbook in rates, FX and equities is a key driver for q2 and has led to an uncomfortable low vol range compression ... the mkt can see the trend, the data just needs to catch up...

Important pieces that captured the key narratives of last week...

Christophe Barraud: PBOC May Require More Stimulus as Chinese CPI Rises at Slowest Pace in Over Two Years

John Mauldin: Plan for Paralysis - Mauldin Economics

SAXO Commodity Weekly: Patiently bullish on gold and copper as crude consolidates

JPM At Any Rate: Global FX: Big Risks, narrow base-cases

South Africa Rand hits record low: South Africa Lashes Out At US 'Megaphone Diplomacy, Bullying' After Arms For Russia Allegations | ZeroHedge

The Last Bear Standing: Banking on Pressure

NewsSquawk: US retail sales, China activity data, Japan CPI, jobs data from UK and Australia

Nordea: Macro & Markets: Cut it out!

Nomura Podcast: The Week Ahead – Mixed US Growth Signals, Tight Debt Limit Talks, Turkey Elections and Japan CPI

Chris Weston from Pepperstone delivers insightful cross-asset analysis on a daily and weekly basis. Focused on event risk, scanning the vol mkt for levels that will trade with a high probability or discussing the cross-asset drivers like yesterday’s piece that focuses on DXY, ZAR, Copper, Nasdaq and CNH.

Trader views - front of mind and under the radar | Pepperstone.

He demonstrates with ease the key themes and mkt drivers. Chris is Pepperstone’s Head of research and holds over 19 years experience in the industry, having worked for and supported retail and institutional clients at IG, Merrill Lynch, Credit Suisse and Morgan Stanley. His experience in FX, equities and fixed-income markets puts him in a unique position to provide insight, research, ideas and risk-management strategies.

Follow in the Harkster ‘Feed of the Week’ channel.

USD Smile - Source: Pepperstone

If you enjoyed this week’s newsletter, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

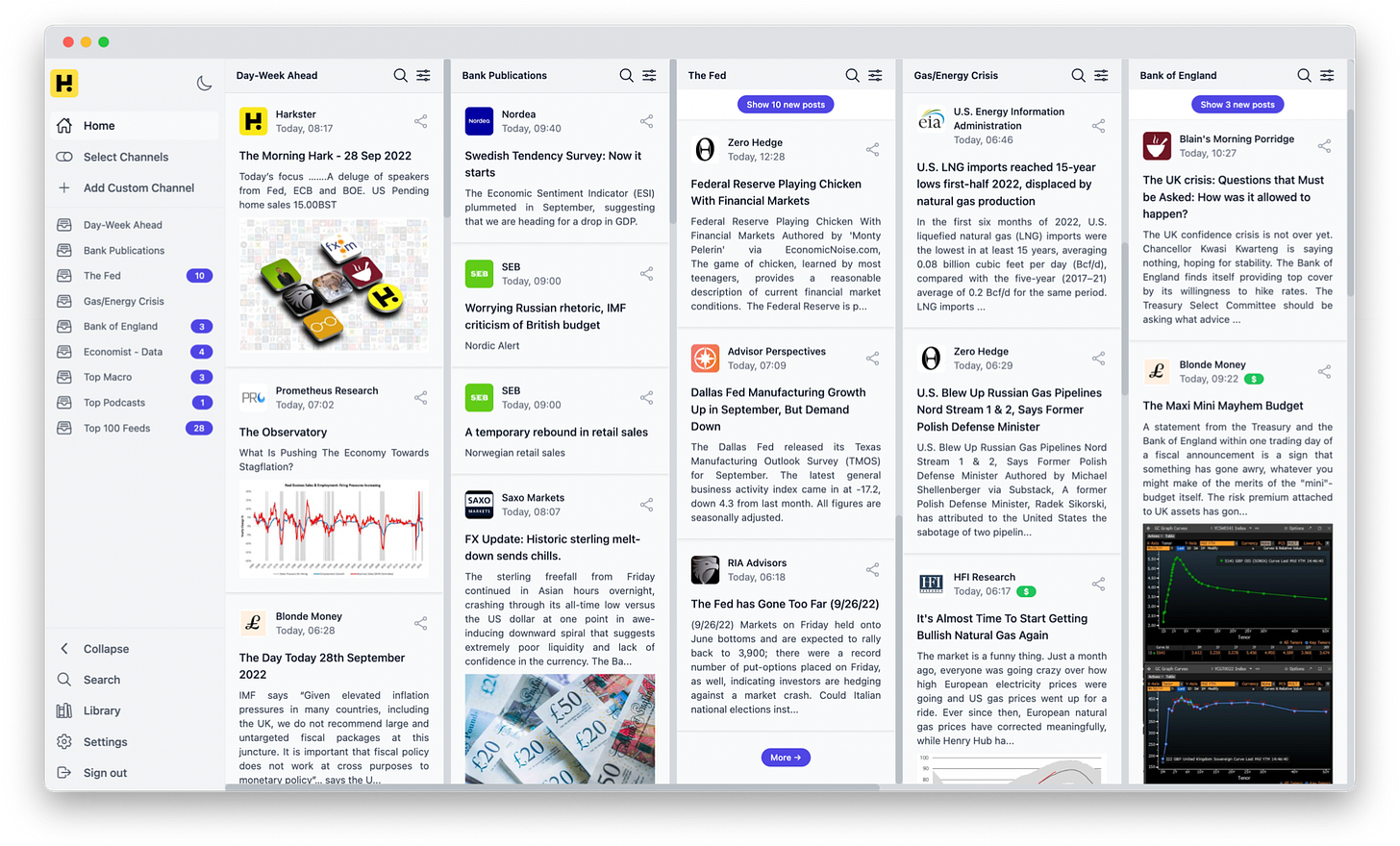

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

Not to mention the USD seasonally bottoms in April/May after tax receipts fall due and rises into the end of the fiscal end of year in October.

Miss the daily hark. It was such an asset.

Great, simple, $ chart - thanks!