The Saturday Hark Back - 24 Feb 2024

Capturing the themes of the week when there’s more time to digest them.

The Hark Back

The key narratives that drove markets last week:

Theme 1 - “Everything Is Awesome!!!”

Theme 2 - Still waiting for a correction?

Theme 3 - Inflation reigniting?

Theme 4 - Is the Fed policy restrictive enough?

Theme 5 - 2024 the year of elections

Top 10 Reads of the Week on Harkster.com

Top 5 Podcasts of the Week

Week Ahead Previews

Theme 1 - “Everything Is Awesome!!!”

The LEGO Movie soundtrack really does capture the current market environment...

Housing price resurgence and strong equity gains for homeowners

Real wage gains

Nvidia smashing the bears and the naysayers out of the water

AI labour productivity gains

Inflation drifting south, allowing the Fed to cut at least once before July 4th

Stocks ATH

Strong labour market

GDP bubbling along at 3%

Short vol and long CARRY in FX (long MXN, INR vs short JPY and CHF)

Renewed hope that the portfolio of policy changes will have helped China turn a corner

Scotland have beaten England four times in a row in the 6 nations

Soft landing.... everything at the Fed is AWESOME!!!!!!

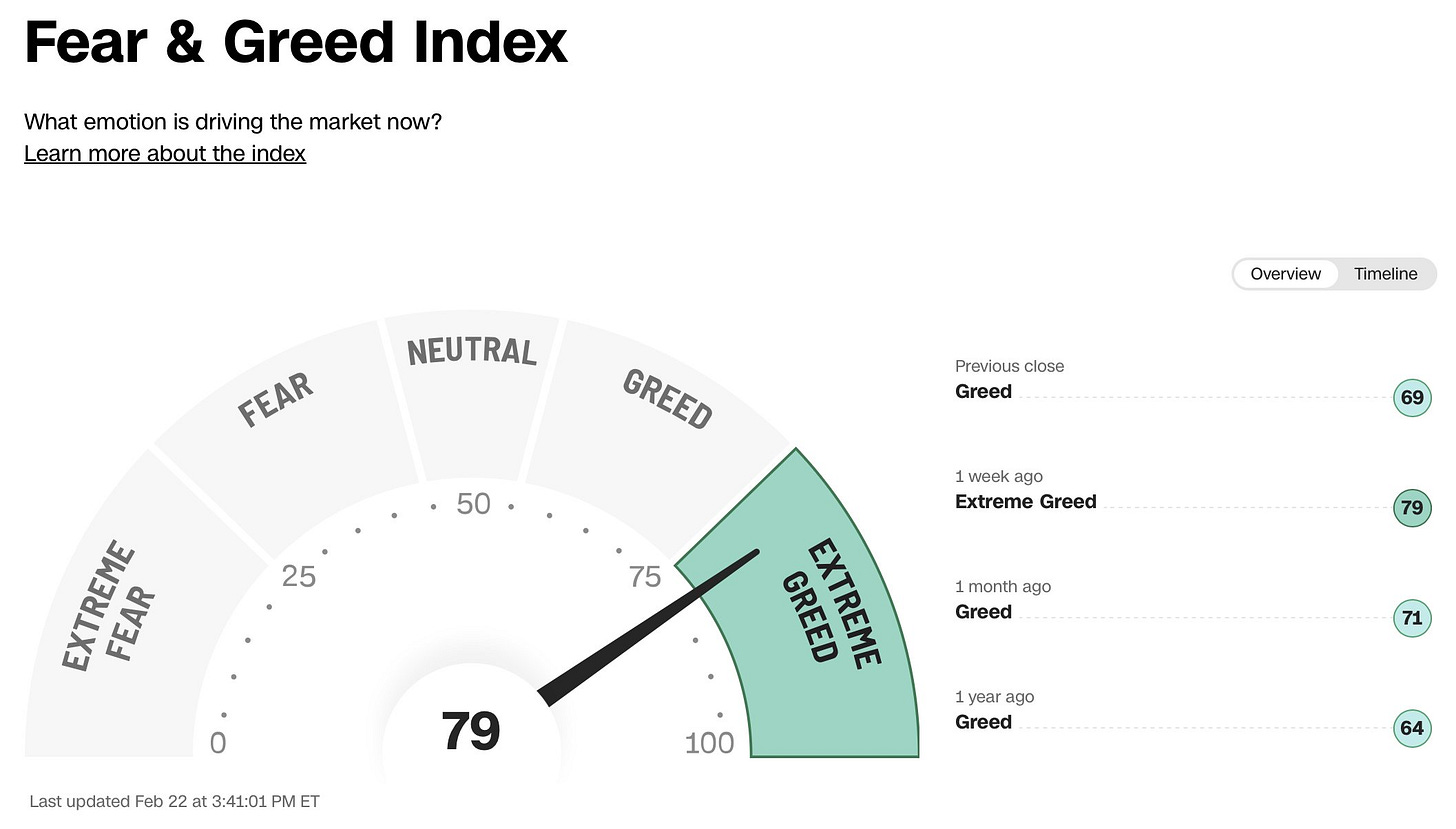

As a result, all the good news is in the price and we head into month end rebalancing after Nvidia's insane earnings growth propelling investor sentiment to extreme greed levels. It may not be time to get in the way of the momentum steam train, but it is a reason to think of hedges, take some profit off the table and wonder what can rock the boat. If everyone can only see good news, where is the surprise coming from? This time last year the majority of traders on wall street didnt know of Signature Bank or SVB, the year before that few expected Putin to actually go into Ukraine... Trends are entrenched for good reason but they dont go on forever ...

Theme 2 - Still waiting for a correction?

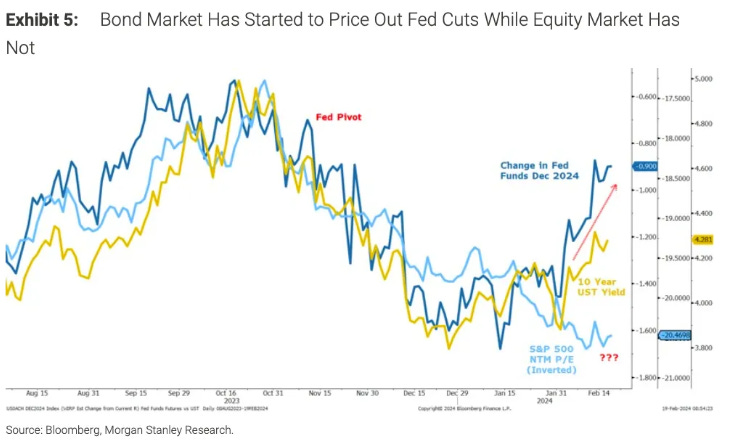

There has certainly been a growing narrative on Harkster.com that a correction in assets is overdue. In particular Daily Chart Book highlights the latest from MS Mike Wilson.... Stocks vs. bonds vs. Fed. "While the back end of the bond market has reacted to this potentially slower pace of cuts, equity valuations have not, creating a divergence that could be reconciled either via lower rates or lower multiples."

Theme 3 - Inflation reigniting?

We've got PCE next week and of course the mkt will be eagerly waiting the Feb CPI print, if it's hot, its going to be extremely difficult to think the mkt will continue to price cuts before Q4. Inflation is the main constraint to how quickly and deeply the Fed can cut. Harkster.com (your research inbox) has seen plenty of macro commentators discussing the CPI / PPI pop in Jan and if the consistent wage gains will propel inflation back higher, just as the soft landing was priced to perfection...

Ecoinometrics - The problem with the soft landing

The Lead - Lag Report: A Sharp Turn, Inflation Round 2?

Saxo Bank - How the debate about the US economy has shifted

DB CIO Weekly - The landing debate

Steno Research - Inflation is BACK! Position accordingly..

The Inflation Guy (aka Mike Ashton) - Looking Back and Looking Forward

Source Pinecone Weekly Brief - Walk in the Pines #150: This Weeks Best

but are we even looking the right way? Truflation is now at 1.65%!!!!!

Source: Truflation

Theme 4 - Is the Fed policy restrictive enough?

There is a risk the Fed will have to temper the bull run as inflation gets sticky? The FOMC Minutes reinforced the view that many members had told us since Davos that they were not confident that inflation was turning to trend and would not commit to a timeline for the first-rate cut. As Fed's Bowman reiterated, “The time for lower rates is certainly not now.” US fixed income is under pressure following the weak 20year auction and initial claims unexpectedly falling to a five-week low, reminding everyone once again of the historically tight labour market. If we're entering a "sticky regime" at a minimum the Fed will have to adjust the dots higher in March (just 2 cuts?) and they may potentially even put a hike back on the table in Q2 if FCI is to lose and progress on inflation stalls.

Hedgopia - March Dot Plot Can Surprise Markets

ZeroHedge - The Fed's Big Problem, There Are Two Economies But Only One Interest Rate

Steno Research - Could the next move be a hike?

The Next Economy - Is MMT the answer?

UBS Daily Audio - 'Back to the Future II'

Apollo Academy - The Fed Is the Reason the Last Mile Is Harder

Bloomberg - Bond Traders Brace for Another US Selloff, Unwind Bullish Bets

FT - Will a second inflation wave turn the AI boom into a winter of discontent?

FT - Wavering investors come around to Fed’s outlook on interest rates

The Blind Squirrel - Coming off the fence on bonds

Nordea Macro & Markets - The perfect soft landing is fading away

Theme 5 - 2024 the year of elections

Shadow boxing, with many of the main debates months away from occurring, the political machines are focused on pre-positioning their candidates for the best possible chance. Biden is still struggling to gain any momentum despite having a large cash reserve whilst the Conservative government have been focused on leaking to the press possible measures for their March budget. Some flight balloons have already been shot down (HMRC U-turns on ‘terrible’ decision to close car tax loophole).

Axios - Biden boxed in on all sides by historic immigration crisis

Bloomberg - Jeremy Hunt Weighs Plans to Spur Pension Funds to Invest in UK Assets

Axios - Biden holds cash edge as Trump, Haley burn through funds

FT - Why are so many evangelical Christians in thrall to Trump?

Axios - Exclusive: Well-funded new super PAC joins Trumpworld

Top 12 Reads of the Week on Harkster.com:

The Telegraph - Electric cars suffer ‘unsustainable’ depreciation in secondhand market

Apollo Academy - Probability of a Fiscal Accident Is Rising

The Pomp Letter - Bitcoin Is Not A Popular Medium-Of-Exchange

Bloomberg - The Bittersweet Truth Behind Surging Chocolate Prices

WSJ - China Quant Fund Suspended as Regulators Tighten Grip on Trading

The Lead-Lag Report - The Massive Refi Explosion

The Next Economy - Is MMT the answer?

S&P Global Market Intelligence - Eurozone downturn moderates as service sector steadies, but price rises cloud rate cut outlook

Steno Research - China Watch: Trading the latest rate cut stimulus

FT - Israel unveils plan for complete postwar control of Gaza

The majority of these links appear in our new "HarksterPro - Intraday Market Colour" channel. If you click on "Select Channels", you should find under "Added Recently" our latest additions to the app. @HarksterHQ will use this new channel to flag good articles/sources of content as well as headlines/market moving events.

Top 5 Podcasts of the Week:

Odd Lots - This Is What's Hard About Building a US Domestic Battery Industry

FT Swamp Notes - Trump’s legal troubles

Real Vision - The U.S. Makes Its Comeback w/ Andreas Steno Larsen

The Week Ahead

Looking forward to next week...

Newsquawk - Highlights include US PCE, ISM Manufacturing PMI, RBNZ policy announcement, EZ, Australia and Japan CPI

Nomura - US Core PCE, Euro Area Flash Inflation and Japan CPI

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.