The Saturday Hark Back - 17 Feb 2024

Capturing the themes of the week when there’s more time to digest them.

The Hark Back

The key narratives that drove markets last week:

Theme 1 - Mixed US data delivers a quiet week for FX and Fixed Income

Theme 2 - XBT inflow story and QQQ

Theme 3 - CB's staying vigilant

Theme 4 - Will Rishi survive this recession?

Theme 5 - How does technology rewire the intricate circuitry of the teenage mind?

Top 10 Reads of the Week on Harkster.com

Top 5 Podcasts of the Week

Week Ahead Previews

Theme 1 - Mixed US data delivers a quiet week for FX and Fixed Income

A slow and steady repricing of US fixed income as the hotter than expected CPI and PPI prints have forced the mkt to roll the first Fed cut from March, to May and now back to June. There are now just under 4 cuts priced for 2024, down from 6 entering the January FOMC meeting.

However, the repricing hasn't been violent, the mixed data has simply not been weak enough to meet the markets bearish forecasts and thus we find ourselves slowly drifting wider to close the spread between the Fed SEP dots, the committees forward guidance and SOFR clearing rate. The inflation trend has been softer, it's just not as soft as expected and there also appears to be growing evidence globally that the phase of sharply slowing price pressures is ending. Inflation is being driven by a re-acceleration of core services... hotel stays, airfares, medical care, owners equivalent, health insurance and transport services all kept the MoM supported (UBS CIO First Take - January CPI print with Brian Rose). Without the substantial deflation in second hand cars, apparel and other core goods sectors this would have been a truly shocking CPI print for the market and the data dependent Fed.

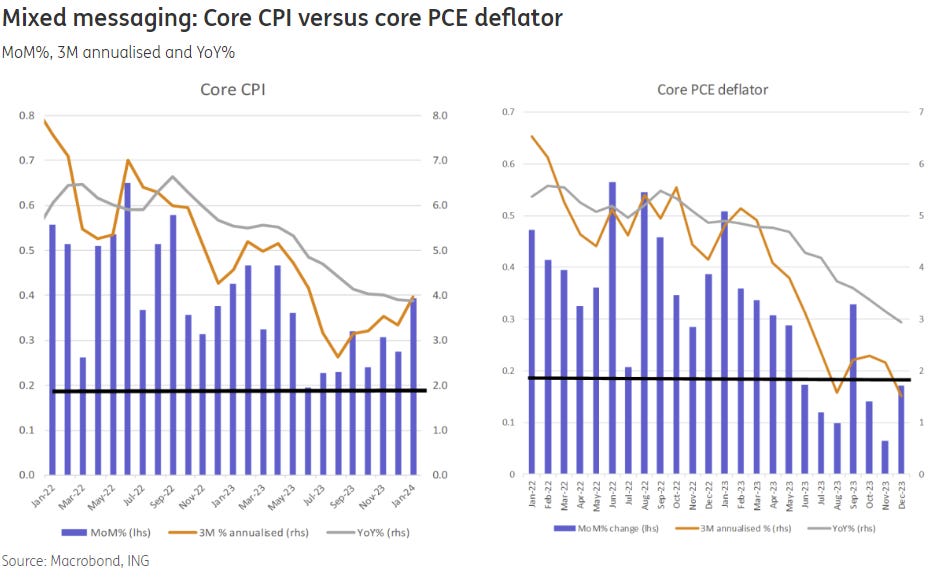

In fact, the Fed are stuck in a world with mixed messages... as core remains sticky but their PCE deflator does not. "The Fed's favoured measure of inflation, the core PCE deflator, may be cooling nicely, but the mixed messages mean the Fed can't relax, with little inclination for imminent rate cuts"... (ING - Sticky US inflation reaffirms Fed caution on rate cuts). Powell and Co are extremely lucky that the economy is not screaming out for cuts. It would be much harder to buy time if the US had hit the recession so many expected by now.

Both sides of the Fed mandate are running stronger than expected

The committee's confidence in the incoming data bringing inflation back to target will have been dented this week. In fact, questions will now be asked if we're in danger of entering a "sticky" inflation regime as we commence down the "last mile" of the fight against inflation. Real wage gains, potential election year give aways, energy prices rising, housing market stabilising, strong consumer spending in Nov and Dec and of course the bumper NFP as the solid jobs market remains at historically strong levels .... The economy is cooling, still making progress towards their 2% target, just not at the pace the market had expected. This is the second straight inflation print to surprise to the upside as domestic sources of inflation are far from tamed. It was always going to be difficult for the Fed to cut when the US economy was chugging along at 3% growth in Q1 (Atlanta GDPNow - Feb 16th estimate: 2.9 percent).

Steno Research - USD inflation review: Powell has to invent a new measure..

E-piphany by Mike Ashton - Inflation Guy’s CPI Summary (Jan 2024)

Steno Research - G3 INFLATION/WAGE WATCH: US INFLATION WILL NOT RETURN TO 2% THIS CYCLE

JPM - Global FX - What Gives?

Bloomberg - US Retail Sales Drop by Most in Nearly a Year After Holidays

ING - Weak start to the year for US retail sales and manufacturing

The NY Times - Three Lessons From a Surprisingly Resilient Job Market

Theme 2 - XBT inflow story and QQQ

As quiet as the FX and Fixed Income markets have been to start 2024, the new economy, AI and bitcoin are on a heater... NVIDIA is now up 50% YTD (Fortune - Nvidia shoots past Alphabet to become the third most valuable U.S. company) ahead of next week's earnings whilst XBT inflow story goes from strength to strength with ETH the next most likely off the rank (Steno Research - Crypto Moves #15 – 90% Likelihood of an Ethereum Spot ETF Approval This Year). Conditions are loose with BofA's financial stress indicator dropping to its lowest levels since 2021 (Bloomberg - ‘Peak Euphoria’ Warning Blares as Stress Vanishes on Wall Street) and the Chicago Fed FCI is now "easier" than before rate hikes began in March 2022.

but still some have started to question if this is all too good to be true.... We all remember when Tesla was trading at $400 and it was a must have EV / ESG play as regulators supported demand with tax credits that are all now disappearing as ESG is not the vote winner that it once was.

Reuters - Global equity funds see big inflows amid stock rally

Morning Star - Going Into Earnings, Is Nvidia Stock a Buy, a Sell, or Fairly Valued?

Man Group - Big Tech Valuations – are we partying like it's 1999 or is this just 1997?

Bloomberg - Einhorn Says Markets ‘Fundamentally Broken’ By Passive, Quant Investing

Animal Spirits Podcast - Passive is Eating the Market

The Last Bear Standing - Heat Check

WSJ - Early Adopters of Microsoft’s AI Bot Wonder if It’s Worth the Money

UniCredit - Chart of the Week - The overlooked challenges of the green transition

ZeroHedge - JP Morgan Pulls Out Of $68 Trillion "Climate Action 100+" Group

ZeroHedge - Is Toyota The Next Tesla?

Theme 3 - CB's staying vigilant

The majority of CB speak this week was all off the same hymn sheet, with some telling the story more eloquently than others (Bostic - "Grateful but Vigilant") but at the end of the day we learnt nothing new. They're indeed open to cuts, but the risks of going too early are apparent to Orr, Bostic, Schnabel, Villeroy, Lagarde, Greene and others.... “Victory is not clearly at hand” as domestic price pressures have not eased. Despite their overcommunication and numerous appearances, markets will continue to re-assess the incoming data to "price" how many cuts are appearing this side of Easter.

Bloomberg - Orr Says RBNZ Still Needs to Anchor Inflation Expectations

FT - Productivity boost needed to keep inflation low, says ECB policymaker

Econostream - ECB’s Villeroy: Risk of Waiting Too Long to Cut at Least as Big as Risk of Cutting Too Soon

Federal Reserve Bank of Atlanta - Grateful but Vigilant: New Perspectives for a New Policy Environment

FT - Bank of England’s Andrew Bailey sees signs of ‘somewhat stronger ’ UK growth

Econostream - ECB Insight: De Guindos Makes Clear That the ECB Remains Firmly in a Waiting Game

Bloomberg - BOE’s Greene Seeks Cooler Price Pressures Before Rate Cut

Bloomberg - Ueda Mulls Rate Hike in Rare Case of BOJ Facing Scant Opposition

Theme 4 - Will Rishi survive this recession?

The UK has entered a technical recession with Q4 GDP QoQ at -0.3% vs exp -0.1%. This comes on the back of inflation remaining at 4%. Ironically that was not the worst news for Sunak this week with the Conservatives getting hit by an historic protest vote in the by-elections of two traditionally Conservatives strongholds. Turnout was low but the voter swing will have Conservative HQ taking note. Maybe they'll find out if Boris wants to come back.

FT - Reform's success is not the real story of the by-elections

Reuters - Britain's Labour Party deals double blow to PM Sunak's Conservatives

The Rest is Politics - Sunak's by-election disaster, Reform UK gains momentum, and political crisis in Rochdale

FT - Reform UK voter support highlights threat to Sunak’s right flank

FT - UK’s ‘technical’ recession is politically toxic for Rishi Sunak

The Guardian - Bring out the PopCons, Liz Truss is the entertainment that keeps on giving

Stagflation, reduced government spending, the little 'r' and ESG roll back... There is no clear message from the UK to global investors or the domestic electorate... The US offers world leading growth and AI supremacy, India is out performing in Asia due to regulatory changes and strong demographics... in comparison, what does the UK offer? There's a political vacuum as voters now struggle to decide who represents them best... Reform, Lib Dems, Liz new PopCons crew (Popular Conservatism) and of course the traditional powerhouses of Labour and the Conservatives ....

Source: ONS via Bloomberg

Theme 5 - How does technology rewire the intricate circuitry of the teenage mind?

This an excellent and must-read piece from 13D with intro/forwards from Brent Donnelly and Ben Hunt...

Rabbit Hole #11: Technology and the Teenage Mind

Having grown up playing computer games ... Super Mario, Golden Eye, Age of Empire, GTA etc etc... The gaming industry came under consistent political pressure due to the violent content that these games brought into households. However, history/time has proven that those games have delivered a fraction of the impact on society that smart phones have for teenagers and adults, but there's no 18+ "rating" for smart phone apps like there can be on movies and games. Similar with ads .. why are "free" games and YouTube allowed to have different ad standards than traditional TV? Does society / governments need to rate the products on our phone? Why is new technology treated different to old?

Top 10 Reads of the Week on Harkster.com:

Bloomberg - China Holiday Travel Surge Hints at Consumer Spending Pickup

Bloomberg - Butterfly or Godzilla? Chaos and the Falling Yen

Reuters - Explainer: European banks and their $1.5 trillion commercial property headache

The Economist - Investing in commodities has become nightmarishly difficult

BNP Paribas - A more nuanced look at Chinese equities

Bloomberg - How Paramount Became a Cautionary Tale of the Streaming Wars

Compounding Quality - Start with the moat

Axios - Biden boxed in on all sides by historic immigration crisis

The majority of these links appear in our new "HarksterPro - Intraday Market Colour" channel. If you click on "Select Channels", you should find under "Added Recently" our latest additions to the app. @HarksterHQ will use this new channel to flag good articles/sources of content as well as headlines/market moving events.

Top 5 Podcasts of the Week:

Odd Lots - How a Second Trump Administration Could Upend US-China Relations

GS Podcast - 2024: the year of elections

JPM Global Data Pod - The new year starts with a bang

Blind Squirrel Macro - We have come a long way from Mad Men

The Week Ahead

Looking forward to next week...

ABN Amro - The week ahead - Feb 19-23

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

that 13D article was terrifying if you have kids. everyone needs to read it