The Saturday Hark Back - 09 Mar 2024

Capturing the themes of the week when there’s more time to digest them.

The Hark Back

The key narratives that drove markets last week:

Theme 1 - The summer of cuts

Theme 2 - BoJ

Theme 3 - ATH

Theme 4 - How can the Fed be comfortable with the softness in FCI?

Theme 5 - Biden's election campaign has started

Theme 6 - Hunt's budget

Theme 7 - 5%

Top 10 Reads of the Week on Harkster.com

Top 5 Podcasts of the Week

Week Ahead Previews

Theme 1 - The summer of cuts

ECB will know a lot more by June, JPow indicated that they're 'not far' now and most importantly the US data this week nailed its (soft) landing. Goldilocks euphoria is flooding through the data sphere with Joe Biden happy to go off script at his State of the Union address to declare "the landing is and will be soft". With the PBoC pumping liquidity into the system, the SNB expected to weaken their ccy (at least stop their ccy purchases), the BoJ just moving from -0.1% to 0.0%, ECB with an explicit easing bias for June (some board members have even tried to keep April on the table) and the Fed comfortable forecasting 2/3 hikes for 2024, the liquidity is there to fuel a market rally.

Steno Research - LAGARDE’S TONE RHYMING WITH EASIER FINANCIAL CONDITIONS

Econostream - ECB’s Nagel: Probability Increasing of Rate Cut Before Summer Break

Econostream - First Interest Rate Cut Very Likely in Spring

Bloomberg - ECB Will Discuss Rate Cuts in April and June, Rehn Says

Bloomberg - Fed Is ‘Not Far’ From Confidence Needed to Cut Rates, Powell Says

ABN Amro - ECB laying groundwork for rate cuts

Reuters - Market hopes are high that big central banks will cut rates around mid-year

Theme 2 - BoJ

If they hike from -0.1% to 0.0%... how does that change the carry strategy? Momentum is a funny beast, with JPY benefiting from a spike in domestic wages, government and BoJ speakers not standing in the way of a hike and of course the 20bps rally in US10s to 4.05%. Furthermore, middle of March has been a seasonal low in USDJPY as potential repatriation flows hit the cross ahead of the local year-end. However, when all is said and done, the BoJ will lift the policy rate from -0.1% to 0%, or maybe -0.1% to 0.1%.... that's it, after the euphoria of a hike out of negative territory will the cta carry models buy jpy yielding 0.1% over eur, aud, mxn, usd etc etc etc...

Bloomberg - Yen Gains With Bank Stocks as Wages, BOJ Remarks Boost Hike Bets

Across The Spread by Weston Nakamura - What BOJ Thinks of Japan Wages and Negative Rates

ZeroHedge - USDJPY Plunges As Soaring Japanese Wage Growth Sparks Surge in BoJ Rate-Hike Odds

Russell Clark - THE BOJ AS A KEIRESTU

Theme 3 - ATH

"Scarcity" has been a defining mantra as CB's buy gold, BlackRock Bitcoin ETF breaks records and Goldmans call for over $1trillion of buybacks this year. With the printing press re-accelerating despite the uncertainty that inflation has actually been tamed, FCI are looser wherever you look... Gold 2180, Bitcoin $70k, Copper > 390 (supporting AUD) and Nvidia / SPX / QQQ. As the market eyes deficit spending, potential government policy to inflate away debt, how else can the US government get out under the $33trillion and counting ...?

Gryning times.... we need a period of hot nominal growth (an economic boom), to inflate away the massive debt boom of not just the post-pandemic era, but the post-Global Financial Crisis era.

Lyn Alden Feb Newsletter - Economic Reacceleration. "For nearly a year and a half, there have been opposing forces of loose fiscal policy and tight monetary policy playing out in the U.S. economy, and navigating the interaction of these forces has been a big part of success or failure for investors during this period."

Brent Donnelly - Friday Speedrun … “the market is debasing the currency and ripping anything not nailed down because there is a non-zero chance that policy is still way too loose”

Further reading on the goldilocks euphoria flooding through assets

Unchained - How, in 7 Weeks, Bitcoin ETFs Reached Inflows That Took Gold ETFs 3 Years

Odd Lots - Lots More on Why Japanese Stocks Are Surging

The Economist - Are passive funds to blame for market mania?

The Last Bear Standing - O Bubble, Where Art Thou?

The MacroTourist - THE DISPERSION TRADE: BALANCED BUT RISKY

TKer by Sam Ro - The stock market doesn't care about your Fed rate cuts 🤷🏻♂️

ZeroHedge - Bitcoin, Bullion, & Breakevens Soar As Markets Lose Faith In 'Inflation-Fighting' Fed

Reuters - Goldman Sachs expects U.S. buybacks to top $1 trillion in 2025

Steno Research - THE LEAST SPECULATIVE CRYPTO BULL MARKET

Theme 4 - How can the Fed be comfortable with the softness in FCI?

Inflation breakevens are now drifting higher, gold and crypto pumped, equities rallying and FCI soft... financial conditions are becoming too easy to tame inflation sub 2% as the US economy has the potential to reaccelerate. In an election year, if the Fed misses June, then they're unlikely to cut either side of the Nov Presidential elections. Can you see them cutting in September for the first time with Trump on the campaign trail vs Biden. Taking politics out of it, why is the market calling for cuts from ECB and Fed at the same time despite large divergence in their growth paths. Torsten Stok of Apollo has done some excellent work this week on why the Fed may not need to cut in 2024.

Apollo - The Fed Will Not Cut Rates in 2024

Apollo - Inflation Expectations Moving Higher

Apollo - Outlook for US and Europe diverging

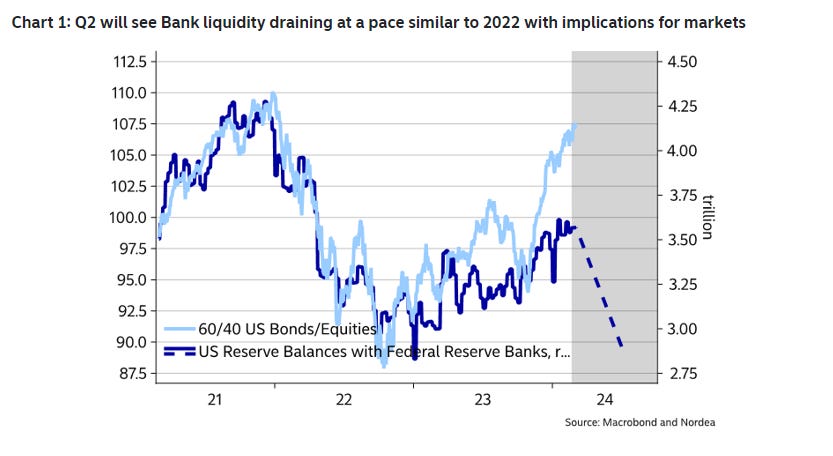

Furthermore, Nordea also highlight the risk of a liquidity drain...

Nordea Macro & Markets - Massive USD Liquidity Drain Coming Up

Theme 5 - Biden's election campaign has started

A fiery state of the union address has dispelled some cognitive impairment fears and led to Biden having the two biggest fundraising hours in the 2024 cycle. He may not have named Trump but he attacked him on all fronts... #1 Ukraine / NATO allies, #2. Jan 6th insurrection, #3. abortion rights, #4. taxing billionaires, #5. immigration / border security and even went off script to discuss the economy... "the landing is and will be soft". According to Politico, in terms of strategy "it’s hard to imagine how the SOTU could’ve gone much better for Biden."

Politico - The turn-the-tables SOTU

Bloomberg - Key Takeaways From Biden’s State of the Union Address

The NY Times - How Cable News Reacted to the Speech

Axios - Biden's State of the Union hecklers face internal GOP groans

FiveThirtyEight - A Very Political State Of The Union

Axios - 5 key takeaways from Biden's State of the Union speech

The Guardian - Who is Katie Britt, the Alabama senator who gave a rebuttal to Biden’s State of the Union?

FT Swamp Notes - Did Biden’s State of the Union hit the mark

FT Swamp Notes - Biden and Trump's immigration duel

Theme 6 - Hunt's budget

For all of the ink that has been spilt on the budget, did it really move the needle? Was there even a blip in the odds of Sunak coming back in to number 10. It's still unclear who actually benefited from the budget and it will do nothing to adjust the decade of stagnation. Furthermore, Bloomberg have reported that the Office for Budget Responsibility said its long-running prediction is “broadly on track” to show a 15% fall in trade and a 4% reduction in the economy’s potential productivity compared to if the country had stayed in the EU.

FT - UK growth prospects barely changed by chancellor’s tax cuts

Bloomberg - UK Is ‘On Track’ for 4% Hit to Economy From Brexit, OBR Says

HSBC The Macro Brief - The UK's narrow margins

Bloomberg - UK Election Budget Pleases Almost No One

Theme 7 - 5%

China has set an "ambitious" 5% growth target, given the prolonged real estate deflationary spiral, loss of household confidence, dwindling domestic demand and Trump tariff war on the horizon. That's 8% nominal growth given they also reasserted their 3% inflation target. Military spending was a sole bright spot amid the broad economic slump and once again it is clear that "officials won’t rely on massive stimulus to spur expansion as they try to break the country’s reliance on debt-driven growth."

Steno Research - 3 TAKE-AWAYS FROM LI QIANG’S SPEECH

The NY Times - Is China’s Era of High Growth Over?

Bloomberg - China to Refine Real Estate Policies to Boost Ailing Sector

Bloomberg - Global Funds Are Returning to China Stocks, Morgan Stanley Says

SCMP - ‘Two sessions’ 2024: risks ahead but China’s economy to stay on long-term, tech-led course

Bloomberg - China Sets GDP Goal That Needs Policy Support ‘From All Fronts’

S&P Global - China's Two Sessions prioritizes industrial upgrades to sustain economic growth

Top 10 Reads of the Week on Harkster.com:

FT - How Mnuchin pulled off a $1bn deal to steady a teetering US bank

MacroHive - Nigel Toon on How AI Thinks and How We Can Control It

Odd Lots - How the Rise of 'Pod Shops' Is Reshaping the Way Markets Trade

FT - The radical changes coming to the world’s biggest bond market

FT - Spiralling US public debt risks action from bond vigilantes

Axios - Musk vs. OpenAI: When the lines blur between for-profit and nonprofit

Man Group Views From The Floor - Back to the Future: MacroScope Signals Economy Mirrors Late 90s Boom

Fortune - Mnuchin to the rescue as commercial real estate loan victim NYCB secures over $1 billion lifeline

The majority of these links appear in our new "HarksterPro - Intraday Market Colour" channel. If you click on "Select Channels", you should find under "Added Recently" our latest additions to the app. @HarksterHQ will use this new channel to flag good articles/sources of content as well as headlines/market moving events.

Top 5 Podcasts of the Week:

FiveThirtyEight - A Very Political State Of The Union

Blind Squirrel Macro - Pod: The 🐿️ must be on drugs!

S&P Global - The Global Cocoa Trade

The Market Huddle - Reconciling Opposing Truths (guest: David Cervantes)

The Week Ahead

Looking forward to next week...

Next week is all about CPI: Does it confirm the Jan uptick is embedded in the economy or was it just a seasonal blip. If CPI is low how high can assets go? Will it be the perfect goldilocks, disinflation regime. However as Brent Donnelly warns, "if CPI is unambiguously strong, the market will start to wonder if inflation has bottomed and there’s nefarious inflationary reacceleration going on here."

Nomura - The Week Ahead – US CPI, UK Labour Market Data and China CPI

NatWest - A major week for major currencies

S&P Global - Week Ahead Economic Preview: Week of 11 March 2024

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.