The Saturday Hark Back - 09 Dec 2023

Capturing the themes of the week when there’s more time to digest them.

Final reminder: If you haven’t upgraded yet, subscribe now to continue reading.

From next weekend (December 16th), we will only send this newsletter to paid subscribers. Keep reading all our newsletters with a HarksterPRO subscription for just $24/month.

The Hark Back

The key narratives that drove markets last week:

It is the season for trending, and last week saw a continuation of some of the core end of year 2023 trends

Softer EUR-XXX: ECB to lead the cutting cycle by March / April (they just haven't admitted too it yet), disinflation, weaker growth and German fiscal hole.

JPY acceleration as US10s rally to 4.2%, US economy slows from its Q3 peak and of course the year ahead pieces that expected BoJ to tighten got a boost from Ueda's comments

Crypto ETF euphoria - we're back!!!!!! $150k price targets permeate across FinTwit

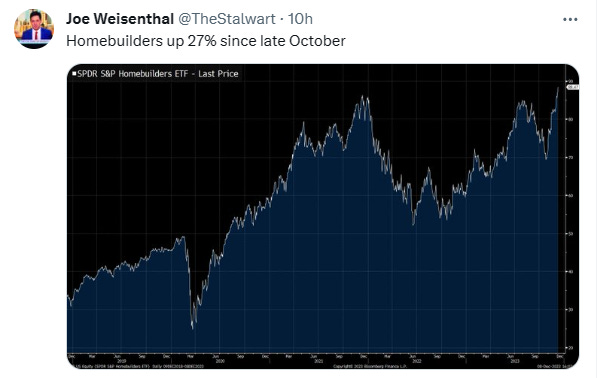

Soft landing vibes have equities flying, wage gains, resilient labour market, lower inflation expectations... what's not to love? Homebuilders most certainly do… +27% since October lows....

Oil's slide off its September highs continues, and is now down 20%. There doesn't seem to be much OPEC can do if China imports less, Europe heads into a recession, EV caps its available market place ... demand destruction continues unabated.

Chinese stocks at multi year lows which leads to some key questions.

Is all the bad news now in the price?

Will we see a turnaround in the Chinese economy in 2024?

JPY, JPY and more JPY

A confluence of factors hit cross-JPY and lead to some short gamma fireworks (Across The Spread by

- Heads up: Potential JPY Surge In Immediate).... CTA stops as the yield differential changes (Ueda exit chatter led to Jgbs selling off whilst US 10s are down almost 100bps from their Oct wide’s (520bps to 420bps), oil's slide lowers the JPY current account deficit and one of the key year ahead trades was long JPY.Some of the key pieces curated from Harkster.com during the past week on the JPY move

Across The Spread by Weston Nakamura - Is The Yen Broken?

MacroHive - 2024 Grey Swan: USD/JPY Collapses

Brent Donnelly am/FX - JPY and CHF

Steno Research - Wrongfooted by Ueda and Gas

Mr Price vs H4L

The year is certainly not over yet with next week set to see two heavy weight camps going to battle. Mr Price enters the contest with heavy discounting of cuts, how will it react to a potential onslaught from Team "higher for longer". Powell and Lagarde have been left with the most to do, but we could also see some surprises from SNB and Norges. Lagarde is being squeezed by the 5/6 cuts priced into the Euro curve whilst JPow also has his work cut out to get the mkt to believe there will not be significant cuts next year from the US (maybe the data will do it for him....)

Fed - how will the SEP be used to re-enforce Higher for Longer

Apollo - The Market Is Underestimating the Fed’s Commitment to 2% Inflation

ING - We expect another Fed hold, but with pushback on rate cut prospects

The MacroTourist - THE REASONS WHY THE FED BLINKED

Nordea - Does the US need rate cuts in March?

ECB - Will Lagarde accept the markets first cut by March? Seems highly unlikely she will want give firm forward guidance of the timing of the first rate cut.

Pepperstone - Playbook For The December ECB Decision

ING - December’s ECB cheat sheet: A reality check for ultra-dovish expectations

Bloomberg - ECB to Clash With Markets Over Rate-Cut Timing, Survey Shows

Reuters - ECB hawk Schnabel scraps more rate hikes after 'remarkable' inflation drop

Nordea - EUR rates: six rate cuts in 2024

Bloomberg - "ECB's new projections alongside its decision on rates. Respondents expect growth and inflation predictions to be trimmed for this year and next, and left unchanged for 2025"

The US and Europe couldn't be further apart to start 2024.

What continues to surprise @HarksterHQ is the cuttings cycles are so similar, in timing and depth... Why does the US need so many cuts? The SAHM Indicator has dropped to 0.3% following Friday's labour data (

- The Sahm rule: step by step) whilst Bloomberg's Kristine Aquino (@krisaqnews) points out that "Outside of the Covid pandemic, the last two instances where the Fed pivoted on policy -- in 2007 to 2008 and in 2001 to 2003 -- coincided with the beginning of at least a year of negative payrolls prints."Source: Five Things You Need to Know to Start Your Day (Dec 08)

Some new 2024 previews ...

ABN Amro - Key views Global Outlook 2024

Macro Hive - 2024 Grey Swans: The Complete List

Top 10 Reads of the Week on Harkster.com:

Bloomberg - US Jobs Report November 2023: Labor Market Strengthens as Hiring Gains

MacroVisor - Charts of the Week - Has the Fed's hiking cycle peaked?

Adam Mancini - Has The Next Leg Higher In SPX Begun? Not So Fast. (Dec 11th Plan)

Brent Donnelly - Friday Speedrun: December 8, 2023

Bloomberg - Good News — The UK’s Pensions Black Hole Is No More

The Felder Report - Will The ‘Vibecession’ Ever Catch Up With The Magnificent 7?

Cubic Analytics - Bitcoin Hits New All-Time Highs

Fed Guy - Crash Up

The Gryning Times - Fed's New Financial Conditions Index

The majority of these links appear in our new "HarksterPro - Intraday Market Colour" channel. If you click on "Select Channels", you should find under "Added Recently" our latest additions to the app. @HarksterHQ will use this new channel to flag good articles/sources of content as well as headlines/market moving events.

Top 5 Podcasts of the Week:

DB CIO - Don't wind down yet

The Blind Squirrel Macro (Podcast) - Scooby-Doo and Vincent Vega walk into a bar.

Real Vision - Mike Novogratz on 2023 and Beyond

The Week Ahead

Looking forward to next week...

Nomura - Final FOMC Meeting of The Year, ECB and BOE Meetings, and the Japan Tankan Report

Newsquawk - Week Ahead highlights include: FOMC, ECB, BoE, SNB; US CPI, China activity data

Hobas Econ Calendars - New York: Next week's G10 & China Economic Calendar

Scotiabank - The Global Week Ahead

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

It is remarkable how the two sides of the economic argument are so dug in, and I feel like it is about evenly split these days. somebody's gonna be really wrong, that's for sure

seems like the US data is going to help Powell and team higher for longer out. I just can’t see the Dems going to the polls in the midst of a recession … Chip Act 2.0 to boost fiscal spend and support Biden in the polls