The Saturday Hark Back - 03 Feb 2024

Capturing the themes of the week when there’s more time to digest them.

The Hark Back

The key narratives that drove markets last week:

Theme 1 - March is not the base case

Theme 2 - What's the Fed going to tell us next week?

Theme 3 - AI productivity supercharging Mag 7 (well Mag 6)

Theme 4 - China on a different course

Theme 5 - NYCB reignites CRE fears

Theme 6 - It's going to be a Swift election

Top 10 Reads of the Week on Harkster.com

Top 5 Podcasts of the Week

Week Ahead Previews

Bonus - Tweet(s) of the Week

Theme 1 - March is not the base case

Powell flipped the switch, there is too much growth to be comfortable / confident that inflation will trend sub 2%. As a result, the Fed are not in "panic" mode to reduce real rates and wants to guarantee the underlying strength of the economy does not re-accelerate inflation. Their cautious approach indicates that they're worried about "sticky" inflation and why not. Base effects are soon to become a head wind to the disinflation process after 6months or so of being one of the key tailwinds. Furthermore, the uncertainty around freight costs and elevated energy costs due to the rising tensions in the middle east are a known unknown to the inflation outlook. 4.5% annual AHE suggests to the Fed that the battle has yet to be won. In fact, is the US economy already re-heating?

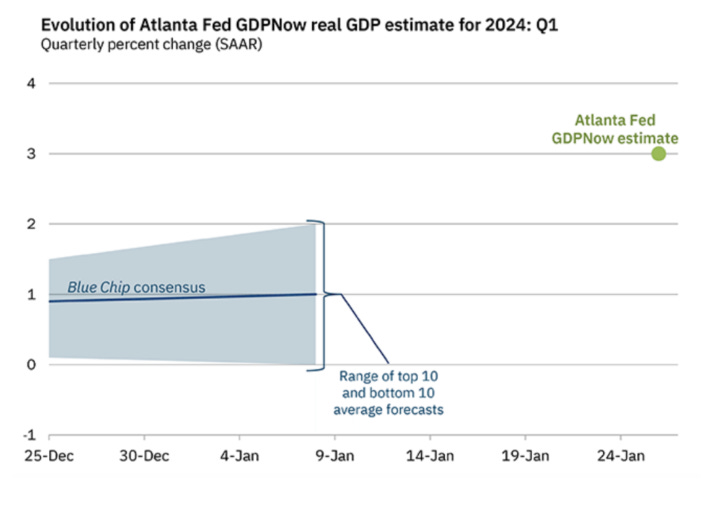

As the dust settles on the "surprise" pushback from Powell, it gives us time to reflect on just how far the market got ahead of itself in Dec/Jan. It's amazing that an economy with 3% growth and we priced not so long ago a 10/20% chance of a 50bps cut in March!!!! I fully appreciate the real rates argument, but JPow has flipped our focus, there is simply too much growth to cut (Atlanta GDPNow at 3%). Let's see what the data brings and if it gives the Fed confidence to deliver the first 25bps cut...

Steno Research - SOMETHING FOR YOUR ESPRESSO: IS POWELL RIGHT?

Bloomberg - Bad Weather Probably Boosted Wage Numbers in January Jobs Report

The Next Economy by

- Hawks and Supply

Theme 2 - What's the Fed going to tell us next week?

A few days after the FOMC meeting, Chairman JPow steps into the Sunday night void left by Kelce and Swift who've taken a week off before the Super Bowl. Powell was right on Wednesday not to be looking for a "weaker labour market”. He also told us that they're "looking for inflation to continue to come down as it has been coming down for the last six months.” Potentially he says something new on NYCB, stability of the US banking system but so close to the FOMC presser it seems likely he'll copy and paste his message for main street (the electorate). After all, Trump believes he's working/cutting for Biden.

Line up of Fed speakers for the week ahead

Source Bloomberg via @ChrisWeston_PS

Theme 3 - AI productivity supercharging Mag 7 (well Mag 6)

What a pity we never saw the cage fight between Musk and Zuckerberg, but this earning season has clearly swung back towards Mark... Meta up 20% on the week, after they launched their first dividend, announced a $50bln buyback program and posted their biggest quarterly sales rise in 2 years. Musk on the other hand is trying to leave Delaware for Texas, and has had to recall millions of cars. Apples revenues were clouded by Chinas growth worries whilst Amazon enjoyed a fine festive period as the US consumer enjoys consuming!

- Stock Market Nerd - News of the Week (Jan 29 - Feb 2)

- The Weekly S&P500 ChartStorm - 4 February 2024

Gryning Times - Productivity Growth -> Economic Growth

Morning Star - Magnificent 7 Stocks: US Tech Earnings in Full

ZeroHedge - Elon Musk Says Shareholders Will Vote On Reincorporating Tesla In Texas

BMO - Meta Moon

FT - Apple’s revenue growth clouded by worries about China slowdown

Theme 4 - China on a different course

Chinese stocks are down and they're struggling to beat the referee's count. The CSI 300 is now down around 8% on the year and hitting 5year lows despite RRR cuts, short sale bans and a potential $278bln rescue fund. Mirroring moves that occurred in the West during the GFC, China tightens security lending to help shore up their embattled market. However western investors remain sceptical of the evolving regulatory environment and In a surprise move, with what could potentially be the final chapter in Evergrande's story, a HK court has ordered the Chinese developer to be wound up after it failed to reach a deal with creditors.

Bloomberg - China Tightens Securities Lending Rule to Support Stock Market

Reuters - China pledges to take more forceful measures to support market confidence

Nikkei Asia - China stimulus measures greeted with skepticism by foreign investors

Bloomberg - Hong Kong’s New Security Law Brings Anxiety to Finance Hub

FT - Chinese developer Evergrande ordered to be wound up by Hong Kong court

Steno Research - Evergrande Nugget: Popping the World’s Largest Asset Bubble

The Economist - Evergrande’s liquidation is a new low in China’s property crisis

Capital Wars by Michael Howell - The China Crisis (Post-Evergrande. A major devaluation of the Chinese Yuan is needed)

Theme 5 - NYCB reignites CRE fears

As the music stops, funding maturity cliff approaches and workers are not returning to the office (Apollo Academy - Work from Home Is Here to Stay)... who is left holding the bag? where do the unrealized CRE and fixed income losses lie?

NYCB caught a fixed income market looking in the wrong direction, focused on QRA, Tech stock earnings and the hawkish Fed pushback. Gold caught a bid and US10s rallied 20 odd bps to 3.80/85% into NFP on the back of safe haven demand induced from the aggressive sell off in NYCB stock and the KBW index.

ZeroHedge - Dominoes: After NYCB, Shares Of Japanese Bank Implode On Massive US CRE Writedown

WSJ - New York Community Bancorp Stock Plunges 38%, Reigniting Fears for Regional Banks

Bloomberg - NY Community Bancorp Plunges a Record 45% After Dividend Cut

Simon White, Bloomberg Macro strategist via ZeroHedge - Bank-Stress Is Wake-Up Call For Goldilocks

FT - Bank losses revive fears over US commercial property market

Deutsche Bank also lifted provisions for losses on loans linked to US CRE from 26mio euro a year ago to 123mn. However, it was Tokyo that took over from NYCB. Aozora Bank has always been intertwined with US commercial real estate, as Weston Nakamura (Across the spread - Dark Skies at Aozora Bank) highlights, the Japanese bank has had connections/exposure to Lehman, Madoff.

"Aozora increased an additional ¥32.4 billion in reserves against souring U.S. CRE loans. Aozora also accelerated sales of its foreign securities, much of which comprised of FX hedged US Treasuries, as unrealized losses mounted."

Theme 6 - It's going to be a Swift election

"It's the economy stupid".... well, it doesn't seem that way for Biden as an AI productivity boom as well as $5trillion fiscal tailwinds has propelled the US economy during his term, leaving it exceptionally strong relative to Germany and China. Biden has 9 months to campaign to the US electorate to make up lost ground to Trump in many of the key battle states despite historically strong jobs market, stocks at ATH, inflation trending back to target, gas prices stable at the court yard and manufacturing ISM trending back towards pre covid levels. Maybe Swift will be the joker in the deck for Biden, but FT's analysis says it can be just as polarising as supportive for candidates when it comes down to Blue vs Red.

FT - Could Taylor Swift really hand Biden victory over Trump?

The NY Times - The Economy Looks Sunny, a Potential Gain for Biden

Hailey is still in the race for the next few weeks until super Tuesday but the money is returning to the Trump campaign

Bloomberg - Trump Says He Would Not Reappoint Powell as Fed Chair if Elected

Fortune - America’s billionaire investors are lining up behind their favorite candidates for 2024

Bonus - Tweet(s) of the Week

Top 10 Reads of the Week on Harkster.com:

Steno Research - G3 Watch: Timing the first rate cut

FT - Red Sea crisis pushes up delivery times for European manufacturers

M&G Investments / Bond Vigilantes - Japan, the steep climb that’s about to flatten out

Bloomberg - Blackstone Is Building a $25 Billion AI Data Center Empire

Steno Research - Macro Sunday #34 - The Red Sea is WORSENING

The MacroTourist - THE FED IS NOT CUTTING BECAUSE THE ECONOMY IS WEAK

Bloomberg - Morgan Stanley Turns Bullish on US Banks Over Capital Rules

The majority of these links appear in our new "HarksterPro - Intraday Market Colour" channel. If you click on "Select Channels", you should find under "Added Recently" our latest additions to the app. @HarksterHQ will use this new channel to flag good articles/sources of content as well as headlines/market moving events.

Top 5 Podcasts of the Week:

Macro Voices - #413 Darius Dale: Still Bullish

Bloomberg - Mark Cabana Connects the Dots on Bonds, Banking and Benchmark Rates

Forward Guidance - Joseph Wang On “Hawkish” Fed Meeting: March Cuts Unlikely, Tapering of Quantitative Tightening (QT) To Begin In Q4 2024

The Market Huddle (guest Simon White) - Inflation Re-Acceleration

The Week Ahead

Looking forward to next week...

ABN Amro - The week ahead: 5 – 9 February 2024

Nomura - The Week Ahead – US ISM Report, German Industrial Production, Japan Earnings Data

Macro Hive - Week Ahead: We Had the Fed and Blow Out Payrolls, What’s Next?

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

So much new information. hard to keep up so thanks for the recap. but you dint even mention QRA