The Saturday Hark Back - 01 June 2024

Capturing the themes of the week when there’s more time to digest them.

The Hark Back

The key narratives that drove markets last week:

Holiday shortened, range bound week with opposing forces colliding, rebalancing flows dominating and prices left bobbing within clearly defined parameters.

Theme 1 - Fixed income sell off (for 2 sessions at least)

Blink and you've missed it. If you were on the beach last week and looked this evening at the week on week returns you wouldn't expect too much to have happened.

However, there were struggles in the UST auctions as a "buyers strike" or at least lower demand turned up for 2s, 5s and 7s auction. The inability to ingest the historic issuance saw 2s test 5% and 10s drift out 4.65% (multi week highs).

As soon as the "trend" had started we were soon reverting back into range... month end duration demand, soft US activity data (Q1 GDP) and of course PCE at 0.2% capped the sell off and took any momentum out of the trade. Back into range we go as Move Index drops south.

A 10bps move has dominated the news cycle, well and truly gone are the target rich macro environment when the Fed was hiking 75bps a meeting and yields were ripping north and south. What have we learnt this year? At 4.30% the 10s maybe rich, but at 5.00% they look attractive??? net net we're still chopping and changing within the clearly defined range .... let's not over analysis every 5/10bps move.

ING - US inflation relief keeps the door open to a September rate cut

BMO - U.S. Core PCE Inflation, Spending, and Income All Moderate in April

Bloomberg - Soft Economic Landing Means Bonds Have a Long, Hard Road Ahead

Bloomberg - Fed’s Bostic Says Many Inflation Measures Moving to Target Range

Reuters - US firms grow more pessimistic on economic outlook, Fed survey shows

Bloomberg - Fed’s Beige Book Points to Modest Growth in US Economy, Prices

Apollo Academy - The Fed Cut Reflexivity Paradox

ING - Supply indigestion

Fidenza Macro - What's behind the jump in global yields?

Bloomberg's John Authers - Throwing in the Towel on Rate Cuts Everywhere

Hedgopia.com - On Back Of Soft Demand For Treasury Auction, 10-Year T-Yield Rallies To Upper End Of Symmetrical Triangle

Theme 2 - Warning signs from Japan...

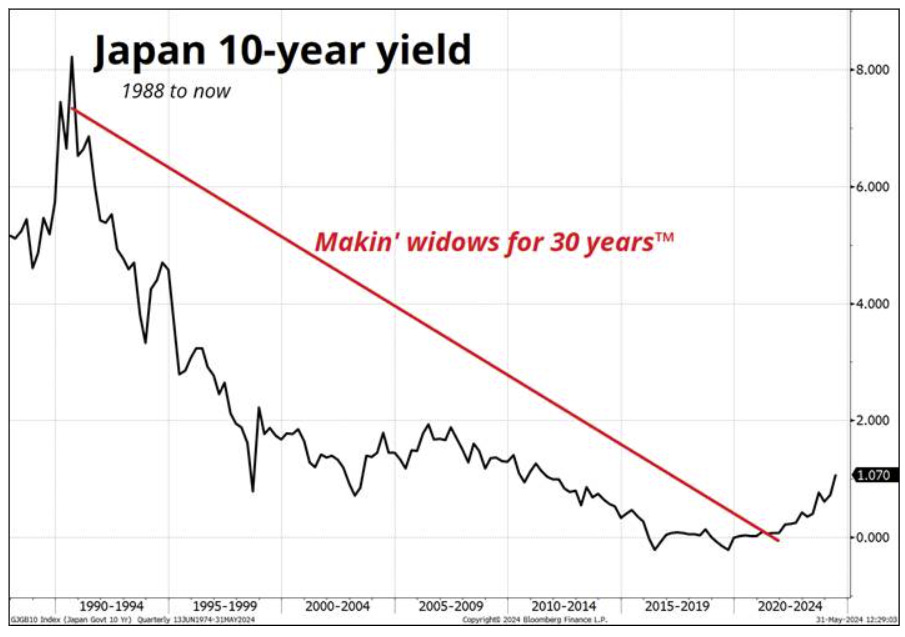

The BoJ dampener and activity from Japanese savers are crucial to global yield pricing. The more the Japanese get at home, the higher the yield they expect from US, Europe and other deficit countries. Expectations are building for a June tapering of the BoJ bond buying and as 10s have broken 1% and the range the BoJ held last year, global fixed income investors are becoming anxious. BoJ will smooth any sell off but as we hit 1.07%, when will they arrive?

Source: Brent Donnelly Friday Speedrun

Theme 3 - How can the Fed mop up the government's interest bill?

Hedgopia.com posted the chart below, flagging the $1trillion in interest payments from Treasury. That’s a lot of money entering savings accounts, pension funds and of course corp balance sheets (apple...????) ... How can Powell slow this money from entering households spending?

Theme 4 - Sticky Inflation = Higher for longer

We ended the week on a good note (PCE 0.2%), but overall inflation data last week remains firmly in the "sticky" camp. Australia, Tokyo and Europe (German, French or Spanish) inflation as well as SNB Jordan's warning, the disinflation trend has entered a sticky patch globally. ECB pre-committed to June, the debate has shifted out the curve as the risk of reflation remains. German inflation popped to 2.4%... base effects, the highest increase in real wages since 2008 (+3.8% YoY for first quarter) and of course sticky service inflation are combining to curb ECB expectations for July and beyond. ECB's Kazak was clear, they're not on autopilot to cut rates incrementally post June. Will Lagarde declare the ECB data dependent next week?

Brent Donnelly am/FX - H4L: EU Edition

ING - THINK Ahead: Would you bet your bottom euro on the ECB?

Rabobank - One rate cut is no rate cut

Reuters - SNB's Jordan sees upward risk to central bank's inflation forecast

Bloomberg - Tokyo Inflation Picks Up, Keeping BOJ on Track for Rate Hike

Bloomberg - Fed’s Bostic Says Many Inflation Measures Moving to Target Range

Bloomberg - Australia’s Elevated Inflation Suggests RBA to Extend Pause

FT - UK shop inflation back to ‘normal’ levels, says retail industry

Bloomberg - Fed’s Bostic Says Many Inflation Measures Moving to Target Range

Bloomberg - ECB Should Not ‘Autopilot’ Into Rate Cuts, Says Kazaks

Theme 5 - Guilty

Trump found guilty, but the money flowed in from supporters and its not clear if it was a positive or negative for his campaign odds. A lot of analysis on the guilty verdict, from the potential of an appeal, his ability to campaign, his messaging about key US institutions through to the likelihood of a suspended sentence. For Reps, Trump is the man in front of the machine, the polices they're looking to implement rather than the President, they follow word for word. Belief in his economic policies is undeterred by his court conviction. In fact, a number of prominent figures in US business and finance are rallying behind him and campaign donations have also soared. Promises of tax cuts, lower red tape and elimination of regulation carry a greater weight than the implications of his criminal trial.

Axios - Trump campaign's donation site crashes after guilty verdict

Axios - Trump campaign says it broke fundraising record after hush money conviction

Bloomberg - Wall Street Billionaires Are Rushing to Back Trump, Verdict Be Damned

Bloomberg - Wall Street Scans for Potential Volatility After Trump Verdict

The NY Times - Why Megadonors Are Unfazed by Donald Trump’s Guilty Verdict

Theme 6 - AI in the press

The NY Times - Google Rolls Back A.I. Search Feature After Flubs and Flaws

TechCrunch - AI training data has a price tag that only Big Tech can afford

WSJ - Google to Invest $2 Billion in Malaysia for AI, First Data Center

The NY Times - Mark Zuckerberg is Popular Again Thanks to Meta’s Open-Source AI

HSBC - The Macro Brief – The good, the bad and the ugly of AI

Top 10 Reads of the Week on Harkster.com:

SMB Capital - The Weekly Trade Plan: Top Stock Ideas & In-Depth Execution Strategy – Week of June 3, 2024

Reuters - BHP walks away from $49 billion pursuit of mining rival Anglo

NY Fed - Taking Stock: Dollar Assets, Gold, and Official Foreign Exchange Reserves

Metals, oil and everything else - gold is cheap

Bloomberg - Traders Are Bracing for a Record-Smashing Summer That Will Shake Up Commodities

Compounding Quality - Set it and forget it

Brent Donnelly am/FX - The South Park Jinx

The majority of these links appear in our new "HarksterPro - Intraday Market Colour" channel. If you click on "Select Channels", you should find under "Added Recently" our latest additions to the app. @HarksterHQ will use this new channel to flag good articles/sources of content as well as headlines/market moving events.

Top 5 Podcasts of the Week:

The Macro Trading Floor - Don't Make This Mistake

FiveThirtyEight - Reaction Podcast: Trump Found Guilty

Saxo Bank - Is electrification the next big thing?

Bloomberg - How a Professional Sports Bettor Really Makes Money

The Week Ahead

Looking forward to next week...

ING - Asia week ahead: RBI likely to pause while China’s exports rise

Nordea - Macro & Markets: Cut now, then see

ABN Amro - The week ahead: 3 - 7 June 2024

Macro Hive - The Week Ahead: NFPs to Show Labour Market Remains Tight

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.