The Morning Hark - 24 Oct 2023

Today’s focus...Soggy start for the day in London and for the flash PMIs. More “unscheduled” Japanese bond buying. Bitcoin has a Lazarus moment and a nice doves/hawks chart.

Overnight Highlights

Prices are at 7.00 BST/2.00 EST, with changes reflecting movement from midnight BST

Oil - Brent and Crude December futures recovered some of their poise in Asia with them currently up smalls at 90.10 and 85.80 respectively. The relief sell off continued yesterday taking oil down three percent at one point as hopes rose for a diplomatic solution and Israel delaying their much anticipated ground assault. However nerves are never too far away as traders twitch over the buy button.

EQ - Asian equity markets having a fairly quiet session with the Nikkei, Hang Seng and Kospi currently at 31,100, 17,060 and 320 respectively.

The US indicies up a touch in Asia with the Nasdaq and S&P futures up at 14,780 and 4255 respectively.

Gold - Gold Dec flatlining in Asia but remains bid. Currently sitting at 1988.

FI - Global yields steady overnight with the US2y and US10y trading flat at 5.07% and 4.84% respectively. Spicy day yesterday which saw 5% captured in the 10y, at last, to only disappear sharply below 4.90. Lot of chat about the actual cause with high profile investors, Bill Ackman and Bill Gross, cashing in their dollar “Bills” on the yield play. Ackman stated that there is “too much risk in the world to remain short bonds at current long term rates”. Seems all a bit pin the tail on the donkey as is ever the case when you get such a sharp reversal.

We know market’s like round numbers and 5% has been long coveted and perhaps, on a quiet day of trading, capturing that level was enough to see some aggressive profit taking. Whatever it was it will make the market very nervous, as if it wasn’t already, over the next few sessions.

European yields, as is their want, followed the big boys lower with the German 10y yield closing the day at 2.88% and the Italian 10y yield at 4.82%.

UK gilt yields similarly so at 4.60%. The 30y equivalent hit another 25 year high capturing 5.21% before closing below 5.05%.

FX - Really quiet in FX overnight with the USD Index currently flat at 105.50. The JPY, EUR and GBP similarly flat currently at 149.70, 1.0680 and 1.2265 respectively.

Interesting that the dislocation that we spoke of yesterday, with regard to the USD, seems to have corrected itself with the USD somewhat back in sink with the rates market. With the sell off in US yields the USD was happy to follow. The EUR has been the main beneficiary with EU rates holding in a bit better than the US. PMIs will hold the key for the short term. A similar disappointment from the EU zone, as we saw overnight in Japan and Australia, and some of that move in the EUR should be unwound. Seems a touch over extended from the untrained eye.

USDILS continues with the bid tone at 4.0550.

FX expiries of note today sees USDJPY having $1.8bn at 150 with $1bn around the 149.50/60 level.

Others - Bitcoin and Ethereum; they’re back! Well at least Bitcoin has recovered to a level which is about 50% of its all time high! Anyway the Grayscale court ruling, which has seen the SEC’s ruling to reject its more marketable Bitcoin ETF being overturned and sent back to them, has been the catalyst to see Bitcoin hit the year’s high after recapturing $35,000. It is expected that the SEC will not dispute the court ruling but how they move forward is another matter. Do they approve the main ETFs one by one or do a more blanket approach?

Additionally Blackrock’s version of a Bitcoin ETF has been listed on the DTCC’s website which is seen as a further step in their journey for a version.

Currently Bitcoin and Ethereum sitting proudly at 34,000 and 1815 respectively.

Macro Themes At Play

Recap

Despite the moves in yields and crypto there is very little to discuss. The BoJ did announce a further unscheduled bond buying program to control yields. I always wonder when you are doing “unschedule” things regularly when do they actually flip over into being scheduled? Feels like the BoJ are getting pretty close to that stage now.

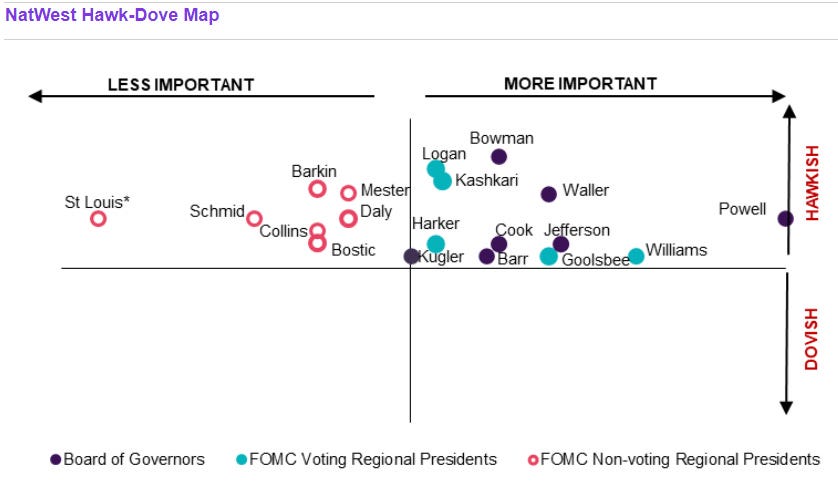

On another wise slow news day I saw this very useful chart from NatWest the other day, regarding the make up of the FOMC, and thought it worth sharing…..pictures/a thousand words and all that.

The Day Ahead

Not what the doctor ordered for the flash PMIs to start the day off with both Australia and Japan disappointing across the board.

Australian PMIs had downside misses for both measures against previous and consensus leaving manufacturing now at 48 and more worryingly the services component returning to contraction after a 4 point drop from previous to 47.6. Both measures at their lowest point for the year.

Japanese PMIs fared little better with manufacturing last month’s print at 48.5 but missing expectations whilst the services was lower versus previous and consensus but at least staying over the 50 line at 51.1.

Rest of the day all eyes on the PMIs, which doesn’t bode well. Plus all eyes on crypto and the yields.

The RBA’s Bullock and ECB’s Lagarde are the central bankers on tap for the day.

Early doors tomorrow the potentially pivotal Australian inflation report.

👍 If you found this morning’s briefing helpful, please consider giving it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience.

Follow the latest market narratives through our curated research & commentary channels on Harkster.com

Main Highlights Ahead

All times in BST (EST+5 / CEST-1 / JST-8)

The main highlights for the day ahead in terms of data and speakers:

Tuesday

Germany HCOB Manufacturing PMI Flash Oct consensus 40 vs previous 39.6 (08.30 BST)

Germany HCOB Services PMI Flash Oct consensus 50 vs previous 50.3 (08.30 BST)

RBA Bullock speaks (09.00 BST)

EU HCOB Manufacturing PMI Flash Oct consensus 43.7 vs previous 43.4 (09.00 BST)

EU HCOB Services PMI Flash Oct consensus 48.7 vs previous 48.7 (09.00 BST)

UK S&P Global/CIPS Manufacturing PMI Flash Oct consensus 44.7 vs previous 44.3 (09.30 BST)

UK S&P Global/CIPS Services PMI Flash Oct consensus 49.3 vs previous 49.3 (09.30 BST)

US S&P Global Manufacturing PMI Flash Oct consensus 49.5 vs previous 49.8 (14.45 BST)

US S&P Global Services PMI Flash Oct consensus 49.8 vs previous 50.1 (14.45 BST)

ECB Speakers

Lagarde (13.30 BST)

Early Wednesday

Australia Inflation Rate QoQ q3 consensus 1.1% vs previous 0.8% (01.30 BST)

Australia Inflation Rate YoY q3 consensus 5.3% vs previous 6% (01.30 BST)

Australia Monthly CPI Indicator Sept consensus 5.4% vs previous 5.2% (01.30 BST)

Good luck

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.