Saturday Hark Back - 18 Feb 2023

Capturing the themes of the week when there’s time to digest them.

Our app (app.harkster.com) will be down for a few hours this afternoon for routine maintenance. We apologise for any inconvenience.

US CPI remains sticky, adding to the slower, higher, longer Fed mantra

The January US inflation report offered some signs of hope but also some despair. Headline has declined from 9.1% to 6.4% during a seven-month period. However, in the last four months, we have seen Core have a much less spectacular decline from a peak at 6.6% to this week’s 5.6%, and both measures remain well above the Fed’s 2% target. If we couple this report with this week’s higher-than-expected PPI and retail sales reports, then it would appear that the Fed still has some way to go. Below I post some articles that try to pick the bones out of the CPI meat.

US regulation on a roll with its crackdown on crypto

In recent days the SEC has gone after Kraken and its staking services business, and only just yesterday, it filed charges for defrauding clients against Terra’s Do Kwon and Terraform Labs. In addition, the New York Department of Financial Services told Paxos it could no longer mint the BUSD stablecoin. Speaking of Binance, they are also reported to be on the verge of paying monetary fines relating to probes from the DoJ and CFTC.

As Europe and the UK move to a more reconciliatory approach to the crypto industry, the US appear to be on a road to push the industry back underground and back to the Silk Road days.

I post below some articles that explain further the US measures and what implications they may have for the industry moving forward.

Realvision - Crypto flies high despite the regulatory onslaught

WuBlock - What will happen to the BNBChain stablecoin ecosystem after BUSD's exit?

What next for Scotland and the UK as Sturgeon takes the hook

My home country was thrown into a state of turmoil this week with the shock resignation of First Minister Nicola Sturgeon. Like her or loathe her, there is no denying that she was a big beast on the political stage, and her successor will struggle to achieve the high profile which she has maintained over her years in power.

Where does her resignation leave not only Scotland but the UK? At first glance, Labour would appear to be the big winners as they eye an opportunity to reclaim some of their “traditional seats” North of the border, and as such, ease Stammer’s path to No.10. However the SNP is nothing if not a strong electioneering machine so it may not be as clearcut as first thought. The Conservatives, meanwhile, got their Union Jacks out of storage and proclaimed that the Union is safe again. Certainly, Sturgeon’s controversial policy to declare the next UK general election a proxy for a Scottish independence vote seems in tatters. Indeed with a general election due by 2024 and a Holyrood election two years later, a new independence referendum seems at least five years away.

All that for the future, but for now, the new leader’s election, which is expected to be announced by the end of March, will give us some better clues as to the path ahead. In the meantime, I’ll leave you with some insights below on how that path may look.

Swingometer - Sturgeon's resignation could Stammer be the real winner

The Spectator - After Sturgeon whats the future for Scotland and the Union

If you enjoyed this week’s Hark Back, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

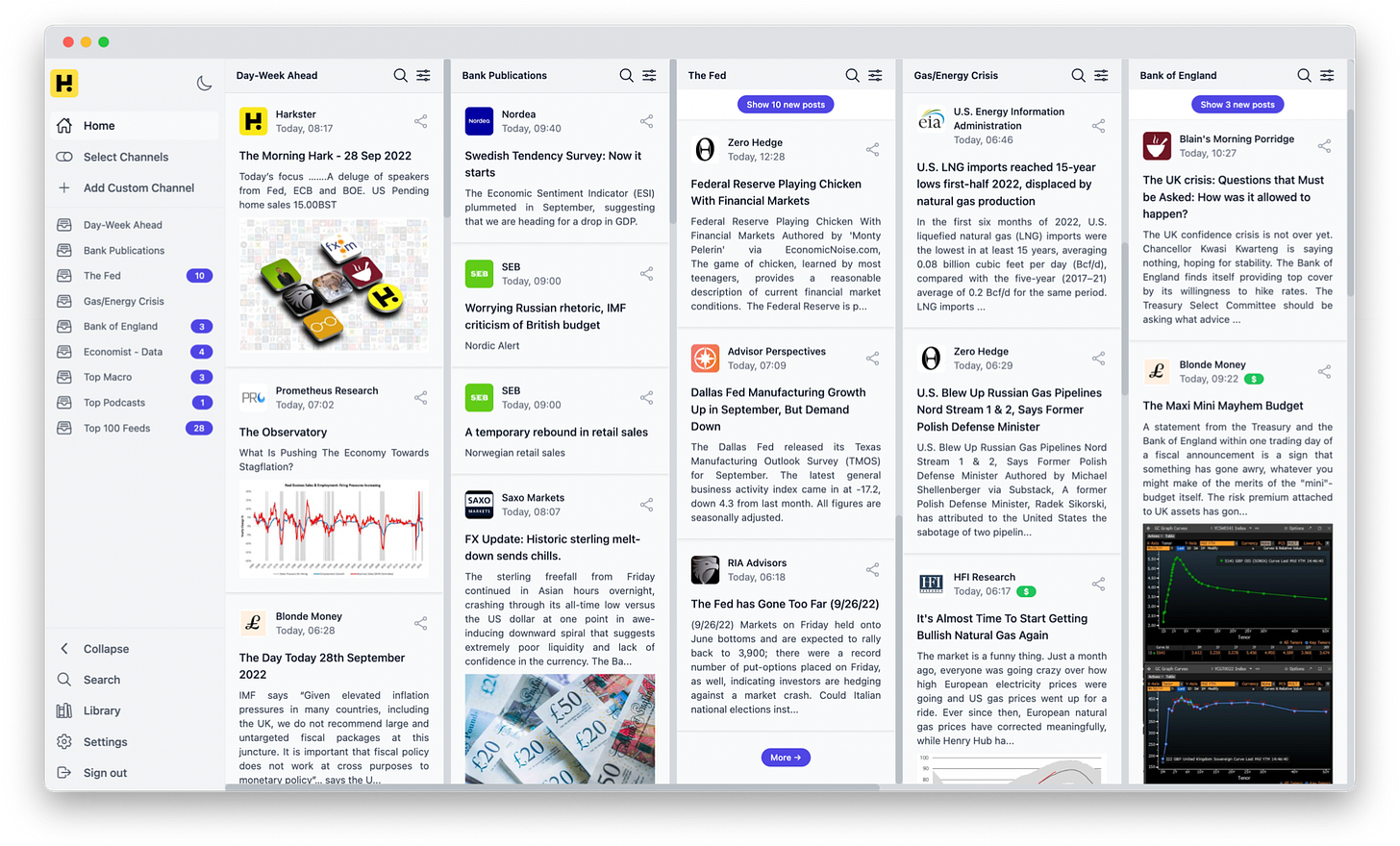

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

great take, thank you!

Good news for Scotland !!!!

Yes, loathed her......