Saturday Hark Back - 11 Mar 2023

Capturing the themes of the week when there’s time to digest them.

Powell - There is more to do!

50 bps is firmly back on the table as an option for the Fed just a few weeks after discarding it completely.

Over the last two weeks we have pointed to resurgent inflationary pressures in the US and that theme certainly cast a long and dark shadow over Chair Powell’s testimonies to Congress this week.

At the February FOMC he was happy to state that: “for the first time, we can declare victory that a disinflationary process has begun”

However, this week, he failed to push back on a potential increase in the Fed’s pace of rate hikes in response to this year’s early hot data prints. The money line from him came as he described the Fed were “prepared to increase the pace of rate hikes if data warrants it”.

The market is already edging ever further to the 50bp outcome for the March FOMC, and only surprisingly weak data will prevent that outcome now.

The testimonies, outwith the higher rate profile, were notable for a couple of spats with Senators Kennedy and Warren, who both had fairly disparaging views of the perception that Powell and the Fed are happy to have collateral damage in the form of more unemployed Americans, as it battles to contain inflation.

Anyway, back to the data. This week’s JOLTS report, worryingly for the Fed, suggested that the ratio of job vacancies to unemployed workers was still around the 1.9 level, a far cry from where they would wish it.

The NFP report was a spin the bottle for the Fed. The headline number easily beat expectations, and the revisions to January’s blowout number were minimal to say the least. On the flip side, we had MoM earnings slowing a touch and the unemployment rate rising. Pick the bones out of that one Jerome.

Complicating things further for the Fed is the fallout from the Silicon Valley Bank issues. Tightening into potential bank runs is never a great look for a central bank. However, are they happy to sit tight whilst they plug that leak and let inflation run wild? I guess that’s why they get paid the big bucks!

All eyes now on the third leg of that particular trifecta; Tuesday’s CPI report.

I post below some links to articles and podcasts that dig deeper into the Fed’s inflation battle.

The Gryning Times - Perceived interest rate shock

Odd Lots - Companies are telling us the reason they are still increasing prices

FiveThirtyEight - Why the Fed wants two percent inflation

ZeroHedge - Are the Fed hiking into the next bust

Silvergate - the road that was the in and out of crypto

Another casualty of last year’s FTX collapse hit the tapes this week with the voluntary liquidation of the crypto bank, Silvergate. Whilst the news was a long time coming, I would throw out the theory that this is a bigger blow to the crypto industry than some of the previous FTX casualties like, say Galios and BlockFi. Silvergate basically performed the crucial gatekeeper role between the traditional finance world and that of crypto as it provided the crucial on/off ramp for those that wished to transact on crypto exchanges.

It may have been clunky and time-consuming but it was the most “efficient” and cheapest way to get fiat onto a crypto exchange. Going forward, that barrier to entry to the crypto world has only got higher, and it’s no surprise that the crypto sector has taken a hit. Outwith the retail sector’s ease of access, more importantly Silvergate provided the crypto market makers with their easiest, cheapest and quickest route in and out of crypto, and without that, their ability to move capital on and off exchanges will be severely impacted. As we have learnt only too well over the last 6 months or so getting funds on and off exchanges efficiently is an essential piece of the crypto puzzle! In addition, remember too that Silvergate had provided that facility 24/7 to accommodate those weekend green and red candles we so often see in the crypto markets.

Outwith the mechanics, there does seem to be a touch of the “people in glass houses” with the “told you so” type reactions to Silvergate’s demise from some of the crypto critics out there. Once again, our old friend, Senator Warren, was keen to opine that “as the bank of choice for crypto, Silvergate Bank’s failure is disappointing but predictable. I warned of Silvergate’s risky, if not illegal, activity—and identified severe due diligence failures. Now, customers must be made whole & regulators should step up against crypto risk.” However, in effect Silvergate’s demise was just your good old fashioned bank run of a deposits versus withdrawals mismatch and basic banking fundamentals. It just so happened to have involved crypto but could easily have been fiat. Perhaps she needs to take a closer look at what’s going on at Silicon Valley Bank! Watch out for those stones coming into your glasshouse Elizabeth.

Its main rival, Signature, remains in place, but all eyes will be on it to see if it can weather the storm, although its stock price has taken an obvious downturn on the news despite releasing updated financial figures which showed the bank had a strong capital ratio and a healthy liquidity position. I guess, on the flip side, it is pretty much the only game left in town!

Below are some articles for a deeper dive for those with an interest. An excellent timeline from Reuters of the Bank’s decline, an entertaining and educational piece from Jesse Austin Campbell on the mechanics of a bank failure and of course RealVision’s podcast on what the longer-term implications are for crypto. Finally, for the forensic accountants amongst us, Signature Bank’s updated financials. Fun for all the family there!

Reuters - Timeline of Silvergate’s decline

Jesse Austin Campbell - How banks fail

RealVision - After Silvergate how will the crypto world survive

Silicon - Signature Bank issues updated financials

FXMacro Guy

It’s an old favourite of ours from TMH, but I wanted to flag the FXMacro Guy’s latest article. It’s an excellent piece as ever which dissects last week from Monday to Thursday; both the incoming data and, in particular, his market views as that data influences those underlying markets. It’s a fascinating read and an extremely instructive one for all budding traders, both old and new.

FXMacro Guy - An instructive week

If you enjoyed this week’s Hark Back, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience 🙏

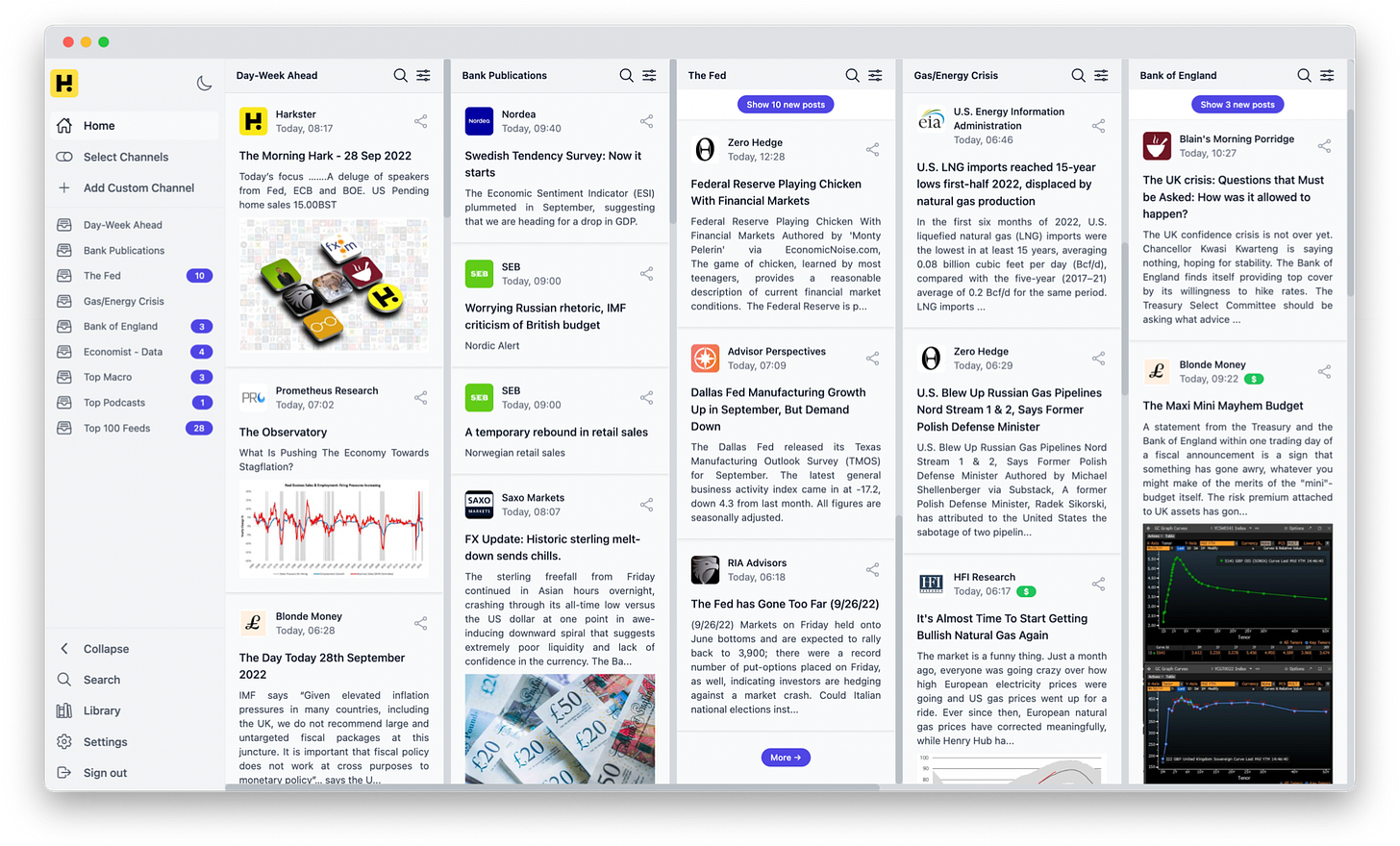

Follow the evolving market narratives through our curated research & commentary channels on Harkster.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

Thank you for the shout-out!

Reading the Saturday Hark Back always makes me miss TMH...

Like broad range of views.