Read on the Trading Floor - 29 Feb 2024

Today’s focus… Inflation, housing, crypto and much more

Macro Themes At Play

Theme 1 - Fed’s Favourite Inflation Indicator

Theme 2 - ECB another print closer to the first cut

Theme 3 - Housing vs CRE

Theme 4 - Crypto

Further reading and listening of note

Theme 1 - Fed’s Favourite Inflation Indicator

We're stuck in this uncomfortable state of pause, moribound consolidation now that rates mkt has converged to the Fed dots, Williams confirmed that 3 cuts are still on the table and PCE drops as expected from 2.6% to 2.4%. With the data inline with the mkts expectations and the rates curve inline with the dots, is it all priced to perfection? What can eventually knock us from this utopia of calm. Trading is a game of patience, but after 3 years of over stimulation, we've got to get used to this new and old low vol regime (until something breaks).

Steno Research - THE INFLATION TARGET IS COMING INTO SIGHT

FT - US inflation falls to 2.4%, according to Fed’s preferred measure

Bloomberg's Simon White via ZeroHedge - No Asset Class Is Remotely Ready For More Inflation

The Inflation Guy / Mike Ashton - AI: Even a Big Deal is Smaller Than You Think

The NY Time - A Key Inflation Measure Moderated in January

Axios - Fed's favorite inflation measure confirms quicker price gains in January

Theme 2 - ECB another print closer to the first cut

Germany's CPI dropped to 2.5% in Feb, from 2.9% in Jan crucially more than market expectations of 2.6%. However, did it open an ECB cut? The data from France (2.9% vs exp 2.7%) and Spain (Core at 3.4%) was more mixed, and potentially there is enough for the hawks to win out a little while longer...

ING - German disinflation continues in February, sending mixed signals to the ECB

Steno Research - EUR-flation Watch: Hands down, I was wrong..

Theme 3 - Housing vs CRE

In the UK, mortgage approvals are ticking higher as rates markets settle, tensions ease whilst in the US the wealth effect from housing is driving a larger divide between home owners and renters.

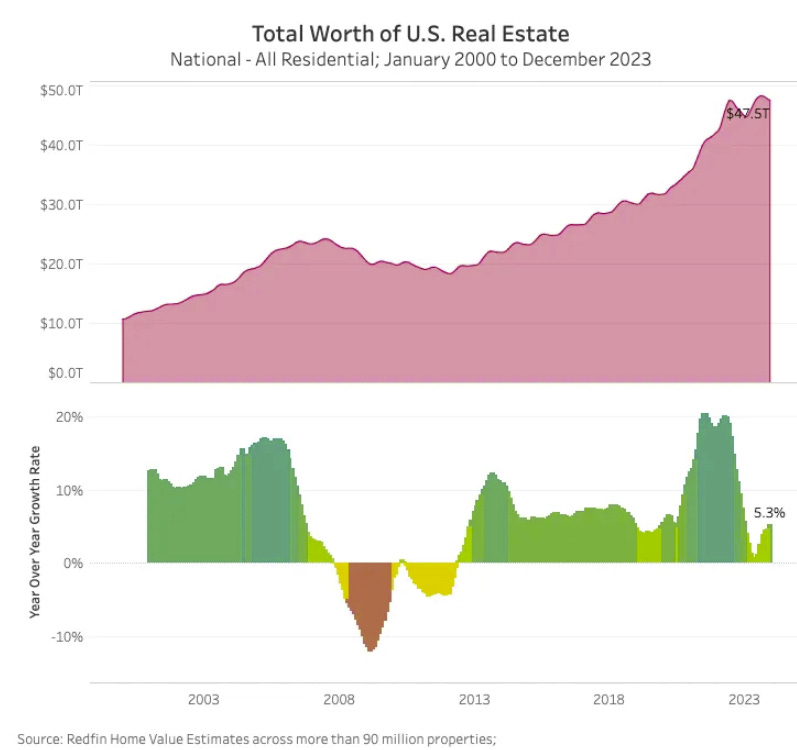

Daily Chartbook - US housing market. "The U.S. housing market gained $2.4 trillion over the last year, bringing its total value to $47.5 trillion."

.... It's still the CRE portfolios that are indicating the large loss provisions with 1 in 4 US loans now in default territory for Aareal Bank.

FT - UK mortgage approvals surge to highest level since October 2022

FT - Private equity-owned German bank hit after 25% of US office loans default

Source Redfin via Daily Chartbook

Theme 4 - Crypto

I take full responsibility for ringing the bell yesterday, as i'm a natural pessimist to the use case of crypto but I have found myself becoming more encouraged by the EM utilisation story, the ETF inflows and of course the impending halving. As is so often the case when there are no bears left, thats the top and it was hardly a surprise to see a technical failure and a 10% drop in XBT. A period of stability following a 40% rally is probably well overdue until we get the next wave of momentum into the halving.

Unchained - Is it time to take profits

Fidenza Macro - Crypto entering its parabolic phase

The Wolf Den - I can’t keep up

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

The Economist - Are passive funds to blame for market mania?

The NY Times - OpenAI and Sam Altman Face More Scrutiny

FT - Chancellor’s plan to scrap non-dom tax status intensifies pressure on Labour

FT - UK vows to bring legislation to create football regulator before election

MacroHive - America’s Turbo Economy

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.