Read on the Trading Floor - 29 April 2024

Today’s focus… BoJ, Powell, Tesla and much more

Macro Themes At Play

Theme 1 - No Comment

Theme 2 - Big week for US data

Theme 3 - Consumer Data + JV's + Price War + Tariffs = EV Market

Further reading and listening of note

Theme 1 - No Comment

Wellington open + local holiday = prime conditions for a nervous USDJPY market to trigger 160.00 in thin conditions. Having printed through, we're now back to bouncing around the 156.00 handle. The erratic moves that we've seen since the BoJ meeting on Friday, with big figures changing within minutes, will only bring us closer to sustained action from local authorities (BoJ to hike 15bps in July, 25 more in Oct?).

MOF have a reputation to be excellent US economists. They may look to slow the one-way march higher in USDJPY, limit Yen's deprecation to 10 handles per month but how can they sell USD into rising global yields, steeper curves and most importantly a Fed pivoting from their Nov pivot as sticky inflation and resilient activity data pushes the first Fed cut towards 2025. Atlanta GDPNow is forecasting Q2 growth at 3.9%, these are not the same economic conditions as Q4 2022.

Kanda's long weekend was interpreted by reporters looking for confirmation that it was indeed them. He declined to comment on whether they had sold USD. He did say “we cannot overlook the negative impact that excessive and abnormal FX fluctuations driven by speculation are having on the nation’s economy. So, we will continue to take appropriate measures as necessary.”

Japanese authorities release their intervention volumes at the end of each month, however any actions within a few business days of month end can be left to the following month. As a result, tomorrow's data set may not show us their true activity and it will in fact be the end of May before we know if it was them or just an erratic holiday move to knock out key options strikes in thin liquidity.

WSJ - Japanese Authorities Intervened in Forex Market to Support Yen

Weston Nakamura - Is This Yentervention?

Steno Research - Trade Alert: Stopped out of JPY in the turmoil..

Nikkei Asia - Yen strengthens sharply after dropping past 160 to the dollar

Bloomberg - Japan Opts to Keep Traders in Dark on Whether It Intervened

Brent Donnelly am/FX - MOF and HG

ZeroHedge - Intervention Or Not, Yen Bears Will Stay Confident

Source: Tradingview.com

Theme 2 - Big week for US data

With the market now focused on monetary policy divergence between the Fed and ECB/BoJ/PBoC, it's a crucial week for USD longs with expectations rising that US10s are on a path to 5% and beyond. Yellen's QRA, ECI, ISM, NFP as well as Powell's hawkish pivot looks set to produce a choppy week. It's tough to see one consistent USD trade through each of the events.

#1. Yellen has shown a strong hand and guided the market through the period of increased issuance. Given her natural dovish bias and the Treasury already guiding the market to increased Bills issuance, it seems unlikely she will spook the mkt and will once again deliver inline with expectations.

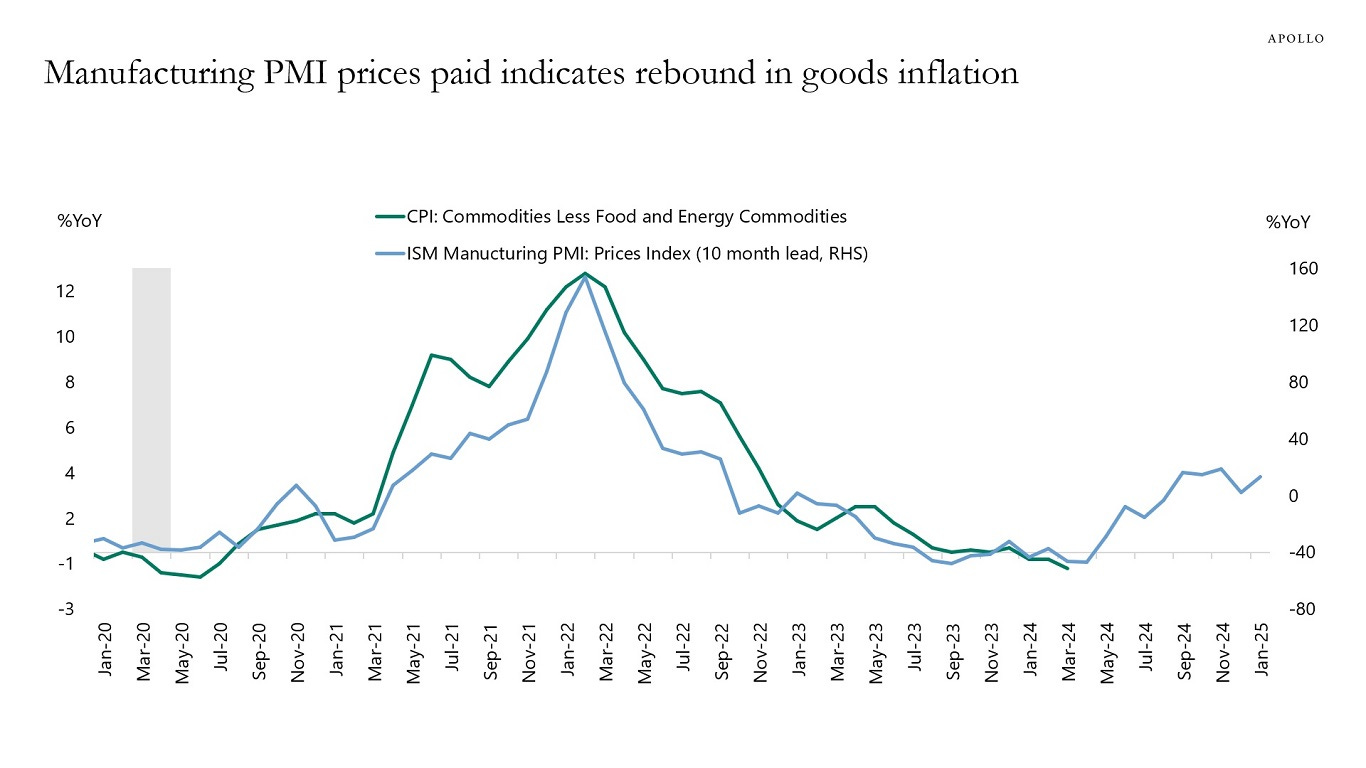

#2. With bond vigilantes on the front foot, the focus will once be on any reinflationary signals in the US data and in particular on higher wage pressures... ISM prices, AHE and ECI

#3. Will NFP drop lower as expected? Will employment growth slow to moderate levels?

#4. It's not in his nature but will Powell out-hawk mkt expectations or will he remain data dependent, simply mark to market. I personally can't see him committing to the next move being a hike, instead he will acknowledge that there is more work to do on inflation, progress has slowed and of course bang the "data dependent" drum.

Bloomberg - US Debt-Sale Plan Seen Benefiting From Fed That ‘Stops Hurting’

Atlanta GDPNow - 3.9% Q2 (April 26)

Bloomberg - Fed Rate-Cut Debate Shifts From When Toward If on Inflation Data

Quoth the Raven - If Treasury Bonds Hit 5%, You're Gonna See Some Serious Shit

WSJ - Back to the '90s? Jamie Dimon Raises the Prospect of 8% Interest Rates

Fed Guy - Chair Trump

Apollo - Goods Inflation Rising

Source: Apollo Academy

Theme 3 - Consumer Data + JV's + Price War + Tariffs = EV Market

Tesla off to a stellar start on the US open, up over 10% as Musk's FSD partnership with Baidu as well as agreeing to sufficient data security measures with Premier Li have added fuel to last week's post earnings rally. Elsewhere, in the battle for EV supremacy, there is a growing acceptance that the EU could place a 15/30% tariff on Chinese EV's as domestic manufacturers can't compete in the price wars. Finally, Toyota have also found a local partner in China, looking to add Tencent's social media tech to its offering to encourage customer growth.

WSJ - Cheaper Teslas? China Says 'You Ain't Seen Nothing Yet'

FT - Elon Musk’s Tesla strikes deal with China’s Baidu for driver assistance

FT - Carmakers need to be tech-savvy to get an edge in China’s EV market

Nikkei Asia - China's EV overcapacity spurs global fears of more price cuts

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Bloomberg - CNY USD: Yuan Devaluation Debate Surfaces as Way to Support China Economy

Steno Research - 5 reasons why the CNY will be devalued next week and how to trade it

Blind Squirrel Macro - Wheat Kings

FT - The Financial Times and OpenAI strike content licensing deal

Bloomberg - Gaza Cease-Fire Deal Was Topic in Biden-Netanyahu Latest Conversation

FT - Britons avoid the pub as cost of living weighs on leisure spending

Morningstar - Markets Brief: AI Leaders Excel in Earnings Season...

Stay At Home Macro - It's the pandemic, stupid

Bloomberg - Meta's AI Spending Plan Spurs Pushback From Investors

ING - German inflation highlights the difficulty of the ECB’s last lap

Econostream - Exclusive: ECB’s Wunsch: A Second Cut in July Would Lead to Repricing That Might Go Too Far

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.