Read on the Trading Floor - 23 Feb 2024

Today’s focus… AI, cocoa and week ahead previews

Macro Themes At Play

Theme 1 - Patiently waiting for a surprise to rock the boat...

Theme 2 - $6400 per tonne

Theme 3 - Week ahead previews

Further reading and listening of note

Theme 1 - Patiently waiting for a surprise to rock the boat...

Trends and themes are entrenched, carry is king in FX as JPY and CHF are used to fund investments in high beta EMFX, AI is not just retooling data centres, adding to workforce productivity gains but also fuelling ATH in indices, CB's are confident they've done enough to restrict economies but are unwilling to commit to cuts as its too soon to declare victory on inflation, there is even renewed hope that China may have turned a corner.

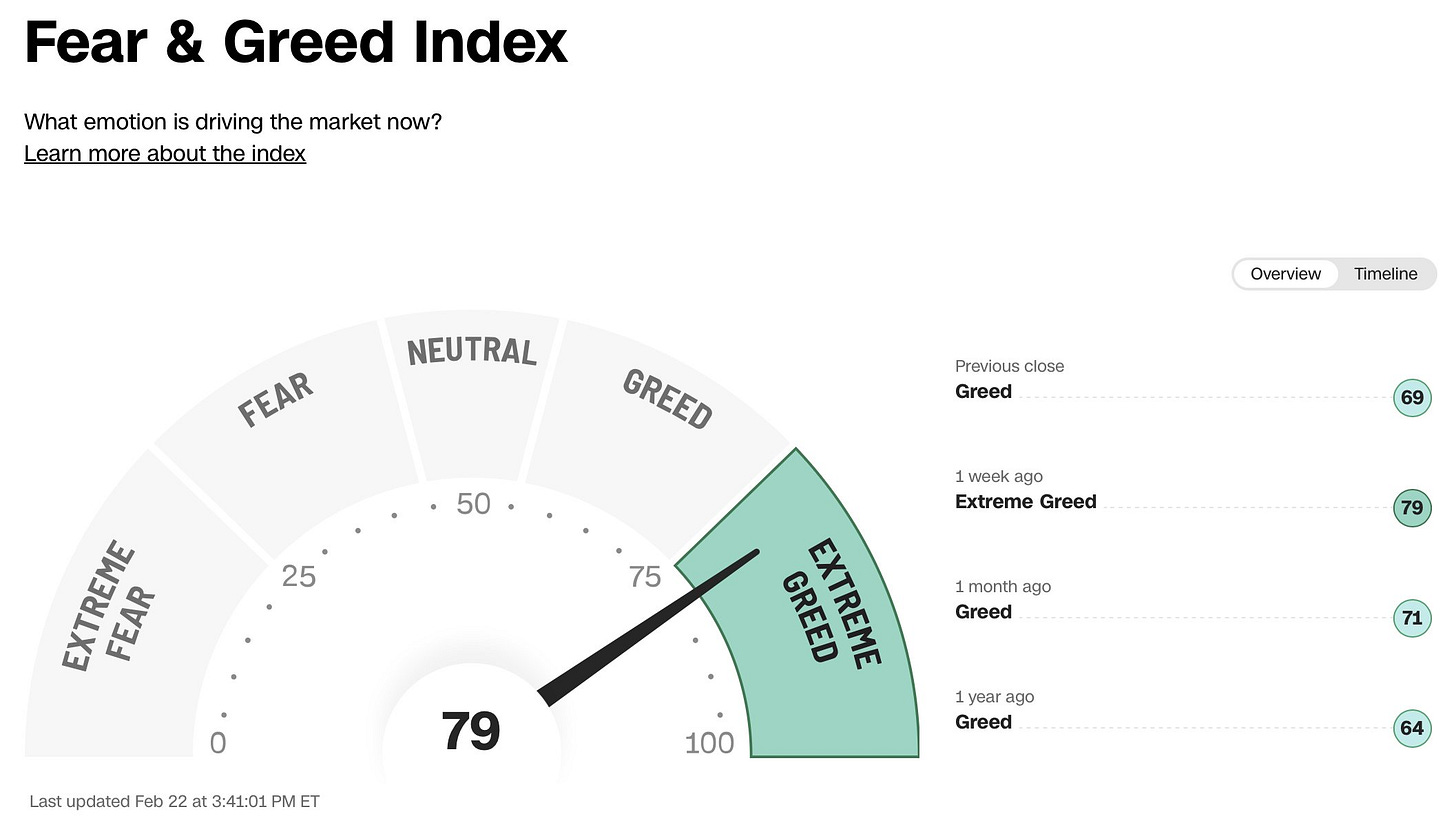

As a result, all the good news is in the price and we head into the weekend after Nvidia's insane earnings growth propelling investor sentiment to extreme greed levels. This is never a reason to trade the other way, or build bearish bets but it is a reason to shop for cheap hedges, take some profit off the table and wonder what can rock the boat. If everyone can only see good news, where is the surprise coming from? This time last year the majority of traders on Wall Street didn’t know of Signature Bank or SVB, the year before that few expected Putin to actually go into Ukraine... Trends are entrenched for good reason but they don’t go on for forever.

Source: CNN Fear and Greed Index

Steno Research - Melt UP!

Axios - Nvidia's boom, Intel's big plans show how AI has turbocharged chipmaking

Bloomberg - Asia High-Yielders Pull Ahead in Carry Race as Policies Diverge

Theme 2 - $6400 per tonne

A new historic high for Cocoa prices, concerns over shortages, output in West Africa (supplies nearly 70% of the world's cocoa requirement) is lower than anticipated due to adverse weather conditions and of course freight costs / geo politics. Maybe i'll finally reduce my Cadburys Dairy Milk intake.

This is not a crypto coin... $6400 cocoa

Source: Tradingeconomics.com

Theme 3 - Week ahead previews

Newsquawk - Highlights include US PCE, ISM Manufacturing PMI, RBNZ policy announcement, EZ, Australia and Japan CPI

Nomura - US Core PCE, Euro Area Flash Inflation and Japan CPI

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Nordea Macro & Markets - The perfect soft landing is fading away

FT - Israel unveils plan for complete postwar control of Gaza

Fortune - Reddit has struck a $60m deal with Google that lets the search giant train AI models on its posts

Two Minute Drill by James Barrineau - Share counts and security blankets

FT - Why are so many evangelical Christians in thrall to Trump?

The Inflation Guy (aka Mike Ashton) - Looking Back and Looking Forward

Livesquawk - German Ifo Business Confidence Rebounds Despite Fall In Manufacturing PMI

Axios - Exclusive: Well-funded new super PAC joins Trumpworld

Telegraph - The Bank of England risks pushing Britain into a depression

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.