Read on the Trading Floor - 22 Sept 2023

Today’s focus… Global Fixed Income sell off, UAW strike, Equities under pressure from higher real rates

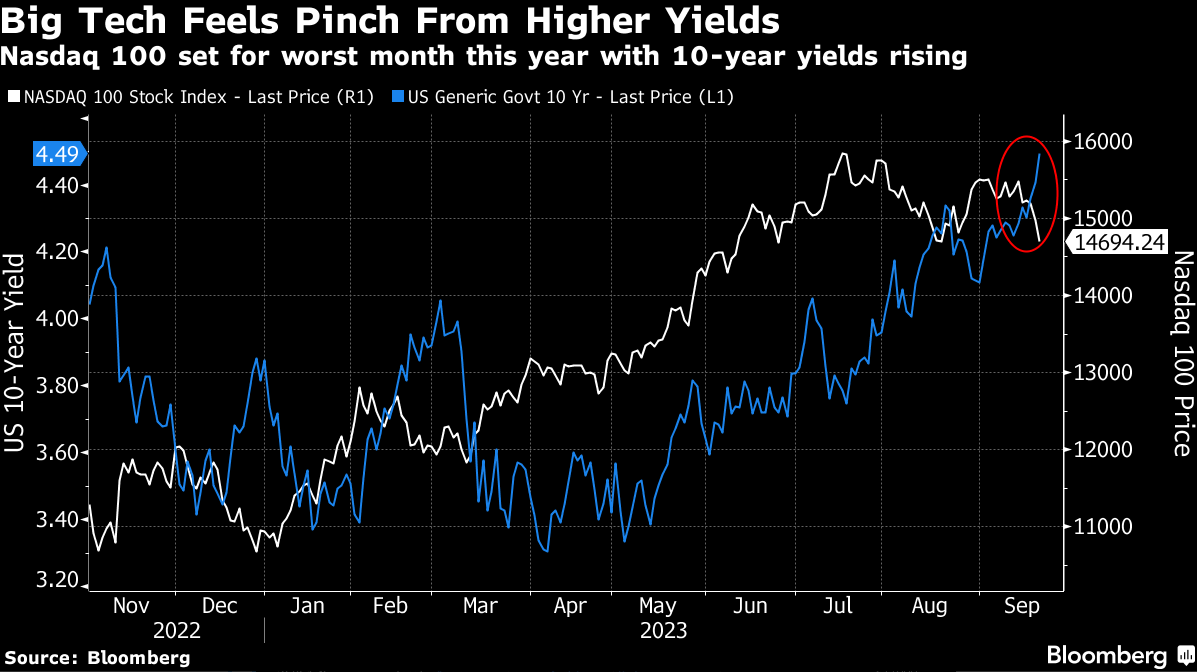

After a volatile week, markets are finally settling down and recovering from the CB euphoria that we've endured over the past 24-48hours (Volatility brings great trading opportunities... but we don't want too much vol!!!). The focus clearly this week has been on the unified theme from global central banks. Last year they all sang from the same hymn sheet that inflation was 'transitory', this year the core message is "higher for longer" (Reuters: Global Central Banks unite in 'higher for longer' credo). As we head into the weekend, the biggest story by far is US10s pressing 4.5% and levels not traded since 2007. The USD wrecking ball, US exceptionalism and positive real rates may have a bigger/quicker detrimental impact on the global growth profile then the US. In particular EM dominated foreign currency debt is vulnerable. Ultimately the market will keep pushing until something breaks and more credit pain lies ahead than behind for households and companies.

The narrative is chasing the US fixed income sell off and the current drivers of the trend are as follows

BoJ YCC dampener has been removed from global duration

Buyer's strike ... Japan and China buying less UST not to mention Fed QT .. as a result, the private investor has a greater influence on the price they're willing to pay for US duration

Higher for longer sets a floor under the front end ... As ING point out in their piece, "the market discount for the funds rate at 4.2% in 2025 effectively sets a floor for market rates right out the curve today".

If the Fed is no longer hiking, where else can the long end go?

US fiscal, a new regime of $5trillion flooding through the economy brings with it higher long run avg rate forecasts (which are slowly creeping into the Fed's SEP)

Resilient data ... recession being priced out of duration

Don't fight the Fed ... data needs to show a recession before duration becomes attractive (again)

Sticky inflation means the Fed put is lower than expected

Source: Bloomberg via The BondBeat

Some of the articles and pieces the market has been consuming post Fed on our bespoke research aggregator... harkster.com

The BondBeat: USTs "modestly" higher, belly BEST on SOLID volumes

Yardeni Quick Takes: Bond Yield Climbs to 4.50% As Yield Curve Is Disinverting.

Mish Talk: Mortgage Rates Jump to the Highest Level in 23 Years

UBS Podcast: Fixed Income Conversation Corner with Robert Cohen (DoubleLine) and Leslie Falconio (UBS CIO)

JPM Global Rates Podcast: Global Rates - European inflation markets, oil won’t boil breakevens

Nordea Macro & Markets: A peek at the peak

BofA Global Research Unlocked: Inflation means shopping around for gasoline and hedges

Equities: Nowhere to hide ...

Just as the AI halo, and in particular the outrageously strong Nvidia earnings forced the last bear to get involved in the equity rally over the summer, the Tech sector is now set for its worst month this year. Have the reasons why poeple were short in August changed much? Did the market really need the Fed to tell us SFRZ4 was too low and that they really meant higher for longer. Timing is everything and even the magnificent 7 have been amongst the biggest decliners this week. Bloomberg report "Chip bellwethers such as Intel, Nvidia and AMD have had a tough week. It hasn’t helped that chip designer Arm fell below its IPO price after just a week, with analysts cautious about its valuation and benefits from the AI boom. This suggests that perhaps the AI frenzy industry-wide has faded and that tech valuations remain elevated given the yield backdrop."

Looking into next year and please note @HarksterHQ is far from an equity expert, but the ever-rising real rate now offered by the US government is a consistent alternative for investors (TINAA... There is now an alternative). Companies cashflows will dwindle as retail sales and housing starts slow and the absence of easy credit will mean companies may find it harder to match their buyback programmes year on year. When rates were at the lower bond it was common practice to release debt for stock purchases, this practice will no longer look viable for CFO's at 5/6%.

Sources:

Bloomberg's Simon White via Zerohedge: Banks At Risk From Positive Stock-Bond Correlation

Brent Donnelly: Going Streaking - Some thoughts on stocks, global macro, GBPCAD and CHFJPY

WSJ: Rising Bond Yields, Interest-Rate Worries Drag Stocks Lower

Saxo Bank: Higher bond yields to test AI rally; Can Just Eat also deliver profits?

Source: Bloomberg via The BondBeat

Finally, the UAW strike continues to garner political attention and looks to broaden... impacting US Q4 growth expectations, potentially starting a softening of the labour market and of course has knock on implications for Biden on the campaign trail (Labours President)

ZeroHedge: UAW Boss To Address Members Amid Stalled Negotiations; Strikes Likely to Expand Across Auto Plants

FT: How ‘true believer’ Shawn Fain reignited pro-union fervour in Detroit

Odd Lots: Steven Rattner on the UAW Strike and the Challenges of Bidenomics

ZeroHedge: Does UAW Union Merit A Huge Raise

Looking ahead to a great weekend of sport as well as next week's event calendar

Nomura Podcasts: The Week Ahead

The Guardian: Premier League: 10 things to look out for this weekend

Independent.ie: Rugby World Cup 2023: South Africa’s bomb squad doesn’t worry us . . . we’re ready for a tough battle – Andy Farrell

Stay informed throughout the day with our new commentary feed (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

ㅤㅤㅤ👍 If you found this piece helpful, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience.

ㅤㅤㅤ

ㅤㅤㅤ

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

Current Trend Drivers....Well said !!!!

Thanks as always for the great work!