Read on the Trading Floor - 22 Dec 2023

Today’s focus… Softer PCE but market is already on holiday

Macro Themes At Play

This will be our last Read on the Trading Floor of the year so we would like to take this opportunity to thank all our readers for their continued support. In addition, we’d like to wish all of you, Happy Holidays and all the best for 2024. We shall be back in print on January 2. Thanks again and we hope Santa is kind, take care!

Theme 1 - How many times can the Fed cut?

Like magic, we end the year with a softer than expected inflation data set for the Fed. I still think Powell was robbed for Time Person of the Year especially when you consider the Q3 (Taylor Swift Eras Tour induced) growth wasn't as good as expected (remarked at 4.9%). Maybe he should have spent more time watching NFL games.

Source Trading Economics

Charlie Bilello’s tweet sums it up very well. We end the year with the tightest monetary policy since 2007 as the Fed Funds rate sits more than 2% above Core PCE. Furthermore, the 6-month average is now at 1.87% and already below the 2% target!!!

After weakening initially, the dollar rallied back into the close (EURUSD 1.1015, USDJPY 142.50). Powell had already told us this number would be soft and the bar to adding new risk on Dec 22nd ahead of the year end turn, festive period as well of course the pnl mark, it makes sense that we’ve not extended. There's no need to put capital to work in thin conditions, however it does set up January nicely for seasonals to continue to perform (positive first few days for equities h/t Brent Donnelly's Trader Almanac).

Livesquawk - PCE Inflation Slowdown Adds To Fed Cut Expectations

Axios - Fed’s favoured inflation gauge shows overall prices fell in November

Fortune - Fed’s preferred inflation measure surprises economists by falling in November

Reuters - Bond investors may be betting too aggressively on 2024 rate cuts, says BlackRock

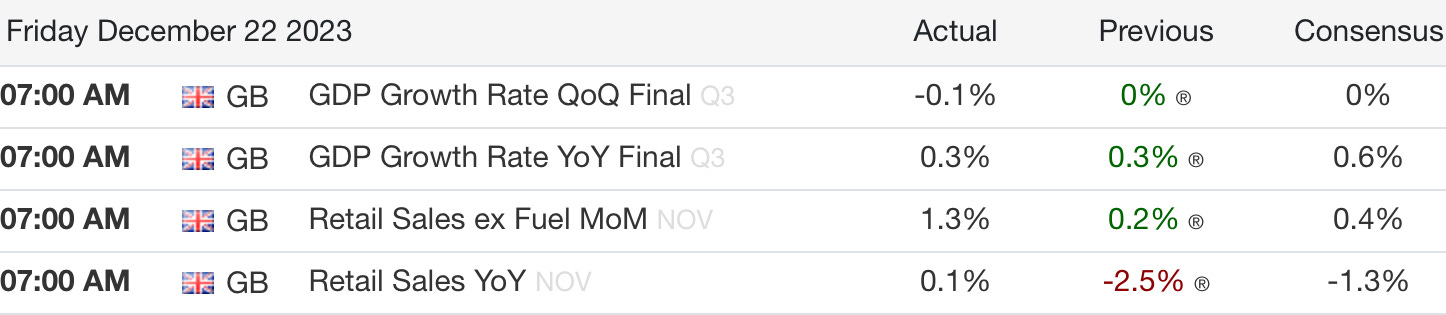

Theme 2 - Technical recession in the UK

The final Q3 print see’s UK revised to negative. Not a great look for Sunak and Hunt ahead of next year’s general election or news for the BoE that must be looking on in envy at the inflation data hitting the US. After all the UK CPI is 3.9%, a lot further away to reach their target.

Can the BoE cut more than the Fed in 2024, MUFC might have a better chance of making the top 4 but if we’ve learnt one thing this year, anything is possible and nothing is certain. If the economy slows faster than expected in H1, watch for BoE pricing to reset.

Source: Trading Economics

Theme 3 - With some time to kill before the Turkey is served, some of the latest 2024 previews to hit our Year Ahead curated channel on Harkster.com

The Last Bear Standing - The Macro Outlook for 2024

Steno Research - Five things we watch for in 2024

Real Vision - Whats in store for 2024

ING - Red Sea avoidance signals a disruptive start to 2024 for trade and supply chains

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

FT - World sport rattled by rulings that open route to goal for new entrants

MacroVisor - Can the Red Sea situation lead to higher prices?

The NY Times - BYD, a Chinese Electric Car Giant, to Build a Plant in Hungary

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.