Read on the Trading Floor - 21 Dec 2023

Today’s focus… Trying not to overanalyzes moves in thin holiday liquidity

Macro Themes At Play

Theme 1 - The Power of 9...

For those who like DeMark, yesterday's sell off probably didn't come as much of a surprise. After all we had triggered 9 green days in a row.

However, for the sake of argument, on a quiet pre-Xmas session, what may have triggered the move?

#1. Yearend holiday liquidity, profiting taking, fat finger... the standard go too stock reasons (pun very much intended) that sell side use to explain shock moves that occur within a news vacuum, without a clear trigger or noticeable headline catalyst.

Academy Securities - The-Party-is-Over

#2. As they become more popular, 0DTE get the blame

Bloomberg - Vilified Zero-Day Options Blamed by Traders for S&P Decline

Spot Gamma - Options Flows & Yesterday's Surprise Sell-Off

but I prefer @Mayhem4Markets take

#3. Ugly 20-year bond auction? This part of the curve is always difficult for the Treasury to fund, so why would a weak auction generate cross asset fear? I thought the Fed were delivering a soft landing?

The BondBeat - USTs lower 'unwinding yest afternoon's risk off SPASM bid' on extremely LIGHT volumes

#4. FedEx demand warning a bellwether for a weak consumer in 2024?

Steno Research - Something for your Espresso: What happened to stonks?

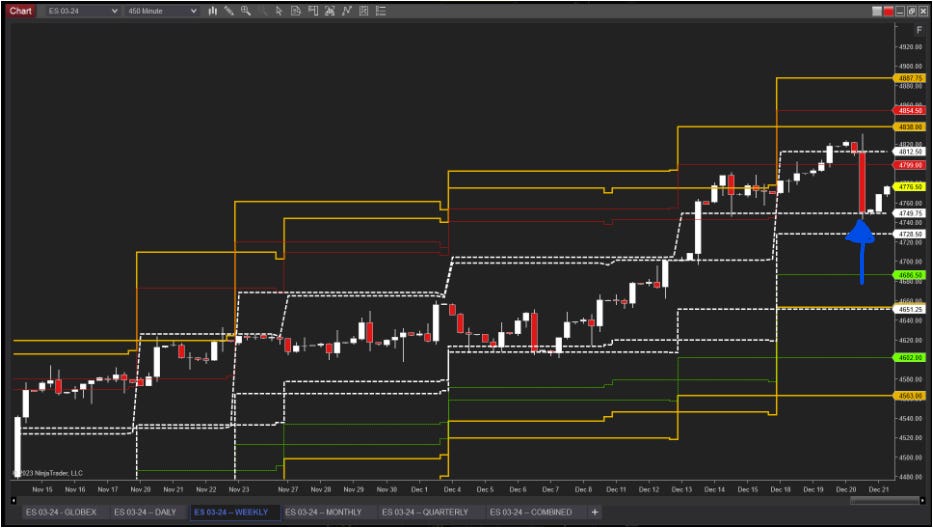

Finally, where did we find support?

H/T

- The ESA sell off was contianed by their weekly implied vol level of supportYou can subscribe to

hereTheme 2 - Softer US data

The US gapping down to the RoW trade continues as the Q3 exceptionalism unwinds. Today's final Q3 GDP print was an outstanding 4.9% (well done Taylor Swift) but it means the peak US performance wasn't as good as expected. Naturally we've seen a softer USD post data but it's 3 months old data (ZeroHedge - Markets Go Wild On 3-Month-old (Revised) Data), tomorrow's PCE is the main event. If it comes in at 3.1%, will the Fed need to cut more than is currently priced in the market to stop real rates from breaking north of 3%.

The Gryning Times - Is Fed Policy 40 bps Tighter?

ZeroHedge - US Leading Indicators Slump Signals "Short & Shallow Recession" In 1H24

JPM - Inflation monitor

The Fred Blog - Watching CPI and PCE inflation in Fred

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

FT - China bans export of rare earth processing technologies

MacroVisor - 2024 Global Outlook

Russell Clark - Artificial Scarcity and Modern Markets

Steno Research - Sentiment Nugget: Central Bank Divergence Into Year-End

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.