Macro Themes At Play

Theme 1 - The Week Ahead

Theme 2 - When Macro Gets Boring (h/t The Last Bear Standing)

Theme 3 - OPEX, 0DTEs, AI and Chips

Theme 4 - A path to a ceasefire?

Further reading and listening of note

Theme 1 - The Week Ahead

After a quiet start to the year, I looked at next week's data calendar with excitement ...

Mon (Jan 22) - PBoC

Tue (Jan 23) - BoJ, New Hampshire Primary

Wed (Jan 24) - Bank of Canada

Thurs (Jan 25) - US GDP Q4 advance, ECB, Norges, SARB and CBRT

Fri (Jan 26) - Core PCE

Headline grabbing data events but will we learn anything new? It's too early to declare "victory" on inflation (h/t Lagarde) so we shouldn't expect anything more than BoC/Norges/ECB trying to push back against Q1 cuts, maintaining a "data dependent" stance and trying to remain as long as possible in this rates holding pattern until confidence is high that they've achieved their 2% inflation target. As a result, next Friday's PCE looks like it could be the most important data point as the #goldilocks theme has lost supremacy.

The Fed's WSJ's Nick Timiraos (@NickTimiraos) has already commented on Twitter...

"Based on the Dec CPI and PPI, core PCE is projected to have been mild last month.

The modelers who forecast this expect core PCE rose 0.17% from Nov.

This would lower the 12-month rate to 2.9%.

The 3- and 6-month annualized rates would fall to 1.5% and 1.9%, respectively"

However, Steno Research see upside risks in their excellent piece US Inflation Watch: Methodology Matters - Upside surprise in PCE according to CPI?

Prepare for the Week Ahead with our dedicated smart channel on Harkster.com. (Subscribe for your research inbox here)

ING - January’s ECB Cheat Sheet: Giving markets the cold shoulder

Nomura - The Week Ahead – US Q4 GDP, ECB Policy Meeting, Central Bank Meetings in Japan and Malaysia

Theme 2 - When Macro Gets Boring (h/t The Last Bear Standing)

Excellent piece from

- The Great Moderation. It is a must read as we move away from the exciting covid markets (inflation, supply chain shocks, fiscal policy) and head back towards the old or maybe new "normal" growth pattern. Accept the new regime don't fight it!!!!"The past several years have been quite unusual. There was a pandemic, a rebound, and a hangover. Inflation, rates, and liquidity have swung wildly. Services and manufacturing diverged dramatically, befuddling traditional macro models. Indeed, it was a very challenging, but admittedly exciting time for economic watchers. But as we move further away from these disruptions, an equilibrium eventually emerges. Water finds its level. This, in my opinion, is the overarching theme of 2024 so far: The Great Moderation."

Theme 3 - OPEX, 0DTEs, AI and Chips

The equity world has been dominated this week by TSMC earnings and the expected AI demand (FT). This has led to Nasdaq outperforming with TSMC expecting a 25% growth in semiconductor sales. The advancements in AI are one of the main attractions to US stocks, as outlined by GS's latest podcast (America Powers On: Why US equities are still poised to outperform in 2024)

From Davos to Taiwan, AI makes the news and it makes the sales (what isn't being sold these days without a AI tag, block chain was so 2022)

FT - Mistral becomes the talk of Davos as business leaders seek AI gains

FT - How AI, Ukraine and election fears shaped the EU’s Davos

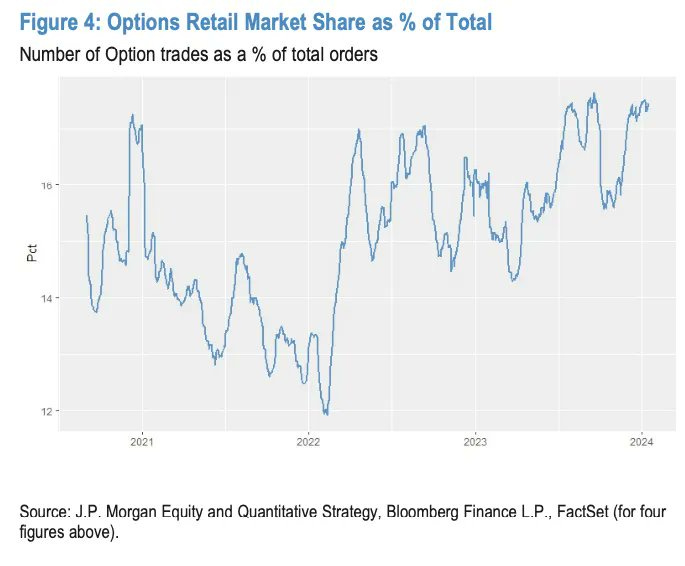

Under the hood, the equity moves are also being fueled by OPEX gamma and of course 0DTE

Bloomberg - Wall Street Quants Warm Up to 0DTE Zero-Day Options Amid Trading Boom

MacroVisor - Breakfast Bites - Options Expiry

Source JPM via

- Daily Chartbook #363Theme 4 - A path to a ceasefire?

This week there has been a few interesting articles trending through Harkster. As the pressures mount in Yemen, Red Sea and the risks of a famine in Gaza rise, can we see the main global powerbrokers bringing the sides together to form a lasting cessation?

Axios - Saudi Arabia: Peace with Israel conditioned on Gaza ceasefire, path to Palestinian state

FT - China pushes for safety of Red Sea shipping as threat to its economy grows

Nikkei Asia - Pakistan and Iran aim to dial down tensions as China offers mediation

Reuters - China’s Red Sea headache, Yemen's social media 'pirate' and US third parties

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Further reading and listening of note

- - Gilt PCA for previous COB: 18th January 2024

FT - Trump is back — how much of a problem is that for the Fed?

MishTalk - Stunningly Great Speech by Argentina’s President at Davos

SCMP - Will China-Russia trade keep skyrocketing as Ukraine war drags into 2024?

Bloomberg's Odd Lots - This Is What’s Driving the Big Surge in US Oil Production

Bloomberg - China’s Biggest Broker Curbs Short Sales After Stock Rout

FT - ECB concerned market bets on rate cuts risk derailing disinflation

WSJ - The $8.8 Trillion Cash Pile That Has Stock-Market Bulls Salivating

FT - UK chancellor signals he wants more tax cuts before election

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.