Read on the Trading Floor - 19 Dec 2023

Today’s focus… #CCYWARS, where have all the bears gone?

Macro Themes At Play

Theme 1 - BoJ hold the line

Theme 2 - Wage agreements and Energy prices

Theme 3 - Fed speak or damage limitation ...

Theme 4 - The market isn't allowing the verbal pushback to spoil a good party ....

Theme 5 - When there are no bears left we should be worried

Further reading and listening of note from Harkster.com

Theme 1 - BoJ hold the line

There was a chance Ueda would surprise but as outlined in the Harkster BoJ Preview the odds were stacked in favour of them remaining on hold, waiting for the spring Shinto wage agreements. Their forward guidance remained the same - "continue expanding the monetary base until the year-on-year rate of increase in observed CPI exceeds 2% and stays above the target in a stable manner."

Good news for US10s... Japanese buyers are still around, Ueda didn't offer any more yield or reasons for cash to stay at home. It was particularly interesting to see how many times Ueda mentioned the Fed. #ccywars to reappear in 2024 as CB's fight deflation? It will be hard for the BoJ to hike at the same time as the Fed's first spring cut?

Bloomberg - BOJ Stays Mum on Rate Hike Timing as Stand-Pat Decision Hits Yen

Reuters - BOJ keeps ultra-loose policy, focus shifts to exit timing

Nikkei - BOJ stands pat, keeps easing bias amid tightening expectations

- - Should the BoJ end Negative Rates?

Bloomberg - BOJ Set to Stay Outlier as 2024 Hike Seen in Contrast to Fed

ZeroHedge - Yen Plunges After BOJ's Ueda Admits It's "Difficult To Exit Negative Rates", Shattering Normalization Hopes

Theme 2 - Wage agreements and Energy prices

For CB's (well for those that have yet to pivot like the Fed), all it will take is an oil bull market (are we at range lows sub $70?) as well as decent wage gains in Q1 2024 to get headline inflation higher.

In Japan, the Shinto wage agreements have not been reached. They normally take place in the spring, and like the ECB / BoE, are a key component for a decision to change track.

FT - Hawkish ECB rate-setter says wage ‘slowdown’ key to timing of policy shift

FT - Bank of England awaiting clarity on wage growth before interest rate cuts, says deputy governor

Former ECB-er Vitor Constancio thinks markets are wrong...

Source: Vitor Constâncio on X:

This week we've already seen attacks in the Red Sea impact the price of oil, combined with record low positioning is there a bull case brewing for oil into Q1? Why is the market so bearish on oil when a "no landing" scenario is arriving in the US.

Steno Research - Energy Cable #50: Oil back in fashion - Steno Research

Bloomberg - Hedge Funds Slash Bullish Bets on Crude Oil to Record Low

Theme 3 - Fed speak or Damage limitation ...

Mester / Williams / Bostic / Goolsbee .. they've all pushed back on market pricing although Daly did point to a more balanced outlook, a focus on not just inflation but a softening jobs market. (WSJ Fed Official Says Rate Cuts Could Be Needed Next Year to Prevent Overtightening)

Unfortunately for the Fed, the genie is out of the bottle and there is no going back. Lagarde was steadfast in her point of view that the ECB had not even discussed cuts, whereas Powell made it clear that they had started to talk about rate cuts. As a result, we've flipped from a curve with a 25bps hike and 50bps of cut to no more hikes and 75bps of cuts... Bloomberg - Fed Chair Jerome Powell’s Pivot Is a Pretty Big Gamble

Source: @johnauthers

Theme 4 - The market isn't allowing the verbal pushback to spoil a good party ....

Its euphoria in assets with Vix @ 12.5, CNN Fear and Greed (Extreme Greed = 79) and unprofitable stocks outperforming. The rest of the market caught up with Mag7 rather than the latter gapping down. It’s an everything rally, that shorts detest (FT - This is a Bad Santa Rally)

The race to raise forecasts = the chase is on

Bloomberg - Fed’s Policy Pivot Is Forcing Stock-Market Skeptics to Become Believers

Bloomberg - Bond Market in 2024: Fed Moves Force Rethink on Predictions

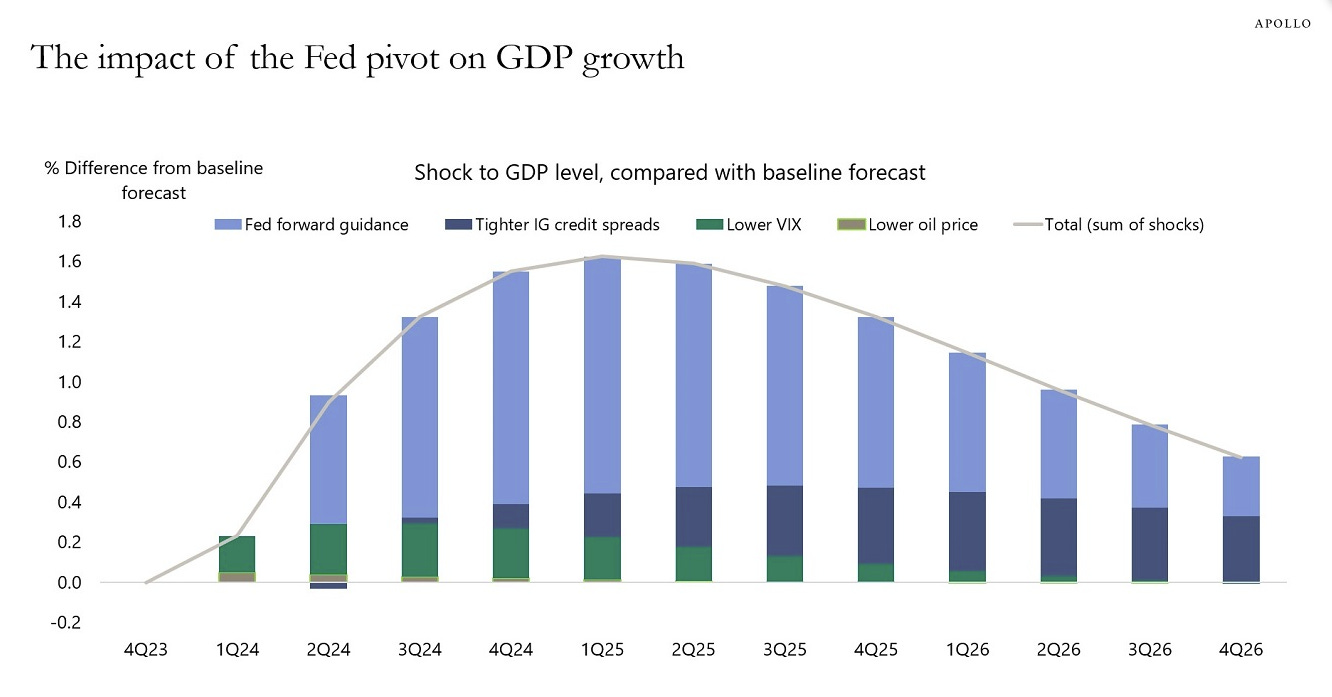

Torsten Slok - "The Fed pivot combined with a one standard deviation decline in VIX, a 60-basis point tightening in IG spreads since March, and a $20 decrease in oil prices since September will boost GDP growth by 1.5% over the coming quarters, see chart below."

Source: Apollo Academy - Fed Pivot Pushing the US Economy Back to No Landing Scenario

Theme 5 - When there are no bears left we should be worried

A warning from

... the soft landing is consensus and almost priced, the risk is now it doesn't arrive - Always ReflexivitySource - The Next Economy by Florian Kronawitter

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

China .. when do we buy the dip?

Inflation was transitory, it was just took 2 years instead of 1

Stay at Home Macro - We are landing this plane, softly

RHS USDJPY deal may not arrive

ZeroHedge - The Fed Pivots To What?

Bloomberg - PIMCO warn of hard landing in UK

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.