Read on the Trading Floor - 17 Jan 2024

Today’s focus… rolling back the cuts

Macro Themes At Play

Theme 1 - UK CPI: Rolling back the cuts

Theme 2 - US Retail Sales > NY Manufacturing

Theme 3 - Waller "as good as it gets"

Theme 4 - If the average mortgage rate is sub 4%... Does the Fed need to cut?

Theme 5 - ECB stuck on repeat... Yes the next move will be a cut, No we don't know when (#summer2024)

Further reading and listening of note

Theme 1 - UK CPI: Rolling back the cuts

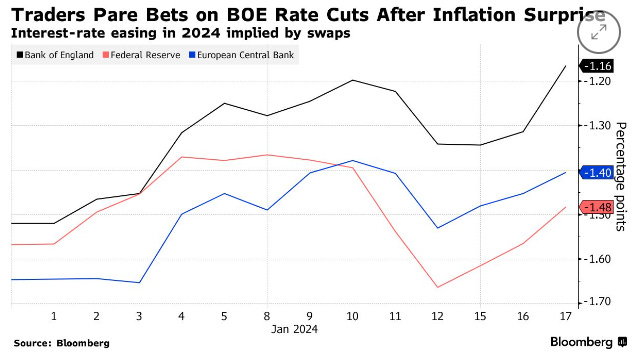

Headline inflation higher at 4% (exp 3.8%), core also 0.2% higher at 5.1% (exp 4.9%). The only good news was the PPI, -2.8% vs consensus -1.9%. Energy disinflation helping the input cost slide which "should" eventually feed into the CPI. However, with the market having started the year with aggressive cutting expectations for the BoE, the result of today's data set was a back-up in the chance of a May BoE cut, from 80% to ~55% with the 2024 cutting cycle selling off 20bps from ~123bps towards 105/100bps.

Theme 2 - US Retail Sales > NY Manufacturing

The goldilocks trade has run out of steam as fixed income sells off with the narrative chasing the price... #1. position squeeze / unwind of the Dec theme, #2. the hard data outperforming the soft prints in the US, #3. expectations that Trump will do more fiscal (but surely Biden has proved that he will as well?) and #4. a coordinated message from global central bankers that Q1 cuts are unlikely. Furthermore, seasonals point to higher yields to start the year as fixed income supply comes hard and fast, 20year UST auction this evening, benchmark corporate deals all week as well as tomorrow's 10y Tips.

Theme 3 - Waller "as good as it gets"

Inflation is slowing towards 2% even though growth and jobs market remain solid but this maybe "as good as it gets". The message from Waller and other DM central banker is that they are worried about declaring victory too early. Williams next on deck this evening at 20:00 GMT.

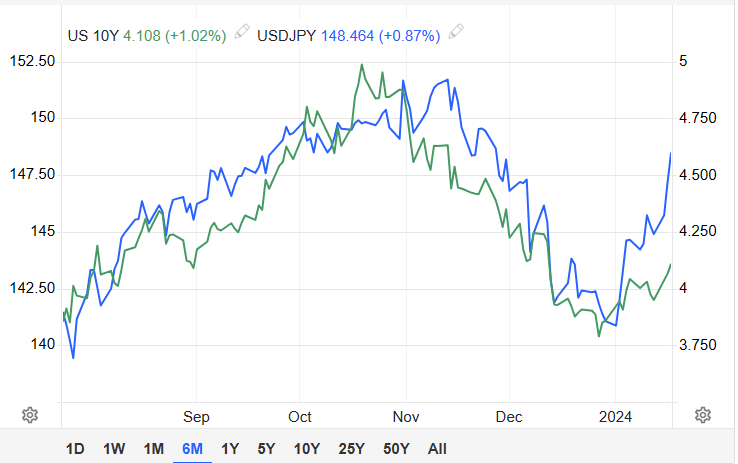

The 25bps ytd back up in 10years has supported USDJPY drift towards 149.00 as BoJ expectations have also been pushed back to H2 as a result of the quake. Furthermore, the strength of the US consumer (retail sales 0.6% vs exp 0.4%) and underlying economy (Dallas Fed - Weekly Economic Index) has caught the market underweight USD after the Nov/Dec sell off. Furthermore USDJPY drifting higher is a positive carry trade.

USDJPY vs 10s ....

Chart Source: Tradingeconomics.com

Finally, Trump odds rising post Iowa landslide (although they may give some back if Haley becomes the clear number two following next weeks New Hampshire primary), Vix seasonal rally as well as the unwind of the Dec goldilocks trade has USDMXN on the move north.

Chart Source: Tradingeconomics.com

Theme 4 - If the average mortgage rate is sub 4%... Does the Fed need to cut?

Theme 5 - ECB stuck on repeat... Yes the next move will be a cut, No we don't know when (#summer2024)

Simkus summed up the ECB's position well ... "financial markets are not going to make the decision for us. Once we get to April, it gets harder to exclude anything... the probability of a cut won't turn really significant until we're in June. but March no way, unless there is some huge surprise and April is only a little more likely than march".

Lagarde indicated it was too early to “shout victory” over inflation and that "we will see in the summer"...

Econostream - ECB's Knot: Fighting Inflation Both an Economic and a Social Objective

Econostream - ECB’s Šimkus: Probability of Rate Cut to Rise Sharply After April

Reuters - ECB's Panetta says liquidity must be focus of attention

Econostream - ECB’s Villeroy: Must Be Patient to Ensure We Hit Inflation Target

Lagarde - ECB’s Lagarde: Interest Rates at Peak; Must Stay Restrictive for as Long as Necessary

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

The Rest is Politics - Is the Middle East sliding into a wider regional conflict?

The Blind Squirrel Pod - Weather Porn

The Capital Spectator - Does NY Fed Manufacturing Index’s Plunge Signal US Recession?

FT - Li Qiang hails China’s friendly ties with Ireland as a ‘good example’

The Lead-Lag Report - The Party Is Over

Economist - China’s population is shrinking and its economy is losing ground

Reuters - Charles Schwab profit drops as costly deposits squeeze interest revenue

Reuters - US Bancorp posts lower fourth-quarter profit on FDIC charge

Reuters - Citizens Financial fourth-quarter profit falls on FDIC charge

Steno Research - 5 things we watch: US recession, US inflation, Euro Inflation, PCE vs CPI, STIR pricing

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.