Read on the Trading Floor - 17 April 2024

Today’s focus… BoJ watch, BoE cuts, Tariffs = Inflation, and much more

Macro Themes At Play

Theme 1 - Intervention Watch

Theme 2 - BoE can still start cutting in June...?

Theme 3 - "as long as needed"

Theme 4 - Tariffs + Sanctions + Food prices + Commodities = Inflation

Theme 5 - Waiting for a response

Further reading and listening of note

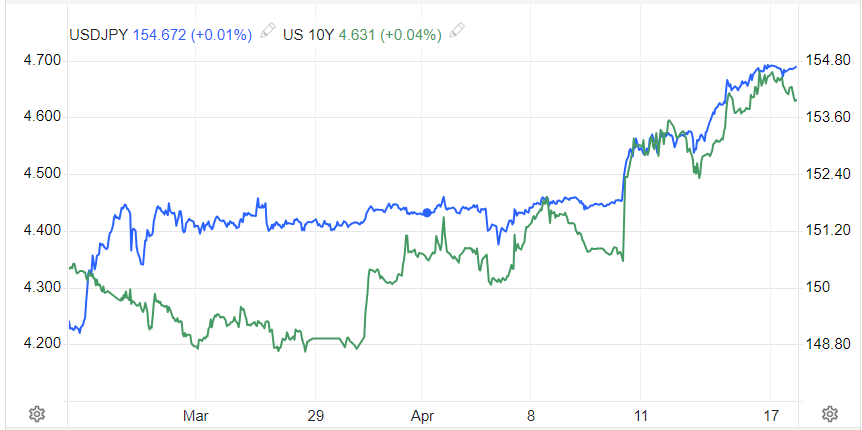

Theme 1 - Intervention Watch

Another day, another session watching and waiting for Japanese authorities. The pressure has reduced on the JPY as US10s settle around 4.65% for now, and many feel 155-156 will be the trigger level. We should probably get used to the standoff as the absence of any key US data this afternoon makes it seem unlikely today will be the day. Watch for a weak 20yr auction to weigh on US curve but without meaningful top tier data it could be another few days/weeks before we see MOF supplying USD if at all. In fact why would they sell USD into a strong US economy????? In 2022 the US economy dipped when they intervened.

Nikkei Asia - Strong dollar poses question over timing of Japan intervention

Brent Donnelly am/FX - My USD view plus much moar (including an MOF Intervention Playbook)

Across The Spread by Weston Nakamura - JPY’s Long, Slow Death

USDJPY vs US10s

Source: tradingeconomics.com

Theme 2 - BoE can still start cutting in June...?

Data this week has not knocked the BoE off course for a June cut.

#1. UER - uptick to 4.2% from prior 4.0%

#2. Wage growth excl bono = 6% and down from prior 6.1%

#3. Headline inflation decelerated to 3.2% from 3.4% but a touch higher than street forecasts of 3.1%

#4. Core dropped to 4.2%, down from prior 4.5% but again higher than streets consensus of 4.1%

#5. PPI also hotter at 0.6% (prior 0.4%), energy prices feeding into the data and residential prices also rising

On the campaign trail Hunt has indicated his preference for a summer cut to lift spirits before the Autumn election (Conservatives need a lot more than a 25bps cut given the cost of living remains so high), Liz has been making headlines selling her book and indicating there are only 10yrs to save the West whilst Bailey is comfortable going before the Fed...

Bloomberg - Stronger-Than-Expected UK Inflation Tempers Rate Cut Bets

FT- Liz Truss considered sacking Andrew Bailey as BoE governor after ‘mini’ Budget

Bloomberg - BOE May Be Able to Cut Interest Rates Before Fed, Andrew Bailey Suggests

ING - Sticky UK services inflation pushes back rate cut hopes

Bloomberg - Jeremy Hunt Says Rate Cuts Would Lift UK Mood, Hints at Autumn Vote

Theme 3 - "as long as needed"

Lack of progress on inflation brings back "higher for longer" in all but name as JPow (sort of) accepts what we've all been thinking. The US economy has weathered the storm of high real rates, labour market is resilient at record levels and inflations progress back to target has stalled. In fact BofA signal super-core rising to 4.8%...

The job is not done and as Fed Vice Chair Jefferson said “if incoming data suggest that inflation is more persistent than I currently expect it to be, it will be appropriate to hold in place the current restrictive stance of policy for longer. I am fully committed to getting inflation back to 2 percent.”

Finally, the market was already there with USD longs in play, US fixed income at YTD wides and auctions struggling last week for demand. This evenings 20yr auction could potentially need a decent concession as that part of the curve is notoriously weak given lack of end user demand for that duration.

WSJ's Nick Timiraos - Fed Chair Jerome Powell Dials Back Expectations on Interest-Rate Cuts

Bloomberg - Dollar Power: Fed's Higher-for-Longer Is Turning the Currency Screws

Steno Research - “A lack of further progress so far this year on returning to our 2% inflation goal.”

The Blind Squirrel - Wandering Stock

Bloomberg - Booming US Economy Inspires Radical Theory on Wall Street (the reality is people have more money)

Claudia Sahm - Sticky is not stuck: inflation

Theme 4 - Tariffs + Sanctions + Food prices + Commodities = Inflation

Biden hits the headlines proposing new 25% tariffs on certain Chinese steel and Aluminum products, as well as reiterating US Steel Corp should remain American owned. Both sides of the isle support an anti-China trade bias, so this is not surprising from Pres Biden in response to Trump's 100% Tariffs. Furthermore DB (via The BondBeat) have indicated "the US consumer today, the exact same grocery basket is 21% more expensive relative to the start of the Biden administration in January 2021".... Politicians should be wary that Tariffs + Sanctions maybe great for headlines but they're also rekindling the inflation beast as well as driving CB's away from US assets.

The BondBeat - while WE slept: USTs higher on strong volumes

Reuters - Germany's Scholz lobbies Xi to improve market access, pressure Russia

Nikkei Asia - Biden to call for tripling tariffs on Chinese steel

Russell Clark - PRECIOUS METALS - WHY IS ONLY GOLD ACTING PRECIOUS

Apollo Academy - Gold Price Rising

Saxo Markets - Copper rally extends to near two-year high

Theme 5 - Waiting for a response

For now $90 has capped us in Brent as western forces do not want Israel to retaliate, Biden has been clear he's there for ironclad protection but will not involve American troops in any counter strike. It's a waiting game. It took two weeks for Tehran to respond to the Damascus embassy attack, which is most likely a similar timeline for Netanyahu. Will he "take the victory" as Biden hopes or will he fall to domestic pressure and rebuff international calls for restraint.

The Rest Is Politics - Iran, Israel, and the Middle East: Stopping the slide into all-out war

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Fortune - AI could eliminate entry-level Wall Street banking jobs

ZeroHedge - Dubai floods broke records, has clear climate change ties

Creditnews - Biden’s new student debt relief targets ‘runaway’ interest but fails to solve bigger problem

Bloomberg - ASML Orders Dive as Chipmakers Pause High-End Gear Purchases

Steno Research - Positioning Watch - Volatility is back, but markets still lean into USD duration.. God knows why..

UBS - How should I be positioned? with Torsten Slok (Apollo) and Jason Draho (UBS CIO)

WSJ - Bitcoin’s Halving Is Coming. Miners Are Looking for New Ways to Make Money.

ZeroHedge - The Bitcoin-Halving Crash-Course – What Is It & Why It Matters

Econostream - ECB’s Cipollone: Should Ease Monetary Policy if Data Confirm 2% Target to be Reached

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.