Read on the Trading Floor - 16 April 2024

Today’s focus… safe havens, China, equity headwinds increase and much more

Macro Themes At Play

Theme 1 - A must read from Brent Donnelly

Theme 2 - China

Theme 3 - Risk aversion

Theme 4 - Waiting for Israel's response

Further reading and listening of note

Theme 1 - A must read from Brent Donnelly

Today's free am/FX is an excellent analysis of safe haven assets during periods of high inflation. Some of the old biases that all traders live by... long JPY, long CHF, long bonds and/or long gold during heightened risk aversion may not perform as you would expect.

An Acute Shortage of Safe Assets

Theme 2 - China

#1. GDP for Q1 beat: 5.3% vs exp 5% and previous 5.2%

#2. CNY Fix allowed above 7:10 as US10s sell off, Trump tariff risks increase, JPY weakens through 155.00, relative inflation/growth outlook all point to USDCNY higher.. will they finally let it go?

#3. Retail Sales: 3.1% vs exp 4.5% (prior 5.5%)

#4. Industrial Production: 4.5% vs exp 5.4% (prior 7%)

#5. EV expansion knocks into Tesla's headcount and market cap.

#6. Overcapacity and government support... following on the heels of Tres Sec Yellen, Chancellor Scholz is in town to chat with Xi about overcapacity and of course the Chinese government support for EV's that are eating into Germanies auto dominance. Could we see EU tariffs imposed by the summer?

Bloomberg - Chinese Economy’s Strong Start to 2024 Is Already Fading

Reuters - China's Q1 GDP growth solid but March data shows demand still feeble

Nordea - China: Keeping up appearances

Bloomberg - China Loosens Grip on Yuan by Weakening Fix Amid Dollar Strength

Nikkei Asia - China's Gen Z turns frugal as economy doubts linger

Nikkei Asia - Xi tells Germany's Scholz to look at industry overcapacity 'objectively'

Bloomberg - Xi Rebuffs Scholz Pressure to Rein In Chinese Manufacturing

The Economist - China’s better economic growth hides reasons to worry

Bloomberg - EU Goes on China Trade Offensive After Getting ‘Played’

Gold, USDCNH and USDJPY trending higher

Source Tradingeconomics.com

Theme 3 - Risk aversion

SPX below its 50sma has the world excited as the “Fed pivot” trend from Nov breaks ...

Source Tradingeconomics.com

#1. April 15th Tax date added momentum to the equity unwind (....but as it has now passed, will flows reappear into QQQ and XBT?)

#2. Geopolitical risk premium has seen a spike in VIX, trigging VAR risk models. The low vol/high carry regime is being replaced by high vol and high uncertainty.

#3. When it comes to economic data, good news is bad news. The Fed curve has repriced on the back of the strength in US data, particularly inflation has 10s > 4.5% and cuts being pushed out past the POTUS election as team "higher for longer" wakes up from its Q1 hibernation.

Bloomberg - Fed Hiking Rates to 6.5% Is ‘Real Risk’ for UBS Strategists

Daly - “The worst thing we can do right now is act urgently when urgency isn’t necessary."

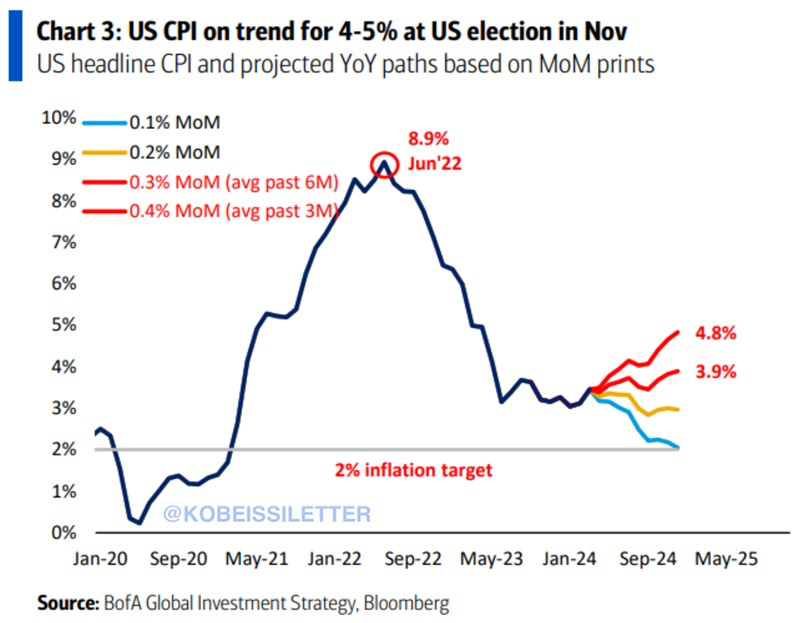

#4. US CPI is far from tamed. @KobeissiLetter highlight BofA's study that "US CPI inflation is on track to hit 4.8% by the 2024 election, according to Bank of America. Over the last 3 months, CPI inflation has averaged 0.4% on a month-over-month basis. If this trend continues it puts year-over-year inflation on pace to hit 4.8% by November, its highest since April 2023. That would be more than DOUBLE the Fed’s 2% inflation target. Inflation has been above the Fed's 2% long-term target for 37 straight months. Inflation is far from over."

#5. US CPI is far from tamed 2.0. @lisaabramowicz1 “Longer-term inflation expectations are rising again. The market's implied rate of inflation over the next five years has risen to the highest level in more than a year, at 2.6%, according to breakeven rates.”

Source: @lisaabramowicz1, Bloomberg

#6. Memestock eupohria and memecoins hit the headlines (Jeo Boden wasn’t a tell?????!!!!) in early April with investor positioned over their ski's (Bloomberg - BofA poll says equity exposure hits highest in over two years). Nobody wanted the USD, everyone wanted something shinny like Gold, Bitcoin, Nvidia etc. Something that they couldn't print, that had scarcity as a key determinant and was "insulated" from deficit spending.

#7. Momentum stalling for some of the key leaders, in particular the Mag 7 has splintered .... e.g. Apple and Tesla.

#8. There is now an alternative as US2s offer a significant yield that equities have to outperform.

but April is a good month seasonally for returns, are we at the lows? Watch for basing in QQQ and XBT to be a tell that narrative has just chased price action, and if tensions ease in the middle east we can see a reprieve in this technical equity selling. After all their are 9 trillion USD sitting in the wings (Bloomberg - BlackRock’s Kapito Says Stocks Are Primed for a Comeback)

Theme 4 - Waiting for Israel's response

The mkt has settled into a wait and see approach. Given Israel's "success" at defending against the well telegraphed air strike, limited to no casualties, potential that Iran only attacked military outposts away from large civilian populous ... is there a need to counter back?

Steno Research - Great Game: Iran's attack was large in scale but harmless in effect

AP News - Israel’s chief says it will respond to Iran’s missile strike

FT - Netanyahu too ‘busy’ to talk to Sunak after RAF helped repel Iranian attack

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

FT - No, a US listing cannot fix every UK company’s problems

Apollo Academy - Capital Markets Reopening After the Fed Pivot

Man Institute: Views from the Floor - The Expected Return of the Magnificent Seven: Revisited

FT - Liz Truss considered sacking Andrew Bailey as BoE governor after mini-Budget

Bloomberg - Japan’s Tepid Warning on Yen Fuels Renewed Weakness Ahead of IMF

Schroders - The Value Perspective with Russell Napier

Bloomberg - Fed Hiking Rates to 6.5% Is ‘Real Risk’ for UBS Strategists

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.