Read on the Trading Floor - 15 May 2024

Today’s focus… Inflation, commodities, AI and elections dominate the news cycle

Macro Themes At Play

Theme 1 - US inflation = moderation at elevated levels?

Theme 2 - So, you're saying there's still a chance of a Sept cut?

Theme 3 - Is the mkt caught in a US2s10s steepener?

Theme 4 - Dr Copper hits record high

Theme 5 - Google launches a raft of new AI tools

Further reading and listening of note

Theme 1 - US inflation = moderation at elevated levels?

In line data set was more than enough to keep the bulls on the front foot! If JPow can look through the PPI ("I wouldn’t call it hot. I would call it sort of mixed.") then a CPI data set on the screws is not going to stand in the way of US equities. With the market worried about "hot" prints, Core CPI MoM inline with forecast at 0.3% and the headline missing by just 0.1%. This is exactly what Powell, Biden and those long US2s will have wanted.

Looking under the hood there was something for everyone. The disinflation trend is still being driven by core goods as services (health care) and in particular lagging components (e.g. car insurance) are providing an outsized share of the upside pressure. Ultimately today's data set was not as bad as feared, thus the mkt breaths a sigh of relief and the hedge/vol unwinds will propel us higher.

As ING commented in their mng piece... "Markets appear to be giving an asymmetrically larger weight to the encouraging bits of US data releases, perhaps mirroring ... the Fed which has failed to turn much more hawkish as disinflation has stalled". As long as a cut is just around the corner, the mkt is happy.

MorningStar - US Annual Inflation Dips to 3.4% April CPI Report Shows

ZeroHedge - Despite Surging Gasoline Spending, US Retail Sales Missed Big In April

BMO - U.S. CPI Inflation Shows Some Encouraging Cooling in April

NY Fed - Do Unexpected Inflationary Shocks Raise Workers’ Wages?

Steno Research - Everything is soft in April

E-piphany - Inflation Guy’s CPI Summary (Apr 2024)

Source: Tradingeconomics.com

Theme 2 - So your saying there's still a chance of a Sept cut?

Not only has CPI landed inline with expectations, today's US retail sales also disappointed. As a result, the market is happy, sun is shinning and the carry machines look set to party. Once again proving that we're trading in a regime were bad news is good news. The pressure is off JPow, his prognosis that the Fed staying "on hold or cutting" has past the recent data set with flying colours.

The mkt was already on high alert for a consumer slowdown given the earning call warnings from Amazon, CVS, Walmart etc. Today's retail sales control group (used for GDP) dropped 0.3% vs exp +0.1%. ZeroHedge highlight that this is the third big miss in the last four months and will weigh on Q2 GDP. Are the lagged impact of monetary policy rate hikes finally feeding through to consumer spending? Slowing jobs mkt, debt burden and now depleted savings are clear headwinds for consumer spending in Q2.

Theme 3 - Is the mkt caught in a US2s10s steepener?

It's interesting to watch US2s struggle to hold on to its post data gains but 10s have stuck at the lows. Does this show positioning? Is the mkt long 2s, earning the carry on unencumbered cash but short 10s? Bond vigilantes had been targeting > 5% not so long ago as the heavy burden of US issuance, Fed running things hot, foreign CB demand dipping and US economy performing better than expected had the street targeting 5.30% not 4.30%.

Source: ZeroHedge.

US 2s bouncing off lows

Source: Tradingeconomics.com

US10s holding on to relative gains

Theme 4 - Dr Copper hits record high

This year we've had spells when oil and gold have dominated the news cycle, now its the turn of uranium and copper to surge. The story is not just on EV's but also the AI chip drive, retooling the entire electricity network as loads are set to soar from EV's, Crypto and, AI as well as the integration of new supply links from solar and wind. Furthermore, decades of under investment due to the pessimistic outlook around the Chinese growth cycle has lowered supply just as new sources of demand have appeared. Throw in a Chinese fiscal support story (long end duration) or two and boom, Copper squeezes.

Nikkei Asia - China to start selling 1tn yuan in long bonds for economic support

Bloomberg - China Mulls Government Buying of Unsold Homes to Ease Glut

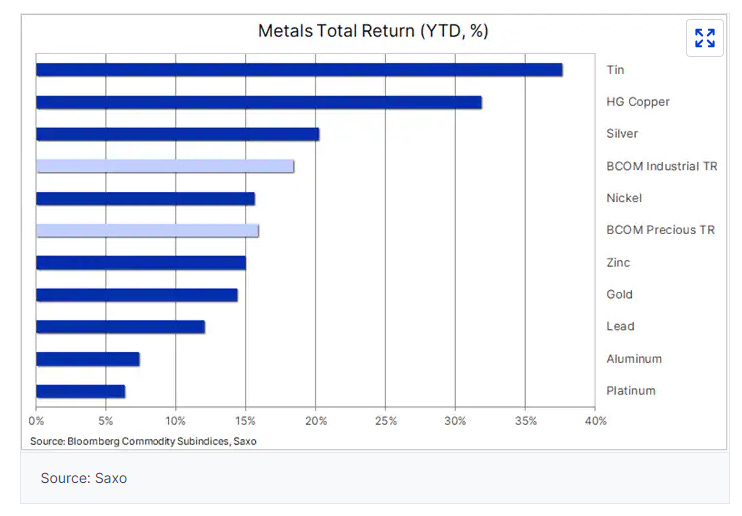

Saxo called it well... 2024 is the year of metals.

The Boock Report - Copper price at record high

PauloMacro - Copper Positioning is Very Extended But It's Probably Not a Top

Bloomberg - Copper Short Squeeze in NY Prompts Rush to Send Metal to US

VanEck - Sticky Inflation Boosts Gold

Theme 5 - Google launches a fully revamped suite of new AI tools

The arms race has well and truly begun as Google were never going to give up their dominance in search that easily, whilst the Sucession-esque scenes at OpenAi continue to playout as Sutskever finally steps away. I think Axios framed the google launch well.... "Showing off the fruits of a research project is considerably easier than shipping a product, as Google's record in prior years has shown."

Bloomberg - Google Infuses Search With AI in a ‘Fully Revamped’ Experience

Bloomberg - OpenAI Chief Scientist Ilya Sutskever Is Leaving the Company

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Bloomberg - Who’s Who in South Africa’s Tightest Post-Apartheid Election

Telegraph - Make election pact with Reform, Rees-Mogg tells Sunak

Econostream - Exclusive: ECB Insiders Confirm Caution Rules the Roost, Even as June Rate Cut Grows More Certain

Daily Chartbook - Investors are the most overweight stocks since Jan’22.

JPM - Animal Farm

SCMP - US tariffs on China: what’s the real impact, and what could happen next?

ING - Watch: Why a rate-cutting ECB won’t be too worried about the euro

Ashmore - EM’s role in the AI revolution: disruptor or disrupted?

FT - China-Russia: an economic ‘friendship’ that could rattle the world

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.