Read on the Trading Floor - 15 Jan 2024

Today’s focus… Iowa and Holzmann

Macro Themes At Play

Theme 1 - USD performs on MLK day

Theme 2 - Iowa Caucus is finally here

Theme 3 - ECB hawks stuck on repeat...

Further reading and listening of note

Theme 1 - USD performs on MLK day

Crude and Brent over 1% lower at $71.75 and $77.50 respectively. No further escalation on the Red Sea whilst non-OPEC oil production has increased as demand worries from China consumer also remains.

Gold is unchanged ~ 2055 and XBT "only" down 60bps as it "consolidates" after last week's 9.5% slide

Bloomberg - Bitcoin’s ETF Hangover Saddles the Token With its Worst Streak in a Month

The Wolf Den #883 - Not All Ships Sail - Will Vanguard Sink?

BoC Business Outlook - "FIRMS EXPECT SIZE OF PRICE CHANGES TO CONTINUE TO MODERATE OVER THE NEXT 12 MONTHS" which along with the dip in oil has USDCAD drifting towards a 4-week high of 1.3450

Theme 2 - Iowa Caucus is finally here

Does anybody have a chance outside of Trump? It is a crucial test for the other Republican candidates, early favourites (e.g. Elizabeth Warren) have lost larger advantages than Trump currently holds. In particular the market will be watching for Hayley and DeSantis performances. According to Politico, "Iowans will give us a pretty good idea about whether the former president can lock up the nomination in mid-March" (Playbook: Iowa enters the spin zone)

Bloomberg - The Iowa Caucuses Are More Important Than Ever, Thanks to Trump

The New York Times - This Again? In Frozen Iowa, the Press Corps Ponders a Slog of a Campaign.

Axios - Iowa caucuses day arrives with sub-zero temps and Trump a big favorite

FT - US election 2024: can any Republican hope to defeat Donald Trump?

Theme 3 - ECB hawks stuck on repeat...

A quiet Monday session has allowed Holzmann's comments to dominate. Along with Lane and Nagel, Holzmann has pushed back against a March cut. Lane over the weekend (interview link) focused on a summer cut, which was reiterated by Nagel today as he emphasises that it is premature to contemplate rate cuts at this time given the persistently high inflation prints. Nagel echoed Lane's proposed potential summer reduction.

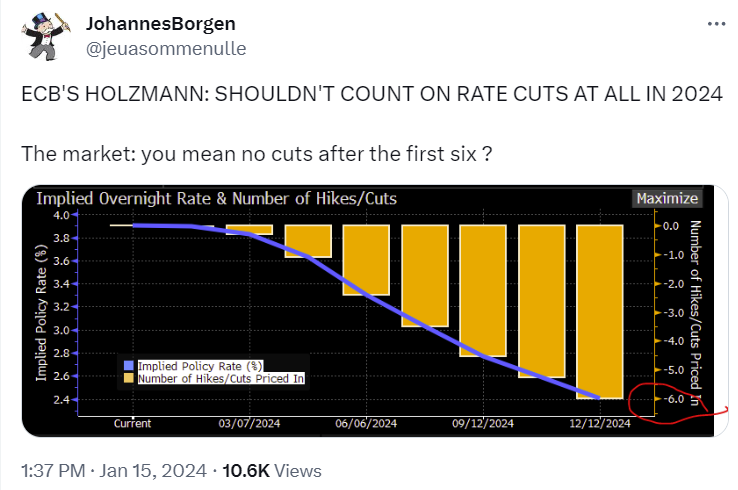

Holzmann, a known hawk went a step further and said there is no guarantee of cuts this year. With 6 already in the Eurozone curve that's some bid offer for us to trade around in 2024...

Bloomberg - ECB’s Holzmann Warns Rate Cuts Aren’t Guaranteed This Year ..... "Threats stemming from lingering inflation will prevent the European Central Bank from lowering interest rates AT ALL this year — even as a recession can no longer be ruled out, according to Governing Council member Robert Holzmann."

Econostream - They Said It - Recent Comments of ECB Governing Council Members

Econostream - ECB’s Nagel: Should Wait for New Data; Maybe We Can Wait for Summer Break

Steno Research - ENERGY CABLE: 4 CHARTS THAT SHOULD KEEP LARGARDE UP AT NIGHT

Tweet of the Day

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Further reading and listening of note

Oilprice.com - A Houthi Retaliation Could Send Oil Prices Soaring

Steno Research - POSITIONING WATCH – WHERE TO FIND VALUE CURRENTLY

Macro Hive - Markets to Watch: Key Clues on the DM Cutting Cycle

A Wealth of Common Sense - Talk Your Book: Building Portfolios with AI

The MacroTourist - SCARCE TO ABUNDANT RESERVES

Odd Lots - The Massive Economic Impact If China Invades Taiwan

DB - All eyes on earnings

JPM - US Rates: Takeaways from December inflation and Red Sea trade disruptions

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

Regarding Holtzmann and the euro rate curve, similar to the US, I don't think it is a proper reading that the market is anticipating 6 cuts. I think a better way to consider it is that there is a probability of 0 or 1 cut and a much lower probability of 300bps or more of cuts if Europe falls into a sharp recession. it just looks like this smooth curve of one cut per meeting, but that makes no sense. the same is true in the US I believe. I would argue the least likely outcome is 6 cuts. either one or none, if the economy continues to perform reasonably well, or 6 50bp or 75bp cuts if we fall into recession.