Read on the Trading Floor - 15 Dec 2023

Today’s focus… Surviving the USD squeeze

Macro Themes At Play

Theme 1 - Williams

Is there a benefit to the dots? In the past JPow has said they become extinct as soon as they're printed. The inflation and growth forecasts give the market enough guidance as to what the CB want. So are the dots an effective tool or are they causing over analysis on the day and thus inducing unnecessary volatility around monetary policy meetings. Then add in a plethora of Fed speakers in between meetings. Are the Fed simply overcommunicating to the market?

FED'S WILLIAMS: "WE AREN'T REALLY TALKING ABOUT RATE CUTS" NOW ...

How can you send the market a forecast of where you would set policy in a years' time and then say that you are not "speculating" about what will happen to rates. The market focuses on the forward not spot, so when the Fed tell us there will be 75bps of cuts next year and remove the last hike, that's as good as cutting now. The expectancy trade doesn't wait for the cut to be actually delivered. The market has to price the probability of it happening by March. Furthermore, it was clear from JPow communication that they've moved from a regime of higher for longer to worrying about staying too high for too long.

As a result, next Friday's Core PCE becomes a big number, JPow hinted that it would come in close to 3.1%, if it is hotter than expected than Williams comments have more weight. For now, the market has faded the move in US2s, and we settle into the weekend close back at 4.40%.

Source: MarketWatch US2s

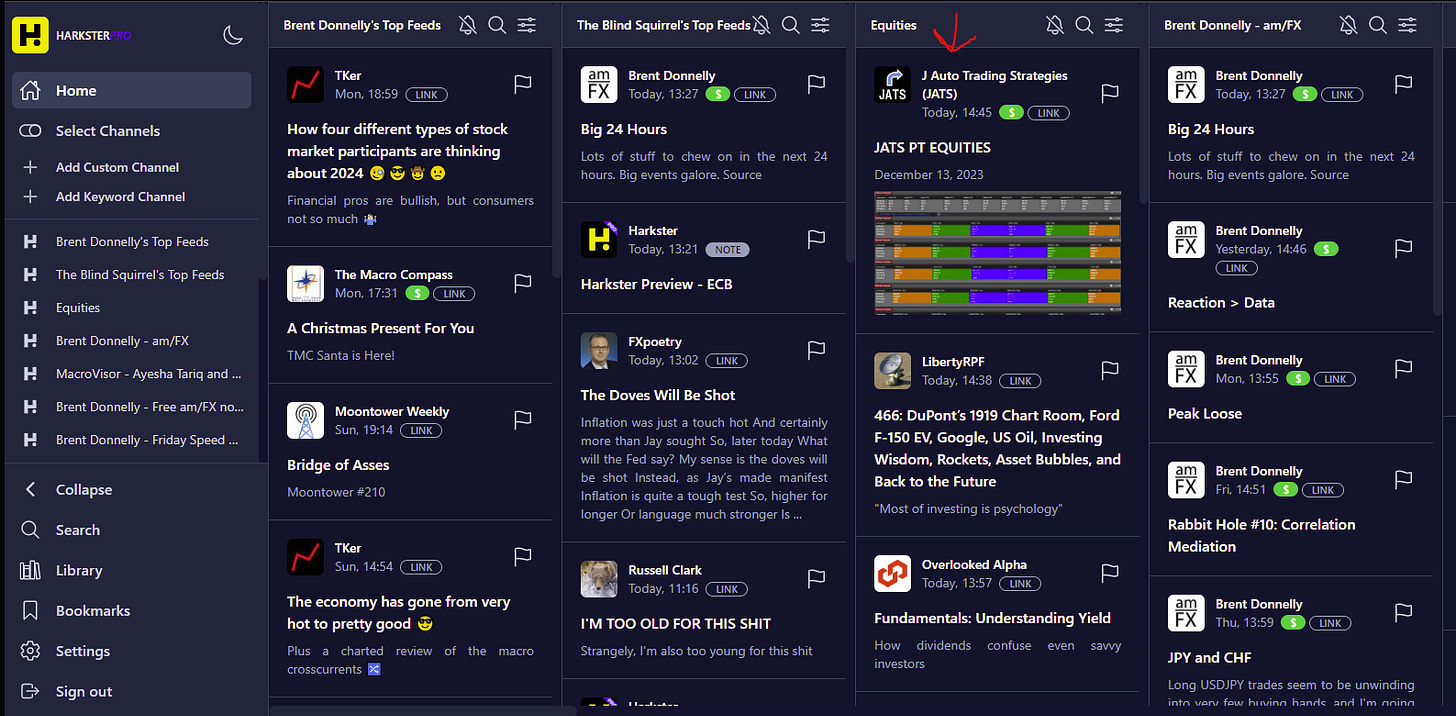

Theme 2 - JATS on Harkster

We're excited to announce

has joined HarksterPro. JATS PT Indicator delivers an instant visualization of where price is trading inside the Quarterly, Monthly, Weekly, Daily ranges and intraday ranges using Opening Range calculations for 1 Hour IB and/or the Globex range.INTRODUCING JATS SUBSTACK & HARKSTER!!!! - by Julie Wade

Theme 3 - Week ahead...

There are still a few events left to trade as well as the strong seasonal patterns that occur in FX around the turn (h/t Brent Donnelly - Bring The Noise)

Nomura Podcast - The Week Ahead - BoJ Meeting, UK CPI and US PCE Deflator

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Ecoinometrics - Don't look at Bitcoin too close, you'll miss the trend

Steno Research - Portfolio Watch: Liquidity the name of the Game

AXIOS - Nikki Haley commits to participating in CNN's Iowa debate

SCMP - Is China’s economic recovery still making headway? 6 takeaways from November’s data

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.