Read on the Trading Floor - 14 Mar 2024

Today’s focus… US data, energy control, Tesla and much more

Macro Themes At Play

Theme 1 - Important data dump from the US

Theme 2 - The future of energy

Theme 3 - Fantastic Four

Further reading and listening of note

Theme 1 - Important data dump from the US

US fixed income weaker (2s @ 4.69% and 10s @ 4.29%) taking the USD stronger after another wave of hotter inflation prints, initial claims declining but retail sales disappointing. PPI rose 0.6% MoM in Feb, marking the largest increase since last August and easily surpassing the streets 0.3% expectations. Initial claims remain glued to 200k, showing no signs of deterioration in the labour market whilst consumer spending is still slowing. Retail sales ex Auto in the US were up 0.3% MoM, but didn't improve as much as expected following a prior 0.8% fall in January and they're below the market forecast of +0.5%. As a result, it’s hard to argue with the narrative that the Fed cut is “not far” but it’s also not quite as close as we once thought. If Jamie and Ken are right, it may still be further than the mkt hopes, potentially after the Nov election but for now though, the fixed income repricing has yet to be violent enough to materially impact VAR models or drive USD flows.

Source: Tradingeconomics.com

Theme 2 - The future of energy

As the world fawns over AI productivity gains and the record inflows into Bitcoin ETFs, are you willing to pay for higher gas and electricity bills to fund the technological advances? The Matrix maybe 25yrs old but it has certainly aged well.

The Telegraph - Rishi Sunak announces new gas power stations to ease risk of blackouts

Doomberg - Prime Time (As Amazon enters the nuclear chat, it’s time to get technical about uranium enrichment.)

Source: The Matrix (June 1999)

Theme 3 - Fantastic Four

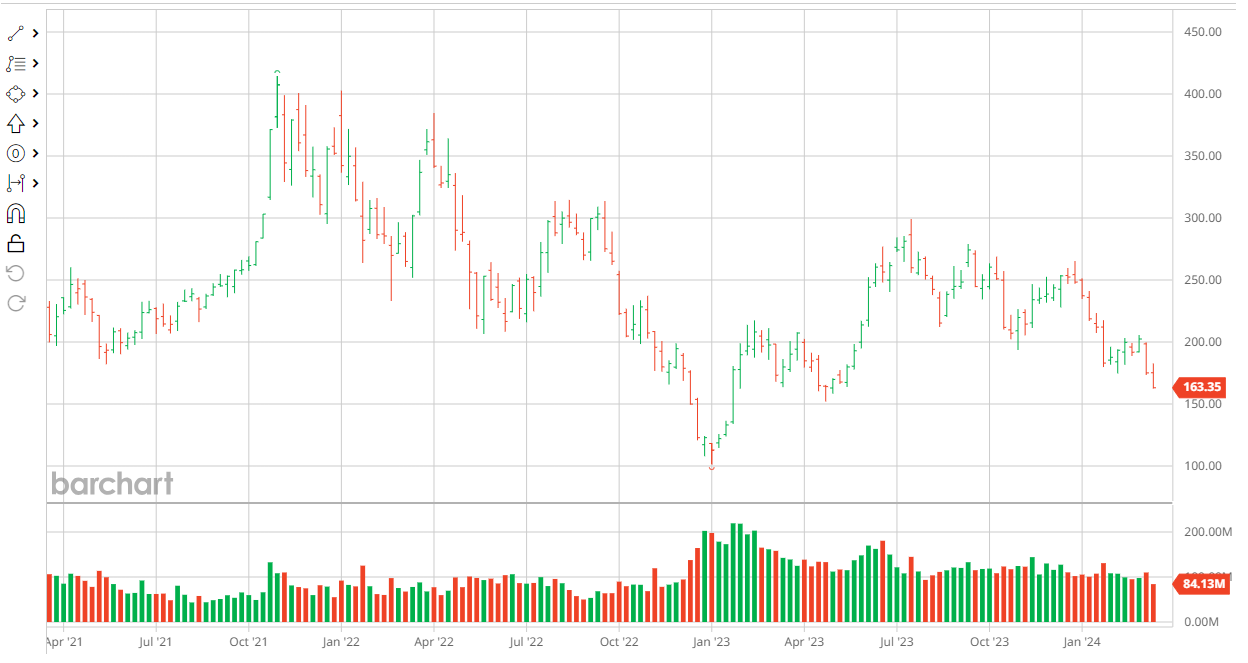

The Mag 7 is splintering into the fantastic four, Tesla suffered another shock sell off as volume/sales growth outlook are expected to trend to 0. Wells Fargo’s Colin Langan via a Bloomberg report indicated "Tesla would have zero growth in sales volumes for the electric-vehicle maker this year and in 2025, it’ll be worse yet: volumes will drop."

Tesla - lower highs and lower lows over the past 9 months

Source Barchart.com

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Apollo - CRE Prices Rebounding

Man Institute - Long Story Short: Sustainability and Systematic Investing

Across The Spread - Quick Note on Market-Moving BOJ Negative Rates Headline

CreditNews - Fed boss: CRE loan losses will trigger ‘bank failures’

Steno Research - MAJOR BREAKOUTS IN SEVERAL COMMODITIES. IS CHINA BUYING AGAIN?

MacroVisor - PPI Data Reveals Rising Inflation Pressures

Brent Donnelly - USDMXN and vol

Advisor Perspectives - The Big Four Recession Indicators: Real Retail Sales Up 0.1% in February

FT - European fund group warns of ‘systemic’ risk from US settlement reform

Axios - The consumer spending that’s powered the U.S. economy could be weakening

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.