Read on the Trading Floor - 12 Mar 2024

Today’s focus… CPI, Gold, XBT and much more

Macro Themes At Play

Theme 1 - Was CPI hot enough for a 50bps dot in March?

Theme 2 - Gold and Bitcoin

Further reading and listening of note

Theme 1 - Was CPI hot enough for a 50bps dot in March?

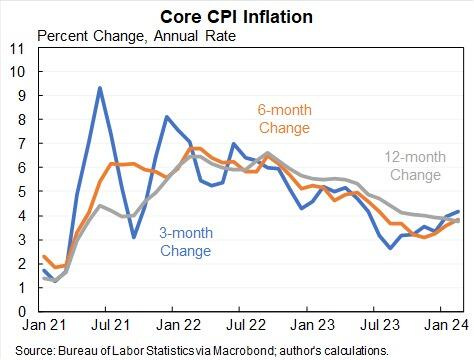

Stagnating, plateauing, stubborn, sticky, cautious decline, patience, vigilance... there was something for everyone in today's data set. CPI came in a touch higher than expected but not so high as to push back expectations of a June cut. The MoM trend was softer (prior 3.9% to 3.8%) but it wasn't as soft as the consensus forecast of 3.7%. However, this is the second straight 0.4% reading for core CPI which suggests that January wasn’t a one-off OER driven anomaly. Crucially there are three more reports before the key June Fed meeting and as a result, a data dependent Fed and market will have plenty more events to pontificate on or worry about before we finally see if the Fed do start their long-flagged cutting cycle. We're at risk of rolling slowly from event to event with the Fed still being "not far" from cutting, but actually never delivering that same cut.

For now, the mkt has behaved incredibly well to reprice from 6 to 3 cuts in 2024. So, what will cause a "freak out" or vol event? If they do miss June than it seems unlikely that they will cut either side of a Nov POTUS election. Either way, does the US economy need cuts? This AI retooling cycle is driving demand, the wealth effect from house prices, stock prices and crypto is supporting the consumer as are solid wage gains. Given there is no stagnation, why do we even worry if they cut in 2024 or not.

The core data will give the committee plenty of reasons to not feel confident that they will ease in the summer and as the ever-excellent Kevin Muir discussed in his latest piece, the markets forward inflation expectations are already rising.... The MacroTourist - FORWARD INFLATION IS RALLYING. The market should only worry if they cant deliver a cut when growth finally declines towards 0.0%. For now, that seems a long way away as the US econoym outperforms.

ZeroHedge Core Data Recap ...

The 3-month annualized Core CPI rate rose to 4.1% from 3.9%.

The 6-month annualized core rate rose to 3.8% from 3.5%.

Core Goods actually rose MoM for the first time since June 2023...

SuperCore: Core CPI Services Ex-Shelter index (aka SuperCore) - soared 0.5% MoM up to 4.5% YoY - the hottest since May 2023...

ZeroHedge - Inflation Hot: Consumer Prices Hit New Record High, Up 19% Since 'Bidenomics' Began

Calculated Risk - YoY Measures of Inflation: Services, Goods and Shelter

FT - US economy: Americans aren’t buying what Biden is selling

ZeroHedge - "That Is Not The Direction The Fed Wants To See": Wall Street Reacts To The Hot CPI Print

Bloomberg - US Core Inflation Tops Forecasts Again, Reinforcing Fed Caution

Inflation Guy's - CPI Summary

Theme 2 - Gold and Bitcoin

The exciting rallies in both gold and bitcoin over the past month have garnered plenty of attention on our platform. I've listed a few excellent pieces that have caught the attention of HarksterHQ and in particular I would recommend

latest piece on Gold in China. To break away from real rates, gold is in demand from households and global CB's to hedge against the global printing presses that are still chugging away. In fact the FT report today (Can rate cuts and quantitative tightening mix?) that "only around half of global pandemic-related QE is set to be reversed by the end of 2025"... scarcity remains a key investment narrative for assets that they can't print (bitcoin, gold, houses etc etc)Fidenza Macro by Geo Chen - Thoughts on new highs in gold and bitcoin

Campbell Ramble - Gold in China

Steno Research - COPPER GETTING SOME HELP FROM CHINA?

Money: Inside and Out - Are Bitcoin ETFs cannibalising other assets?

Unlimited by Bob Elliott - The Role of Gold In a Portfolio

RIA Advice - Digital Currency And Gold As Speculative Warnings

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Bloomberg - Nvidia Vs. Cisco — A Bubble by Any Other Metric

GS: High mortgage rates, limited inventory continue to challenge the US housing market

Econostream - ECB Insight: Framework Announcement Tomorrow Likely to Signal Start of Transition Process

Brent Donnelly am/FX - Long EURGBP

Bloomberg - Jamie Dimon Warns US Recession ‘Not Off the Table’ Yet

Compounding Quality - Interview Shreekkanth Viswanathan

Man Institute: Views From the Floor - Ripe for the (Stock) Picking

Gordian Knot - Are We Heading for a Volatility Event?

Steno Research - Something for your Espresso: Running on a broken Chinese engine?

The Lead-Lag Report - An Incredible Setup

Bloomberg - Traders are back to seeing three rate cuts from the Bank of England in 2024

Nikkei Asia - Japan chip stocks slump amid signs of overheating

Blind Squirrel Macro - Who dares fade 'The Highlander Effect'?

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.