Macro Themes At Play

Theme 1 - US CPI looms on the horizon

Another day of patience as the mkt waits for a crucial US CPI print. Leaders of the recent rally have consolidated after a wave of profit taking hit the likes of Nvidia and of course Nikkei (Brent Donnelly am/FX - Sus). Both having breached key technical thresholds only to quickly revert, in particular Nikkei showing signs of exhaustion following its clear break of 40k only to now be back below the previous record high of 38,957. A doji for SPX and an absence of bears on fintwit makes for an interesting setup, however this may all be just a wave of position squaring ahead of an uncertain CPI event rather than definitely a "top" or turning point in the excessive FCI loosening we've seen since the dovish Fed pivot (Hindsight Capital the best performing fund on the street).

"Understanding" and/or reverse engineering the January spike in OER has been the defining proponent of previews for this week's CPI release. The BLS’s re-weighting was a key driver of the substantial Jan surprise. For example, Pepperstone have indicated that "single-family detached homes now having a higher weight in the OER index, and rent inflation here outpacing that of other housing categories". The risk is OER is likely to remain elevated for some time, somewhat underpinning the core CPI metric

Axios - Why there's so much confusion over housing inflation

Pepperstone - February 2024 US CPI Preview: The Final Piece Of The Pre-FOMC Data Jigsaw

Steno Research - US INFLATION WATCH: OER A ONE-OFF?

Scenario 1 - Immaculate disinflation

Very difficult to see the market repricing May aggressively, maybe we see a nod to May, but June will continue to anchor the Fed curve. This is where their communique has guided us and "one print" should not aggressively change the markets probabilistic outcomes for H2 2024. In effect, one soft number should not give them the “confidence” they need to declare comfort in knowing CPI will be soon back below target.

The first move on an inline to softer number will be positive for risk sentiment... gold, copper, spx, US2s and weigh on the USD, what will be more interesting if this move does not stick and provides greater evidence (doji's etc) that the technical momentum is waning. Remember highs are printed on good news, not bad. As a result, @HarksterHQ will be waiting to see which moves stick once option XXXXX have been cleared!!!!

Scenario 2 - Fed policy isn't restrictive enough, "higher for longer"

Are we certain the Fed will cut 3 times this year? Powell indicated they're "not far" from the first cut but another hot CPI print and the market will have to focus on the March SEP dot plot remarking higher to 50bps of easing in 2024. It will only take 2 policymakers adjusting their plot higher to flip to a median of 75bps back to 50bps. Furthermore, keep an eye on the 3-to-6-month annualised rates, this is where the Fed will look for the underlying trend direction to give them confidence that we're indeed heading back sub 2%.

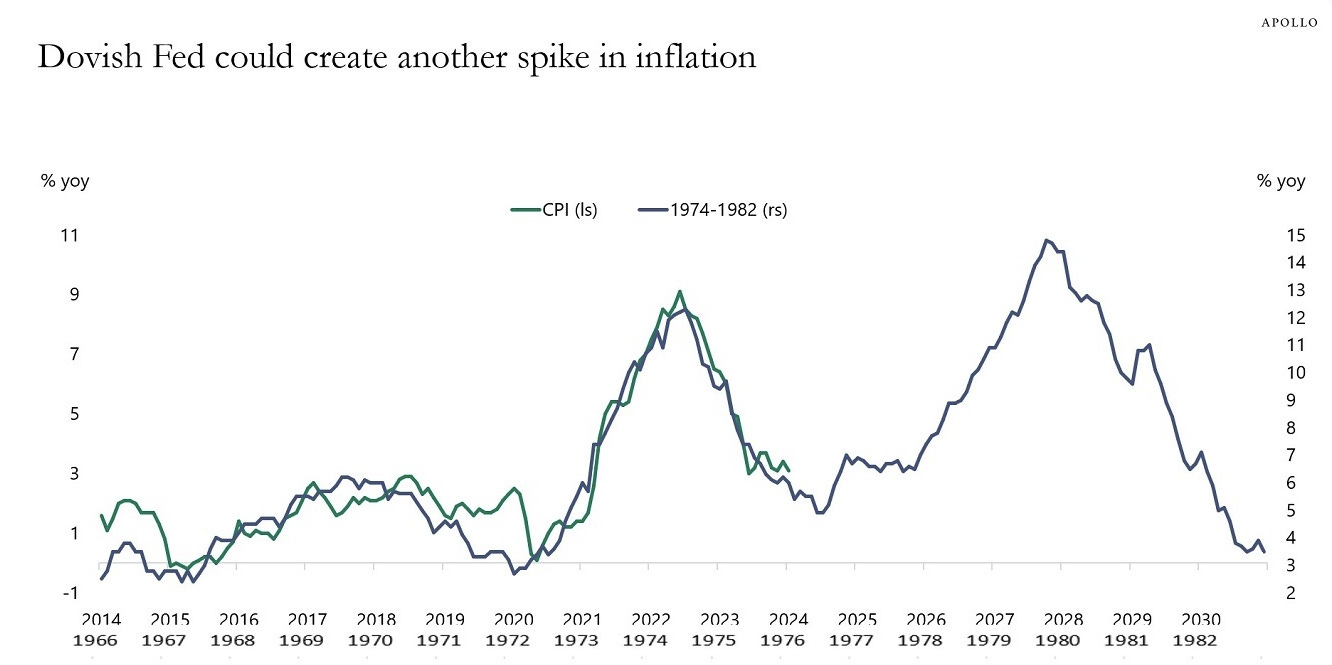

Apollo have been working hard on the "no cuts in 2024" trade and with assets "bubbling", it's hard not to believe the case for a "meaningful" easing cycle in US has weakened materially as labour market remains historically strong, wealth impact of crypto/stocks supports the economy as well as household equity gains post covid and the 5% being paid out on UST .... Are we mapping the 70s cycle tick for tick?

Source Apollo's Torsten Slok

Further reading for your CPI prep

Bloomberg - Traders Are on Alert for a Hotter-Than-Expected Inflation Print

Bloomberg - Barclays Says Sell US Treasuries After ‘Excessive’ Bond Rally

Apollo Academy - Is the Fed Done Fighting Inflation?

Liberty Street Economics - Expectations and the Final Mile of Disinflation

Pinecone Weekly Brief - Inflation Aint Dead Yet

The Inflation Guy / Mike Ashton - Live Long and Prosper with Inflation-Linked Annuities

Axios - Why there's so much confusion over housing inflation

Source: Tradingeconomics.com

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Reuters - UBS pushes back its BoE rate cut forecast to August from May

Bloomberg - Horses Bound for Cheltenham Festival Face New Brexit Hurdles

Fidenza Macro by Geo Chen - Thoughts on new highs in gold and bitcoin

Campbell Ramble - Gold in China

The Next Economy by Florian Kronawitter - On Liquidity

Steno Research - COPPER GETTING SOME HELP FROM CHINA?

Bloomberg - BOJ Mulls Ending Yield Control to Focus on JGB Buying Size: Jiji

Russell Clark - ONLY THE US CAN DESTROY THE US DOLLAR

Steno Research - MORE LIQUIDITY TO THE MOST HATED RALLY IN RECENT HISTORY

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.