Read on the Trading Floor - 09 April 2024

Today’s focus… Gold, CPI, JPY and much more

Macro Themes At Play

Theme 1 - Inflation eve

Theme 2 - CB previews to pass the time

Theme 3 - Got Gold?

Theme 4 - Market vs BoJ Stand off

Further reading and listening of note

Theme 1 - Inflation eve

Another quiet session, with the majority of markets in a holding pattern as investors remain cautious, patiently waiting for fresh impetus from tomorrow's US CPI. Will core remain at 0.4%? Will 10s break 4.5%? Will fixed income offer something more than stocks? Will the Fed's window to cut rates before the Autumn election close shut?

MacroVisor - Breakfast Bites - US CPI Preview

Saxo Bank - US CPI lower than expected CPI may prove insufficient to stem yield surge

The Next Economy - Second Wave or Bump in the Road?

Bloomberg - Bond Traders See 4.5% Yields as Next Test as Focus Shifts to CPI

Real Vision - Will Inflation Bring Out the Fed Hawks?

Steno Research - The week at a glance: US CPI to surprise hawkishly paired with a surprise rate cut?

Brent Donnelly am/FX - CPI biased to weak

Theme 2 - CB previews to pass the time

If hotter CPI is a concern in the US, the market is looking for signals elsewhere that CB's are ready to cut rates in Q2 as growth disappoints in Europe, Canada and further afield.... FT - Central banks lower the bar for rate cuts

BoC

ECB

Saxo Markets - Data-driven until June, Fed-dependent thereafter.

RBNZ

Westpac - Preview of RBNZ Monetary Policy Review, April 2024

Livesquawk - RBNZ’s Focus Remains On Forward Guidance

Theme 3 - Got Gold?

Another ATH for the shinny brick that is single handily keeping CB execution traders, Desk Strategists and FinTwit commentators entertained. Explanations for the divergence of Gold and US real yields (Chart 1 source BofA) are landing firmly a the door of major CB's.

Source: BofA

The broader commodity index (led by copper now at a 15month high) is being helped by the Chinese/US/German manufacturing turning higher, EV roll out, inflation hedge, wars (Ukraine vs Russia) and proxy wars (Israel vs Iran)... the reasons are a plenty, price action is engrossing as commodities offer momentum that is lacking in FX, Equities and Fixed Income markets.

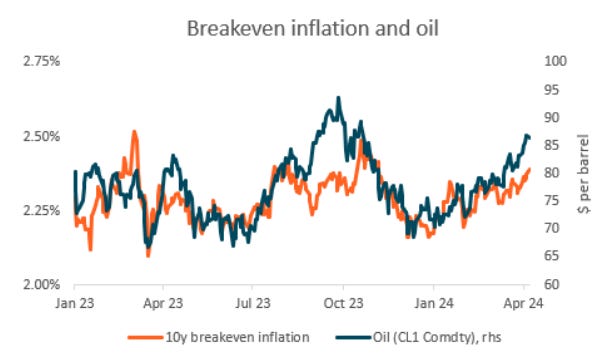

Rising copper/oil prices = higher food prices = higher rates of inflation = higher yields... It's too early for CB's to declare victory on inflation?

Source BNYM

Steno Research - GOING GLOBAL AND REAL!

Bloomberg - Food Prices Are Up Under Biden, Like Every Other President

FT - Global oil market likely to be ‘extremely tight’, says Citadel

The Macro Trading Floor - The Next Big Trade?

Steno Research - Energy Cable: Melt UP in commodities upcoming?

Theme 4 - Market vs BoJ Stand off

Like a spaghetti western, the market sits under 152.00, as the verbal jaw boning is sufficient to slow the ascent. Higher CPI and we will spike, as fixed yields test 4.50% in US 10s that's when we'll see where the BoJ/MoF interest comes... The positioning in short JPY/ long carry is BIG, even if they sell USD, the market feels comfortable that it wont hold the sell off for long. JPY only gains when the Fed enters their cutting cycle which looks later and later in 2024.

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Saxo Bank - The investment case for European equities

Nikkei Asia - Buffett-backed Japan trading houses rise on high shareholder returns

Man Institute - Views from the Floor - Upcoming Bitcoin Halving: A Reason to be Bullish?

Bloomberg - Ex-Fed President Bullard Says Three Interest Rate Cuts This Year Is Base Case

Telegraph - Politics latest news: Reform UK hits highest ever level of support in new poll

Steno Research - Israel-Iran War Coming?

Morningstar - Don't Chuck Wood: Why Pole Stocks Are The Next EV Play

Man Institute - Views from the Floor - Upcoming Bitcoin Halving: A Reason to be Bullish?

Compound Quality - Warren Buffett emailed me

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.