Read on the Trading Floor - 05 April 2024

Today’s focus… NFP, Oil and ILS

Macro Themes At Play

Theme 1 - Was there a clear message from the Fed?

Theme 2 - High Alert

Theme 3 - Bubbling short USD trade?

Further reading and listening of note

Theme 1 - Was there a clear message from the Fed?

Have we learnt anything from all of the communique this week? We're a few months from a cut, the board needs more data to be confident, there will be no cuts if there is no progress on inflation, watching AHE to ensure the pace of wage gains is commensurate with hitting their 2% inflation target.... effectively none the wiser, all soundbites we had already heard from the Fed minutes / press conference and data is what we were already watching. Less truly is more....

Reuters - Fed's Kashkari says 2024 rate cuts under threat if inflation continues to stall

Bloomberg - Fed Speeches: Latest on Remarks From Harker, Barkin, Kashkari, Others

Steno Research - Out of the Box: 6 reasons the Fed will be hiking rates in 2024

Bloomberg - The Fed Is Wrong About How Low Interest Rates Will Go

Full recap of recent comments in today's The Morning Hark - 5 Apr 2024

Theme 2 - High Alert

Biden, Netanyahu, Aid for Gaza, Israeli embassies put on high alert, UAE cutting ties with Israel, Israel cancelling all leave for defense forces .... Oil / ILS will be closely watched into the weekend, will the fear of a retaliatory attack lead to mounting pressure and/or, the buying of risk hedges no matter the NFP print? After a stellar start to the year, wouldn’t it be better not to risk the weekend gap lower if something was to happen in the Middle East. Be on the watch for a defensive mindset into the weekend, it will be truly telling if we get a seasonally soft March NFP and still equities can't rally.

Crude > $91 / $92 could well be a trigger for further unwind of risk positions as the market wonders what the Iranian counter response will be, where will they hit and what will the magnitude of their attack be...

Axios - Israel warns of consequences to any attack from Iran

Axios - Biden calls for "immediate ceasefire" in tense call with Netanyahu

Axios - Israel agrees to increase humanitarian aid delivery to Gaza under U.S. pressure

Steno Research - Something for your Espresso: An eye for a head?

Source: tradingeconomics.com

Theme 3 - Bubbling short USD trade?

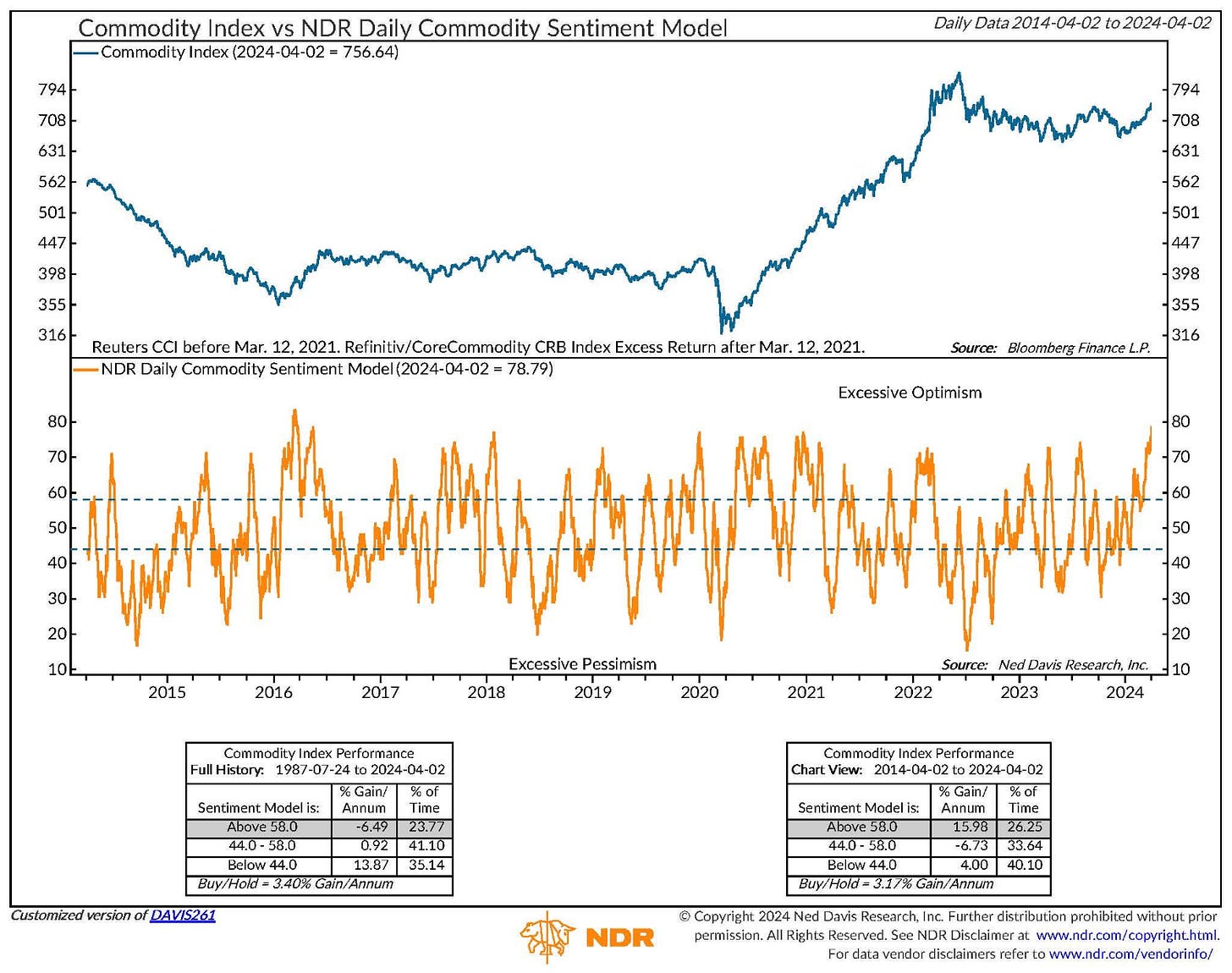

With commodities taking the lead from AI as a key macro driver over the few sessions, shouldn’t the currencies of those producers also benefit? Steno Research and Brent Donnelly am/FX have highlighted the bubbling short USD trade as global manufacturing rebounds, XI opens his doors to US CEO's, Gold hits all time highs streak and silver/copper join the rally. In fact NDR's Daily Commodity Sentiment Model is at its highest (most optimistic) since March 2016.

Steno Research - https://stenoresearch.com/watch-series/trade-alert-playing-the-last-reflation-saloon-and-nok-technicalities/

Brent Donnelly am/FX - US Unexceptionalism

NDR - NDR: Daily Commodity Sentiment Model - A Surge in Optimism

Source - NDR via Daily Chartbook

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Bloomberg - BOJ Governor Ueda Says Chance of Hitting Japan Price Target to Rise From Summer

ING - Bank of Canada preview: Why the BoC could open the door to a June rate cut

SCMP - Janet Yellen in China: overcapacity high on the agenda as secretary takes swipe at exports

HSBC - Under the Banyan Tree - Nvidia, Bitcoin and enough cement to turn Britain into a carpark

FT - Global supply of equities shrinks at fastest pace in decades

Odd Lots - Steve Eisman on the Three Big Macro Stories of Our Time

FT - Sunak’s unpopularity comes down to simpler reasons than often thought

The NY Times - Want to Invest in SpaceX or Stripe? There’s a Fund for That.

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.