Read on the Trading Floor - 04 Jan 2024

Today’s focus… Fed's balance sheet, USDJPY, red sea price pressures and much more

Macro Themes At Play

Theme 1 - Focus on the Fed's Balance Sheet, RRP and QT

Theme 2 - US labour Market

Theme 3 - How soon will the Fed cut?

Theme 4 - USDJPY

Theme 5 - Red sea price pressures

Theme 1 - Focus on the Fed's Balance Sheet, RRP, QT

The market has been looking for a hint that QT would end as the excesses in the RRP market heightened concerns that something would break before long. The Fed minutes obliged, hinting (Bloomberg) for the first time that they too see a need to limit their balance sheet roll off sooner rather than later or a least start that discussion to ensure "ample" bank reserves remain in play.

There is also a sequencing element to consider. How can the Fed be tightening their balance sheet in H2 at the same time as cutting rates to reduce the pressure "real rates" are having on the economy. To get ahead of any mixed signals and as the board becomes more comfortable in inflation's path back sub 2%, they need to prepare the market for B/S changes. Powell has always emphasized a need to be consistent and transparent when it comes to their B/S practices.

Given the complexity of modern-day finance, as multiple narratives fight for supremacy .... the simplicity, insightful and comprehensive summary of the day's best charts delivered by the

is greatly appreciated by @HarksterHQ.The curation really does deliver on the old adage that “A picture is worth a thousand words”. It blends a fantastic array of cross section macro and market data into a concise daily read.

Theme 2 - US labour market

ADP beat expectations 164k vs exp 115k (up from Nov's 101k). Leisure and hospitality sectors led the (potentially seasonal) hiring. Initial claims also ended the year at the lows, almost at a 1year low (Chart Source Tradingeconomics.com) .

Furthermore, "if the massive loosening of financial conditions is any signal, continuing claims are about to plunge (4 week lagged continuing claims track US FCI)..." (Source ZeroHedge: Initial Jobless Claims End 2023 At Year Lows)

…. but this comes a day after JOLTs Quits rate put the market on... "recession watch".

point out “another warning sign for the labour market is the downward slope of temporary hiring for more than a year. Temporary workers are often considered a bellwether for the labour market as they are often the first hired when businesses start staffing up and the first dismissed when the economy sours."(Shifting Labor Market Dynamics & Anticipated Federal Reserve Rate Cuts)Thus there has been something for everyone in the labour data so far this week. Ultimately the soft landing is still in play as the labour market shows signs of bending around the edges but no signs yet of cracking under the weight of the historic rate hiking cycle inflicted by the Fed.

To finish, a great thread from @darioperkins on the "divine coincidence". How much influence did the Fed and other CBs have on achieving a rebalancing in the job openings?

Theme 3 - How soon will the Fed cut?

Will the data soften quickly enough to allow a Q1 cut? Jan 11th we will see the release of the Dec inflation data. It's otherwise a quiet week so all eyes will focus on the direction of travel of the data towards the Fed's dual mandate. The 6 month trend is already sub 2% for core PCE but expectations are high with 6 cuts in the curve (

- A January Rate Cut?) ....The Fed have told us they will not wait for 2% inflation to cut, so is there a soft enough number that can be released next week for the Dec inflation print to induce a Jan cut?

The market's expectations for March continue to recede ....

Sell side strategists are at mid-year

Fed dots indicate June but the minutes "appropriate by the end of 2024"

Source: CME FedWatch

Source: tradingeconomics.com

Theme 4 - USDJPY

USDJPY has been the main beneficiary of the US yield move (chart below), however there has been more to the move than yield story, if anything 10s and USDJPY correlation looks stretched.

Local banks led by MUFG have pushed out any potential BoJ move until April, as they will need to assess the impact from the Noto Peninsula disaster as well as the Q1 wage agreements. (Bloomberg - Earthquake Raises Bar for BOJ to End Negative Interest Rates)

Will local money flow off shore as investment rules are revamped

The Japan Times - Revamped NISA program launched to spur investment wave in Japan

Across The Spread by

- Japan Rejoins Global Markets: Watch US Equities as New NISA Launchesam/FX by Brent Donnelly - USDJPY and NOKSEK

USDJPY vs US10s

Source: tradingeconomics.com

Theme 5 - Red sea price pressures

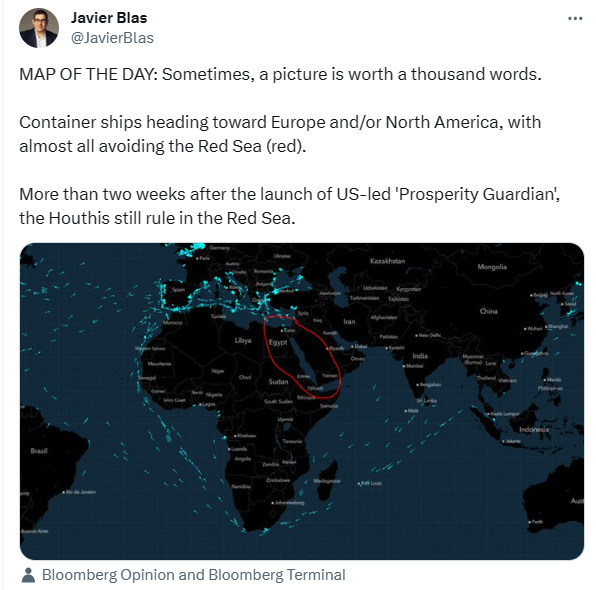

One risk to the inflation story (although it may be too soon for the incoming data) is the freight costs induced by the tensions in the middle east but their small pop is not as important as the rally in crude and brent which will impact the recent "base effect" savings that we've seen globally in Q4 in inflation prints.

Bloomberg - Attacks in the Red Sea Are Reconfiguring Global Trade Again

ZeroHedge - Spot Container Rates Surge By 173% Due To Red Sea Disruptions

Steno Research - Suez Watch: Massively rising Container freight rates, while Dry Bulk, LNG and Crude rates are more muted

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Further reading and listening of note

Discovered on Harkster.com

ZeroHedge - The 10 Most Positive Things That Might Happen In 2024

ING - German inflation rebounds in December... "strengthening the case for the European Central Bank to wait a little longer before discussing rate cuts"

The Bitcoin Layer - Leishman: You had 15 years to front run Wall Street

Unchained - Bitcoin's 15-Year Journey: Just Getting Started?

Saxo Bank - Commodities: Crude oil and gold in focus as a new year begins

Coingraph News - “Record-Breaking Crypto Exchange Trading Surpasses $1 Trillion Mark in 2022”

FT - UK mortgages and services data point to stronger fourth quarter

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.