Read on the Trading Floor - 02 Feb 2024

Today’s focus… MAGA Jobs, JPow, Musk vs Zuckerberg and much more

Macro Themes At Play

Theme 1 - MAGA US Data

Theme 2 - What's Powell going to say?

Theme 3 - AI productivity boom in Tech vs CRE fears rekindled

Theme 4 - Week Ahead Previews

Further Reading and Listening of Note

Theme 1 - MAGA US Data

There is simply too much growth to feel comfortable that inflation can return to 2% in a sustainable way, especially with upside risks to H1 inflation prints due to Red Sea / Freight costs as well as base effects. The Fed speakers have been clear, cuts are indeed coming but they need further clarification from the incoming data to be comfortable that they've not cut too soon. 4.5% annual AHE suggests to the Fed that the battle has yet to be won. In fact, is the US economy re-heating?

Initial Claims - The biggest 2 week jump in initial claims since the start of 2022

NFP - 353k vs exp 180k (prior 333k)

UER - 3.7% (SAHM rule was so Q4)

AHE MoM - 0.6% vs exp 0.3% (prior 0.4%) (Hourly wages increased the most since March 2022)

AHE YoY - 4.5% vs exp 4.1% (prior 4.4%)

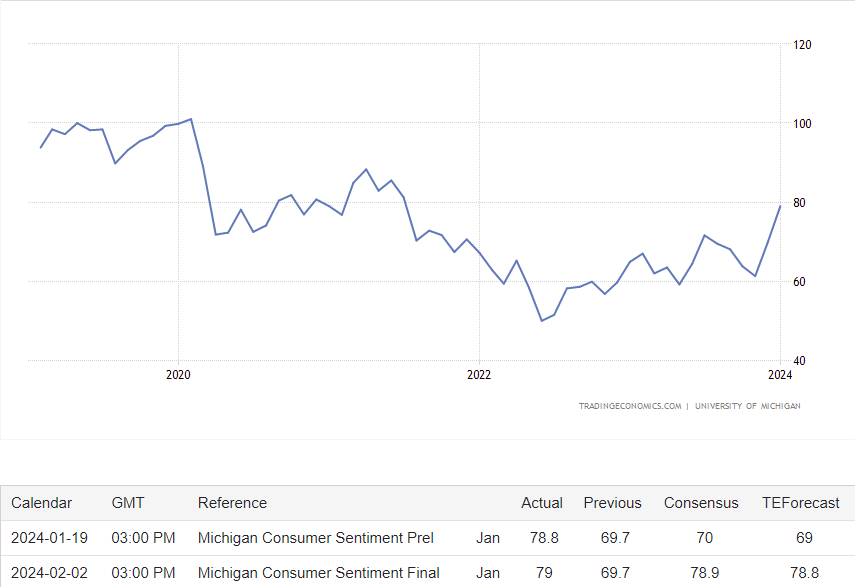

Univ of Michigan Survey - 79 vs exp 78.9 (prior 69.7)... returning to pre-covid levels

Source Tradingeconomics.com

Steno Research - SOMETHING FOR YOUR ESPRESSO: IS POWELL RIGHT?

Calculated Risk - Comments on January Employment Report

Bloomberg - US Payrolls and Wages Surge, Likely Keeping Fed Rates on Hold

Bloomberg - Bad Weather Probably Boosted Wage Numbers in January Jobs Report

The NY Times - The Economy Looks Sunny, a Potential Gain for Biden

Theme 2 - What's Powell going to say?

A few days after the FOMC meeting, Chairman JPow steps into the Sunday night void left by Kelce and Swift who've taken a week off before the Super Bowl.

Powell was right on Wednesday not to be looking for a "weaker labour market”. He also told us that they're "looking for inflation to continue to come down as it has been coming down for the last six months.” Potentially he says something new on NYCB, stability of the US banking system but so close to the FOMC presser it seems likely he'll copy and paste his message for main street (the electorate). After all, Trump believes he's working for Biden

Bloomberg - Fed’s Powell Will Discuss Interest Rates, Inflation on 60 Minutes Sunday

Bloomberg - Trump Says He Would Not Reappoint Powell as Fed Chair if Elected

Theme 3 - AI productivity boom in Tech vs CRE fears rekindled

Hindsight's wonderful but trade of the week goes to long META short NYCB... was the latter idiosyncratic or indicative of wider issues in the portfolios of banks?

What a pity we never saw the cage fight between Musk and Zuckerberg, but this earning season has clearly swung back towards Mark... Meta up 20% on the week, after they launched their first dividend and posted their biggest quarterly sales rise in 2 years. Musk on the other hand is trying to leave Delaware for Texas, and has had to recall millions of cars...

Gryning Times - Productivity Growth -> Economic Growth

Morning Star - Magnificent 7 Stocks: US Tech Earnings in Full

ZeroHedge - Elon Musk Says Shareholders Will Vote On Reincorporating Tesla In Texas

Theme 4 - Week Ahead Previews

ABN Amro - The week ahead: 5 – 9 February 2024

Nomura - The Week Ahead – US ISM Report, German Industrial Production, Japan Earnings Data

Macro Hive - Week Ahead: We Had the Fed and Blow Out Payrolls, What’s Next?

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

FT - Premier League transfer spending drops to lows last seen in depths of pandemic

The BondBeat - BNP QTOW: Initiating US 10y short

Bloomberg - BOE Chief Economist Warns UK Rate Cuts Are Still ‘Some Way Off’

JPM - EM Fixed Income: Trying to stay on the straight and narrow

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.