Read on the Trading Floor - 01 Feb 2024

Today’s focus… May > March, NYCB, CRE, Earnings and much more

Macro Themes At Play

Theme 1 - Indigestion of news and data

Theme 2 - May > March, QT Live

Theme 3 - Data dependency starts with NFP

Theme 4 - Commercial Real Estate

Further reading and listening of note

Theme 1 - Indigestion of news and data

Too much news, too many CB meetings, too many moving parts, too many earnings... mkt is bloated with contrasting and opposing narratives, leaving little appetite to take / add to risk. There seems like a paralysis from analysis and limited scope to add to risk at these elevated levels and valuations. As a result ranges continue to compress, fixed income and fx markets maintain their churn around clearly defined YTD ranges.

QRA announcement

Fed agree we won't see anymore hikes, but March is not the base case

Bank provisions for CRE portfolios returns to the front page of the finance section

Apple, Amazon and Meta earnings after the closing bell

Lower labour costs, Initial Claims also softening as the market waits for NFP tomorrow, a key input for March pricing (it's final death nail or reopens the chance of a cut)

DB continues the trend of banks and tech firms lowering head count, reducing fixed costs

and that's before we consider the message from BoE, ECB and Riksbank, liquidation of key Chinese property firms as well as Red Sea / Middle East tensions

Theme 2 - May > March, QT Live

Fed removed their hiking bias but “the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” QT will start later in the year and they don’t need RRP to hit 0 before slowing QT (tapering the taper).

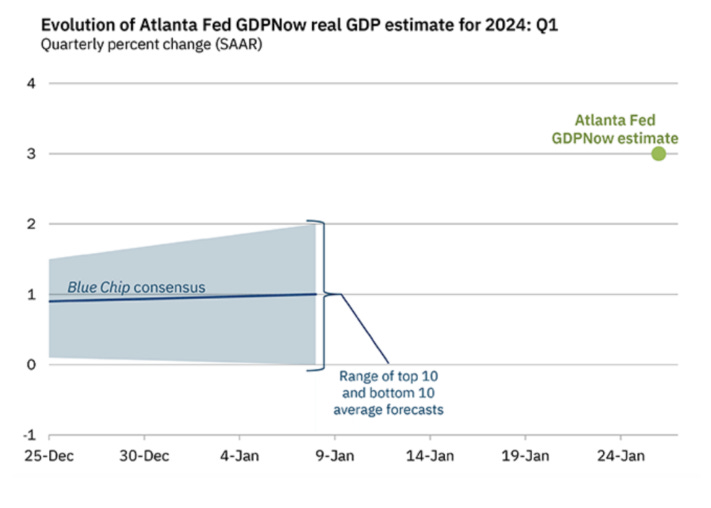

As the dust settles on the "surprise" pushback from Powell, it indicates just how far the market got ahead of itself in Dec/Jan. It's amazing that an economy with 3% growth and we priced not so long ago a 10/20% chance of a 50bps cut in March!!!! I fully appreciate the real rates argument, but JPow has flipped our focus, there is simply too much growth to cut (Atlanta GDPNow at 3%) and the risks of base effects as well as Red Sea tensions feeding into "sticky inflation" narrative have made the bar to a March cut too high for the board. Let's see what the data brings and if it gives the Fed confidence to deliver the first 25bps cut...

The Next Economy by Florian Kronawitter - Hawks and Supply

Bloomberg - Powell Says a Fed Interest-Rate Cut in March Is Unlikely

Theme 3 - Data dependency starts with NFP

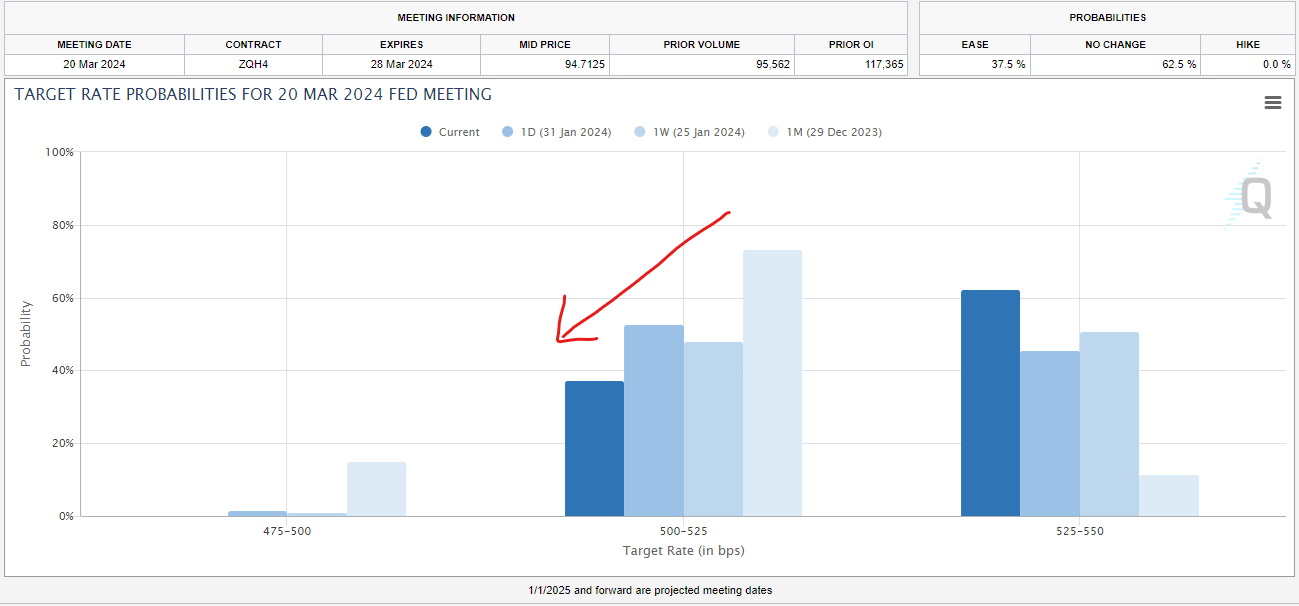

With Powell indicating the core of the board believe a March cut is not their base case, Tomorrow's NFP as well as CPI (Feb 13th) must come in exceptionally below market forecasts to bring March back onto the table. There is still a 37.5% chance of a March cut, so more can come out.. or be pushed further into 24/25!

Source: CME FedWatch

but is the labour market already starting to soften....

ECI and labour costs came in below consensus this week

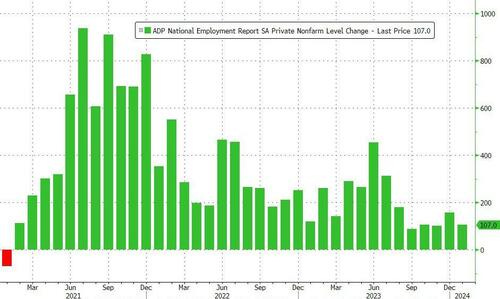

ADP saw the second lowest monthly increase in jobs since Jan 2021's drop in jobs...

Calculated Risk - Weekly Initial Unemployment Claims Increase to 224,000

Source The BondBeat

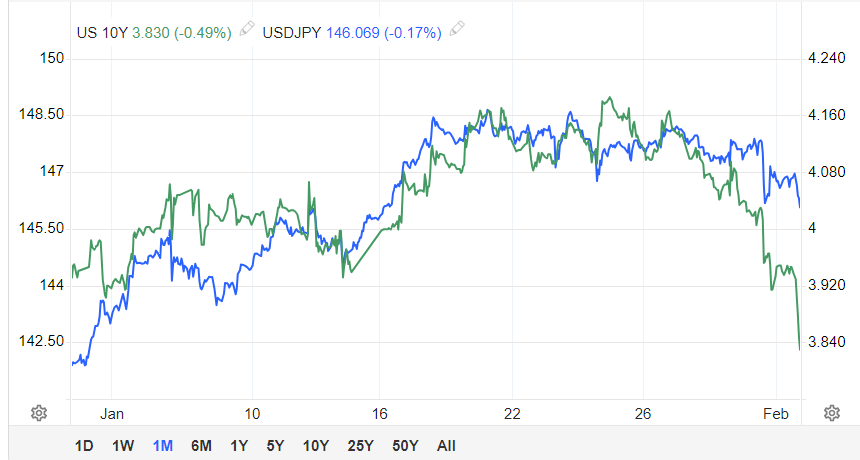

USDJPY has tracked the rally in 10s despite ISM beat and "hawkish" Fed.

ISM 49.1 in Jan from 47.1 in Dec and well above the streets forecast of 47. This is its highest since October 2022.

Chart Source - Tradingeconomics.com

Theme 3 - BoE, ECB, Riksbank... getting closer to cutting but not there yet?

Got to love the BoE vote, really does stand out relative to the "consensus" Fed and ECB decisions. 6/2/1 reads like a football formation rather than a CB voting structure. ECB Lane is looking for more before confirming when the first cut will come. Similarly, the Riksbank laid the ground work for a cuts...

ZeroHedge - Cable Rallies After 'Hawkish' Pivot By Bank Of England

Steno Research - G3 Watch: Timing the first rate cut

Nordea - Dovish Hold

SEB - Riksbank indicates that rates could be lowered in the first half this year

Theme 4 - Commercial Real Estate

As the music stops, funding maturity cliff approaches and workers are not returning to the office (Apollo Academy - Work from Home Is Here to Stay)... who is left holding the bag? where do the unrealized CRE and fixed income losses lie?

NYCB caught a market looking in the wrong direction, focused on QRA, Tech stock earnings and the Fed.

ZeroHedge - Dominoes: After NYCB, Shares Of Japanese Bank Implode On Massive US CRE Writedown

WSJ - New York Community Bancorp Stock Plunges 38%, Reigniting Fears for Regional Banks

Bloomberg - NY Community Bancorp Plunges a Record 45% After Dividend Cut

Simon White, Bloomberg Macro strategist via ZeroHedge - Bank-Stress Is Wake-Up Call For Goldilocks

FT - Bank losses revive fears over US commercial property market

Deutsche Bank lifted provisions for losses on loans linked to US CRE from 26mio euro a year ago to 123mn. However it was Tokyo that took over from NYCB. Aozora Bank has always been intertwined with US commercial real estate, as Weston Nakamura (Across the spread - Dark Skies at Aozora Bank) highlights, the Japanese bank has had connections/exposure to Lehman, Madoff.

"Aozora increased an additional ¥32.4 billion in reserves against souring U.S. CRE loans. Aozora also accelerated sales of its foreign securities, much of which comprised of FX hedged US Treasuries, as unrealized losses mounted."

but the big keep getting bigger, as a two-tier banking industry forms in the US. Those who have deposit insurance and those that don't

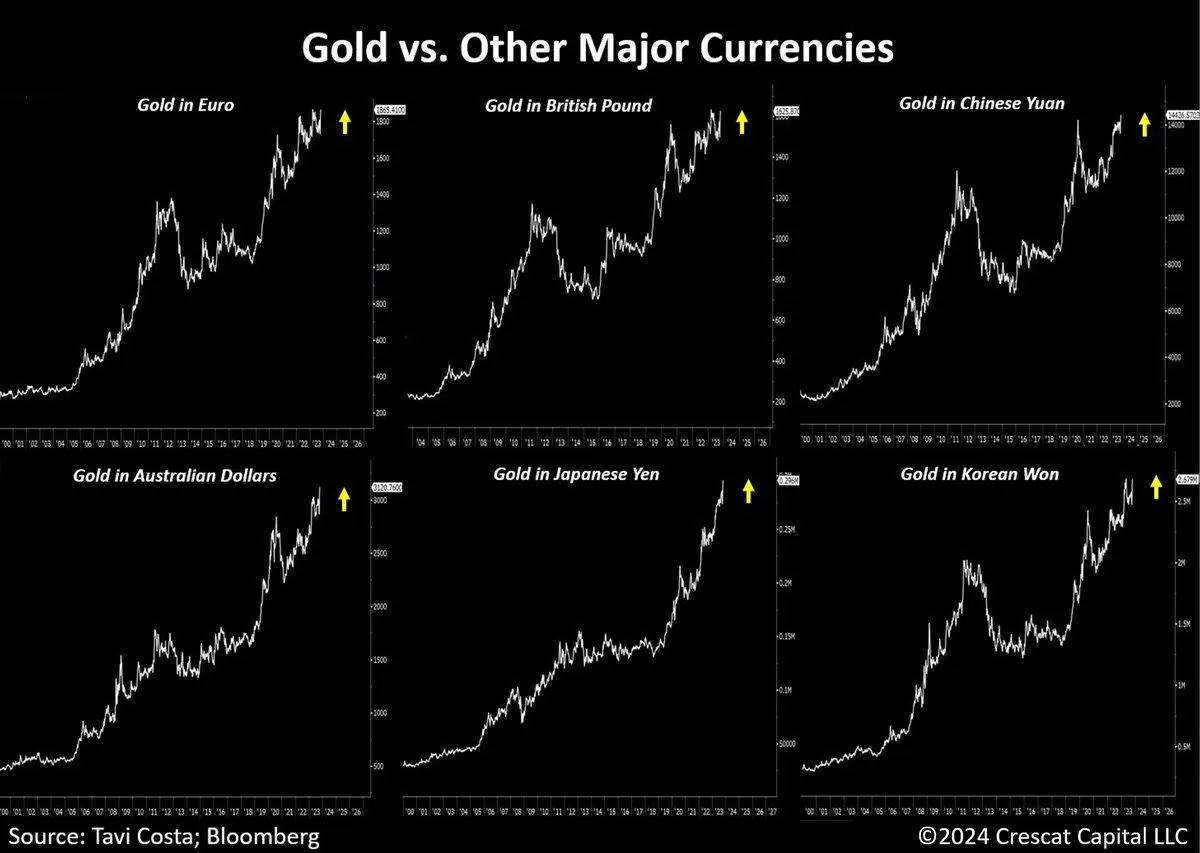

Race for safety - Gold hitting multi year highs against 6 major countries

Source Bloomberg via Crescat Capital (@tavicosta)

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

MorningStar - Shell: Stock of the Week

FT - Red Sea crisis pushes up delivery times for European manufacturers

Bloomberg - Mark Cabana Connects the Dots on Bonds, Banking and Benchmark Rates

S&P Global - Red Sea concerns: A fresh shake-up to European oil market logistics

Fortune - America’s billionaire investors are lining up behind their favorite candidates for 2024

M&G Investments / Bond Vigilantes - Japan, the steep climb that’s about to flatten out

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.