Read on the Trading Floor - 01 Dec 2023

Today’s focus… Central Bank Communication vs Market Pricing (The Sequel)

If you haven’t upgraded yet, subscribe now to continue reading.

Read on the Trading Floor will gradually move behind a paywall over the next week. Starting today, the free content included will be limited, and from December 11th, we will only send the newsletter out to paid subscribers. Keep reading with a HarksterPRO subscription for just $24/month.

Macro Themes At Play

Central Bank Communication vs Market Pricing (The Sequel)

JPow's fireside chat

ISM .... oomph

GS calling for a Q2 ECB cut

Some week ahead previews of note

Theme 1 - Central Bank Communication vs Market Pricing (The Sequel)

What an odd cycle of forward guidance we've worked through. Central bankers all coalesced on the view in the early part of last year that inflation would be transitory despite it exploding to decade highs and now as disinflation has run through the global economy (China exporting deflation, slide in commodity prices, base effects, higher real rates, AI productivity gains etc), Team "Higher for Longer" has now appeared out of the ashes of Team “Transitory”.

"November saw the biggest easing in financial conditions in history" (ZeroHedge). If Central Bankers are remaining cautious because they fear an easing of financial conditions will rekindle inflation, well it isn't working ...

Source ZeroHedge

Theme 2 - JPow's fireside chat

A little Bowman, a little Williams, a little Waller and a little Mester... JPow had something for everyone in the audience, he didn't endorse Wallers' insurance cuts, but he also didn't go out of his way to correct them. Furthermore, the FCI softening has been historic, the market moves so great that the fact they've not materially pushed back on the repricing in the USD, US2s, US10s and Equity space since he mentioned "tightening financial conditions" on Nov 1st, then isn’t he indirectly endorsing them?

Federal Reserve - Powell, Opening Remarks

WSJ - Fed’s Interest Rate Hikes Are Probably Over, but Officials Are Reluctant to Say So

NY Times - Fed Chair Powell Says It’s Too Early to Guess When Rates Will Fall

FT - Fed's Powell says 'premature' to rule out further rate rises

The Block Report - Powell tried to push back but that lasted only a few seconds in Treasuries

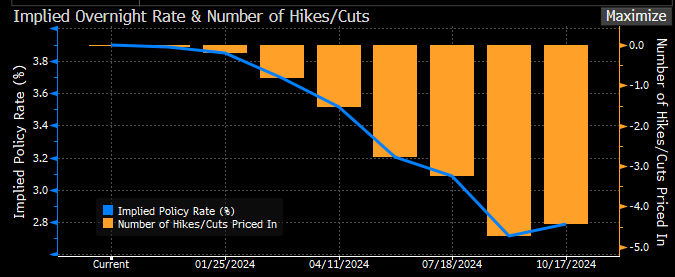

The market is pricing the probability of deep cuts but when have we seen 125bps of easing in a year without something materially bad happening in the economy. 125bps of easing are not "insurance" cuts.

Finally, as we enter the Blackout window, it will be intriguing to see what the Fed SEP dots will show on Dec 13th ... Will the board still have one more hike in the curve? Makes for some SEP/dot plot fireworks .. What will the Fed tell us in 2weeks let alone 2months...

Theme 3 - ISM .... oomph

JPow "Incoming Data Will Tell Fed If It Has Done Enough Or Needs To Do More"

US NOV. ISM MANUFACTURING INDEX UNCHANGED AT 46.7; EST. 47.8

US ISM FACTORY EMPLOYMENT INDEX FALLS TO 45.8 FROM 46.8

MishTalk - ISM Manufacturing Contracts for the 13th Consecutive Month, Order Backlogs Plunge

This has taken the Atlanta GDPNow reading to 1.2% on Dec 1st from 1.8% on Nov 30th and down from the 5% lvls in Oct. This has extended the 10s rally into the close 4.22% and of course weighed on USDJPY that is closing the week at the lows sub-147.00.

Atlanta GDPNow dips to 1.2%

Source Bloomberg

USDJPY vs 10yr yields

Source Bloomberg

Theme 4 - GS calling for a Q2 ECB cut

A staggering repricing in Europe with 5 cuts in the curve by Sept. PMIs remain in contraction zone whilst the German fiscal situation is the antithesis of the US (Nordea - Macro & Markets: Fiscal headwinds to prompt early rate cuts?).

Still a large divide between the ECB's communique and the 125bps of cuts priced to start in 2024 (Econostream - They Said It - Recent Comments of ECB Governing Council Members)

WIRP Eurozone

Source Bloomberg

Theme 5 - Some week ahead previews of note

Nomura The Week Ahead Podcast - US NFP, ISM Surveys, ECB Inflation Expectations, China CPI, Tokyo CPI and RBA policy decision

Macro Hive Week Ahead - Data to Show Economy still Humming

Newsquawk Week Ahead Highlights - US jobs report; China CPI/trade data; RBA, BoC rate decisions

ㅤㅤㅤ

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Pieces

Discovered on Harkster.com

Strict new IRA tax credit rules aim to boost domestic industry but could slow transition from petrol

Is it a company, a charity, for the greater good or for profit?

Above my paygrade...

The MacroTourist - AN ATTRACTIVE OPPORTUNITY IN MBS/CREDIT LAND

Interesting chart in here - stocks and bonds the highest correlation in 20yrs

Ecoinometrics - Bitcoin is building momentum

Simon White, Bloomberg Strat via ZeroHedge - Bumpy Inflation Says There's More Rate Volatility To Come

Covid policy response will widen the generational gap further

St Louis Fed - Understanding the Generational Gaps in Homeownership

Now we're is that pension you've been ignoring all year

NY Times - The 60/40 Portfolio Is Alive and Well

ㅤㅤㅤ

Stay informed throughout the day with our new commentary channel (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

ㅤㅤㅤ

ㅤㅤㅤ

ㅤㅤㅤ

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

The dichotomy between the commentary and the data is quite remarkable. of course, nobody has clear eyes on the future, so I guess it makes sense, but I cannot recall both sides of the story being so adamant about their side before. usually there was some hedging