Consensus:

Rates unchanged

QT unchanged ($60bln Tres and $35 MBS)

Press conference message: Data dependent, neutral bias, growth better than expected and inflation continues to fall towards its 2% target faster than expected

Will JPow outline the conditions for rate cut?

There's a risk that tonight will be relatively tame, making NFP on Friday and CPI on Feb 13th are more important events in the lead up to the March meeting.

Dovish Surprise?

How can JPow build market expectations for a March rate cut?

Taper the taper, slow down QT programme or open the door for it to be ended early in March.

Hawks:

Financial conditions have eased significantly since late last year (although he didn’t say this in Dec)

There is simply too much growth to cut, as the economy is still growing close to trend. A cautious Fed, with new voters leaning more hawkish see little reason to prepare the market for a March cut, instead Powell will leave it to the Q1 inflation data.

They're in no rush to ease as financial conditions are softening and the 75bps of easing in the Dec dots is sufficient to guide real rates lower as inflation returns to target over the course of 2024.

Statement Changes -

BNY - FOMC Preview: No Answers, Plenty Of Questions

In the past, the Committee has referred to “...the extent of any additional policy firming that may be appropriate...” We expect less of an emphasis (perhaps even omission altogether) on potential “policy firming” and a more two-sided description of the potential rate path.

ING - Federal Reserve to downplay chances of imminent action while holding rates steady

Continuing talk of rate hikes in the press statement is not going to look particularly credible to markets.

The Fed could choose to go back to its previous stock phraseology (used in January 2019 when it held policy steady after it had hiked rates one last time in December 2018) that “in determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realised and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective”.

The Morning Hark - 31 Jan 2024

The Fed has a communication issue with the statement still alluding to potential further hikes. Will they dare strike a line through “any additional policy firming that may be appropriate” will be data dependent? Would this set the market off to the races again? Keep it in and March looks likely to be off the agenda but take it out and March is seen as a “live” meeting.

They drummed Goolsbee, Harker, Logan and Kashkari off and whistled back on Mester, Barkin, Bostic and Daly to the voting members boat. On that basis the 4 we lost, at the margins and as a group, were fairly centrist the four replacements are more on the hawkish side of the debate. On that basis don’t be surprised to see a more hawkish slant to the statement.

Growth / Jobs Data

ING - "March interest rate cut looked too soon to us given strong growth and the tight jobs market, so the recent Fed official commentary downplaying the chances of an imminent move hasn’t come as a surprise."

JPM AM - Too Much Growth for Early Easing

Disinflation...

- - Will we see a Dovish Stance?

From the (PCE) report this past Friday, inflation over the past three and six months is running below 2% (annual rate) - below the Fed's target.

Torsten Slok - Apollo Academy Daily Spark

Soft landing / Goldilocks priced in everywhere but probability of hard or no landing is not zero

- - Macro Notes Jan 30

... recent spikes in global energy prices and shipping costs along with strong consumer spending data are creating some new pipeline inflationary pressures. Furthermore, the recent easing in financial conditions is now providing a solid tailwind to the housing market. If they are too dovish, they risk easing conditions further, possibly pushing inflation back up.

DB via The BondBeat -

"recent lower inflation rates are driving real yields up, and this implied tightening will at some point need reversing. But against this tightening, there is also a stimulatory impact from lower inflation. As inflation slides it i) boosts real disposable income ii) adds to the growth of real money balances; and, iii) supports real wealth if asset inflation is running ahead of goods and services inflation. So which effect should the Fed be emphasizing and what is the impact on markets? "

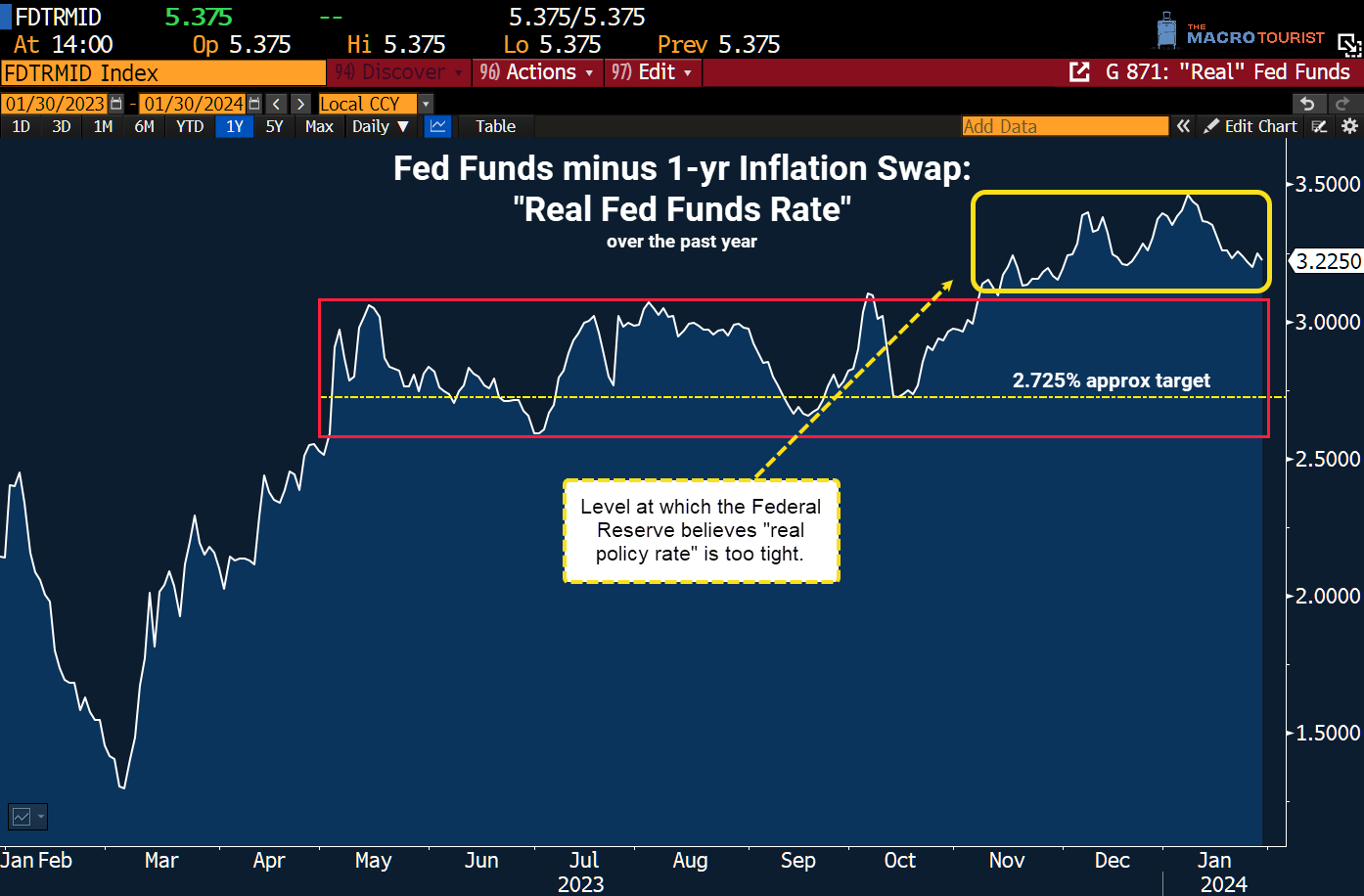

- The MacroTourist - THE FED IS NOT CUTTING BECAUSE THE ECONOMY IS WEAK

Fed Funds minus 1-yr inflation swaps

Source - The Macro Tourist

QT

Will QT be mentioned in the statement or "only" by JPow in the statement?

Dallas Fed's Logan addressed the topic in a recent speech (link)

BNYM - the statement could reference the Fed’s openness to “adjusting” balance-sheet normalization in response to changing economic and financial conditions.

Reuters - Fed meeting likely to see start of debate over ending balance sheet contraction

The scars from September 2019 – the last time the Fed ran off its balance sheet – run deep for a number of policymakers, and they’ll want to take steps to avoid a replay.

Evercore ISI, Barclays Capital, J.P. Morgan, Jefferies and TD Securities look for the Fed to announce a plan to slow QT at its March meeting and to begin implementing it quickly, likely at the May meeting

ING - It’s likely the Fed formulates a plan to slow the pace of QT over the second half of the year, as by mid-year we expect to see the reverse repo balances pretty close to zero. Maybe cut it by a third for starters. We’d then be on a glide path over the second half of 2024 where bank reserves would begin to ease lower. We’d then expect QT to have concluded by year-end. Over to the Fed to see how they deal with it.

DB via The BondBeat - Remember that the market is usually wrong about the Fed… will they be more accurate this time?

What's in the price?

Source: The Bitcoin Layer - 'Twas The Night Before Fed Day

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Sources

Discovered on Harkster.com

A further Ten Fed Previews that have arrived in our curated channel on Harskter.com

Bloomberg's Simon White via ZeroHedge - The Fed’s Independence Was Nice While It Lasted

Yardeni Research - What Will Powell say?

Economic Policy Institute - Don't wait on growth - the Fed should cut rates at this week's meeting

Saxo Markets - FOMC Preview: the Fed might be on hold, but easing is inevitable

Fedguy.com - Passing the Buck

ZeroHedge - Treasury-Refunding Has More Market-Moving Potential Than Fed

Employ America - January 2024 FOMC Preview

Global Macro Monitor - Can The Fed Cut Rates w/ Financial Conditions So Easy?

- - Currency Levels Jan 31

Fidenza Macro by

- The case for more Fed cuts and lower yields

Subscribe at WWW.HARKSTER.COM

Stay informed throughout the day with our new commentary feed (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

The short answer is NO.....

Excellent article !!!!