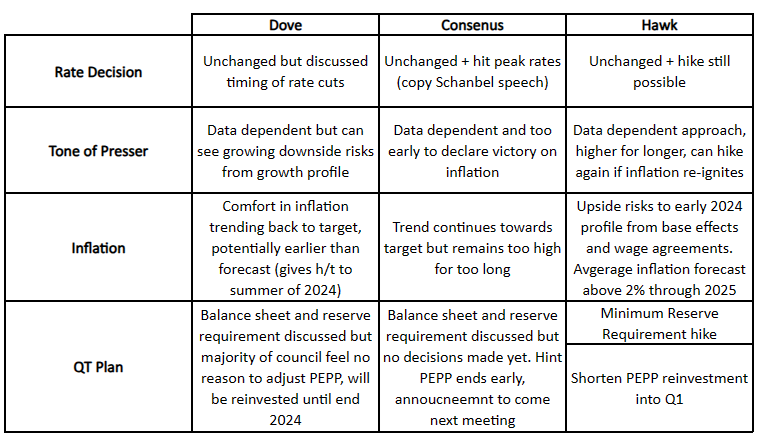

Consensus - incremental change in rhetoric but Lagarde doesn't go as far as the dovish market pricing (which the ECB already sees as excessive).

She will move away from "Higher for Longer", and closer to Schnabel's recent comments (terminal reached, potential for cuts in the middle of next year). Discussion of cuts at this stage is premature, ECB to remain focused on bringing inflation back to target and not rush to premature conclusions based on short term market developments. With March already 60-40% in favour of a cut, is the bar too high for a dovish surprise? Even if Lagarde was to endorse some cuts next year, could she really add substantially to March pricing?

Conversely, why should she wait to indicate cuts are coming, the economy has slowed sufficiently in key states, German fiscal situation is mirky, the market has priced for 5 cuts, why argue? Is it credible to continue along a "higher for longer" path, is it good risk management in the face of aggressive mkt pricing to wait to indicate cuts are coming with inflation potentially sub 2% before the end of the school summer holidays.

How have the ECB guided us towards tomorrow's meeting, what have they said?

Lagarde - "weakening of inflationary pressures to continue, even though headline inflation may rise again slightly in the coming months, mainly owning to some base effects"

Lagarde - "We need to be attentive to the different forces affecting inflation: the unwinding of past energy shocks, the strength of monetary policy transmission, the dynamics of wages and the evolution of inflation expectations."

Schnabel - no more hikes, inflation developments have been encouraging, opened the door to cuts by mid 2024.

Kazak - "science fiction" to consider cuts

Villeroy - cuts "may arise in 2024 but not now"

Lane - stay the course until we see wage data early next year

Wunsch - "Is it a problem if everybody believes we're going to cut? Then we have a less restrictive monetary policy and i'm not sure that then it's going to be restrictive enough. So it increases the risk that you have to correct in the other direction."

Is inflation coming back to target?

The market believes so, 2year inflation swaps are fixing around 1.8% and from next summer, headline inflation could already be back sub 2%.

Thus, Lagarde should be comfortable saying, further progress has been made to return price stability to 2% target. Afterall, we've had 3 successive months of inflation figures surprising to the downside (headline now 2.4% YoY).

The last statement referred to inflation as “expected to stay too high for too long” but given the recent data trend, look for ECB to soften this language.

However, there is still elevated uncertainty around the medium-term outlook for inflation. Core at 3.6% YoY is still too far above the ECB's target and inflation risks are not yet tilted to the downside. (Livesquawk - Sharp Drop In Eurozone Inflation Fuels Speculation Of Spring ECB Rate Cut)

It is too early to declare victory, prudent risk management that interest rates will still need to be 'maintained for a sufficiently long duration'

Discussion of cuts is premature. There will be no endorsement of the market's excessive dovishness.

Is there a risk that the ECB's staff inflation forecasts do not come down as low as the markets?

Saxo Bank - "A tight labor market will remain concerning for the ECB when looking at inflationary pressures in the eurozone. Unemployment remains at 6.5%, the lowest on record. Despite wage pressures starting to ease, they remain above 5% (compensation per employee), too high to ensure a return to the ECB inflation target of 2%. That’s why policymakers might not be rushing to dovish rhetoric this week and will instead want to stay on hold for longer, putting under scrutiny next year's rate cuts currently priced markets."

PEPP reinvestment plans ...

It is still early in the process so we're unlikely to see a firm decision tomorrow, with most analysts expecting the March staff forecast round to allow for a PEPP announcement. Lagarde will most likely confirm the discussions have started. She has already told the market that the PEPP program will need to be re-examined in the “not too distant future."

Livesquawk - "Analysts were of two minds about whether the bank is ready to discuss plans for bringing forward the end of reinvestments from its Pandemic Emergency Purchase Program. Some predict a definitive announcement on Thursday, with others saying officials will wait until next year to provide details about the final steps."

Saxo - "if PEPP is discussed at this meeting, it will not only provide a floor in terms of how early pre-emptive interest rate cuts may come, but it might also come as a blow to the periphery. Suppose policies to end reinvestment under the PEPP are implemented as early as January 2024. In that case, a pre-emptive cut is unlikely to happen at the next monetary policy meeting in March. That should be enough for markets to push the probability of the first rate cut to April or June."

What's in the price?

Cuts cuts and more cuts - First full cut by April, March at 60% chance, 5 in total in 2024.

Source: ING

Decision Tree:

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Sources

Discovered on Harkster.com

Eight ECB Previews that have arrived in our curated ECB channel on Harkster.com:

ING - December’s ECB cheat sheet: A reality check for ultra-dovish expectations

Econostream - ECB Insight: No Euphoria, No Victory Lap, No Rate Cut Talk; Lagarde Attentive and Focused

Econostream - ECB Insight: Governing Council More Than Ready To Discuss QT, but Is Lagarde?

Livesquawk - ECB Set For Second Straight Hold As Markets Wait For Dovish Pivot

Pepperstone - Playbook For The December ECB Decision

Nordea - ECB Watch: Shortcut

Stay informed throughout the day with our new commentary feed (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.