Harkster Preview - BoE Decision Tree (Sept 20)

Today’s focus... Did the drop in CPI materially change the BoE’s terminal rate?

Consensus has changed on the eve of the CB meeting after today's inflation miss. The 10-15bps rally across the front end of the curve has drastically changed market expectations for tomorrow's meeting. According to Bloomberg's WIRP GB, there is now a

50-50 chance of a hike (down from 80/85% yesterday)

1 hike now left in the curve by year end having been closer to 1.5 when the market expected CPI to come in hotter following the Canadian print, rising energy prices, and rent renewals.

Terminal has slipped to 5.4% (down from yesterday's 5.55%)

Their first cut has been brought forward from Q3 next year to June

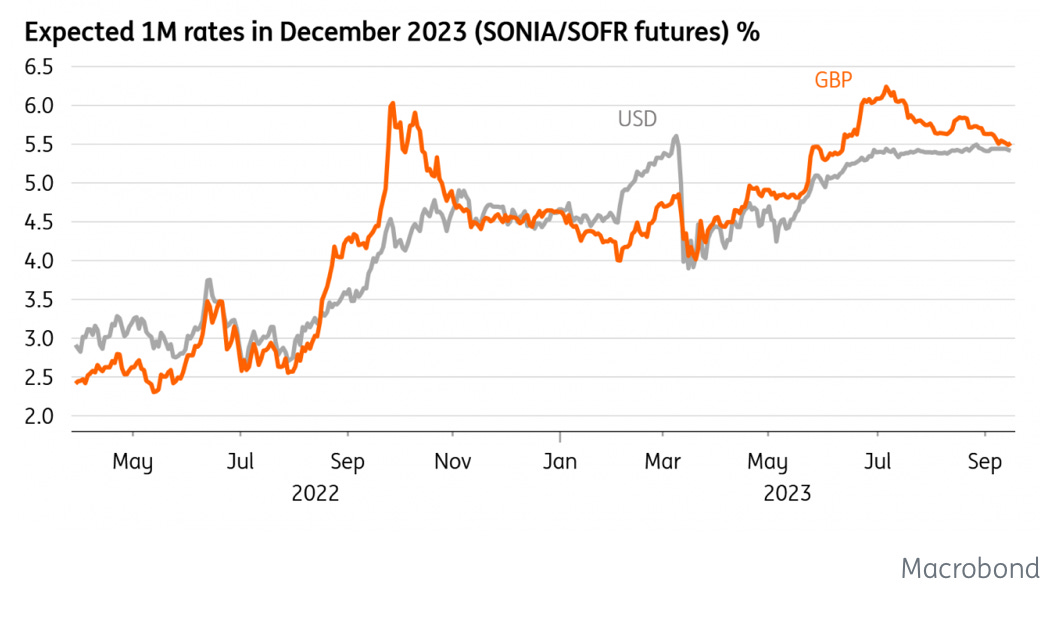

What a few months we've had, it was only July when the market was pricing in four more rate hikes and a terminal price > 6.25%. As ING / Macrobond demonstrate, markets have aggressively lowered their BoE expectations during Q3.

Where do we go from today's CPI miss? .... Dhingra vs Bailey vs Mann

Dhingra leads the dovish camp, rates have already risen too far and there is a clear risk of over tightening.

Bailey's speech to the Treasury select committee has set wheels in motion for the market to consider that we're "near terminal" and to be prepared for a pause. Leading indicators, housing and activity are all waning but even though the market is cheering today's CPI miss and rates have rallied, the prospect of a softer landing, slowing untethered rate hikes from Bailey & Co is a positive for activity as the maturity wall gets a little lower to traverse.

But Mann still has a point, inflation is at 6.7%, the street may have missed the forecast, but the simple fact of the matter is wage pressures and sticky core inflation are becoming embedded, and inflation is well above the BoE's target / mandate. ONS said the headline figure was driven by falls in "often-erratic" cost of overnight accommodation (no Taylor Swift concert in the data???) and airfares, as well as food prices rising by less than the same period a year ago. If BoC's Kozicki can say yesterday's surprise was simply a "choppy data" series, can the BoE conclude anything different, just because today's print was in their favour doesn't mean their reaction function can be any different.

Will they pause and leave another hike on the table later this year? Or will they hike and follow the ECB's path and indicate that they're done. Either way the focus should not simply be on whether they hike or not tomorrow but where they see terminal rates. Furthermore, BoE's Pill gave the market a vivid picture of a "table top" or "table mountain" profile to demonstrate their higher for longer message and preference over a 'Matterhorn' like peak followed by quick cuts.

BNY's Geoff Yu points out the strength in the labour market as well as higher input energy costs as key reasons to support one last 25bps hike and follow the ECB to "done" status. The forward-looking employment indicators do not point too any strong deceleration in the labour market. The lack of ‘deceleration’ means the MPC will likely repeat its assertion from August that services inflation is “projected to remain elevated at close to its current rate in the near term”. Despite the soft headline CPI for August, the more services-exposed RPI numbers are still quite robust. Accordingly, the same price arguments made in the previous meeting continue to stand. This means there is very little justification for the BoE to hold rates, especially considering the new risks emanating from energy prices.

Finally, QT ... a one off at the September meeting designed to pre-warn expected supply, expectations are for the £80bln (34bln sales and 46bln maturing gilts) to be increased for next year as it had no "material impact" on the market. FT reports Dep Gov Ramsden comments indicating the sales had no material effect on borrowing costs because the amount was small compared with the government's £252bln gross financing requirement this year.

Harkster BoE Decision Tree:

If you found this preview useful, please give it a ‘Like’ at the bottom of the page. It only takes a few seconds and helps our free commentary reach a wider audience. 🙏

Steno Research: 5 Things We Watch - Fed, BoE, energy, GDI/GDP & BoJ

MacroHive: BoE Preview: A Final Hike?

BNY Mellon: Labour Market Preventing BoE Pause

ING: Why the Bank of England might not raise rates on Thursday

Notayesmanseconomics: The BoE should not raise interest-rates this week

FT: Bank of England expected to raise interest rates to 5.5%

Stay informed throughout the day with our new commentary feed (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

ㅤㅤㅤ

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

The Medicine doesn't always taste good...

But we must get back to 2 %...

Soft Landing still very possible....

Consumers must tighten their belts and not be over leveraged.

I wish the US Gov't would do the same, but I doubt it...

Interest Rates to stay Sticky High...4.3 - 4.75 % 10 year

FED did and said the Right Things.....Higher for Longer is here.....