Harkster ECB Preview - Mar 06

Today’s focus... Everyone is focused on a dovish surprise

Consensus: Marking time at 4%?

The story is growing, bubbling that Eurozone inflation is reducing faster than the US and of course growth is stagnant in Germany as boom times remain in the US. As a result, there is a natural bias to the ECB previews to suit the EUR bears narrative, with many participants hoping for a more dovish policy meeting tomorrow. Downside reductions to inflation and growth forecasts accompanied with Lagarde's verbal cue's increasing the chance of an April cut (especially if the GC talked about the conditions for a cut).

However, with sticky inflation remaining a key concern, inflation credibility also a focus of the GC, the risks tomorrow is the ECB are not as dovish as expected and stick to a June cut window. In particular, with services inflation pressures appearing globally and Q1 Eurozone wage data yet to be seen, the ECB will most likely repeat their "data dependent", wait and see approach and leave the mkt firmly guided towards a June cut even if the latest round of staff forecasts indicates downside risks to inflation. Thus, we should expect Lagarde to preserve optionality and steer clear of pre-committing to a specific date.

With the rate decision and statement expected to remain unchanged, the dovish risks lie in the staff inflation forecasts.

Look for the statement to reiterate... rates will remain at “sufficiently restrictive levels for as long as necessary”.

Lower gas prices and faster than expected disinflation will lead to significant staff downgrades.

The inflation outlook will mirror the existing base case: 2024 is a year of transition and the inflation target will be met in 2025.

A crucial part of the inflation outlook wage growth is still missing

Growth is starting from a softer than expected place and with Germany struggling, it will remain an anchor, a drag on the region's recovery along with the headwinds from #1. Middle East tensions, #2. Ukraine war and #3. China's well-advertised deflationary spiral which will also weigh on the regions export sector. As a result, risks to the growth outlook remain tilted to the downside.

2024

Any signs that inflation could reach 2% earlier than the third quarter of next year would open the door to earlier rate cuts.

Growth anemic < 0.5%

2025

Revised lower to 2.0% from its present 2.1%

Always the optimist, longer run growth to trend back to 1.5% in 2025

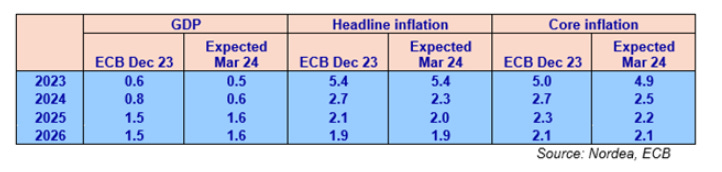

Nordea - Revise down both the GDP and inflation forecasts in the March round.

The downward revisions are also supported by the downside surprises in the data, which implies that we expect the largest revisions to take place near term, while in the longer end of the projection horizon the staff view may not change considerably.

Clear focus in the literature for a dovish surprise

It will be extremely interesting if Lagarde was to declare that interest rate cuts have been discussed. The accounts for the last meeting indicated it was premature. In particular if she said further data is required before the process begins but the discussion of "how and when" to normalize is underway.

ING - were the members to say “had a first discussion on preconditions for rate cuts” or “we decided to start this discussion at the next meeting”, this would mark a further shift in the direction of policy easing

The market will be hunting for hints in her communique to suggest that an April cut is becoming more likely

Will the ECB come up with a comprehensive set of clearcut preconditions for a rate cut?

Hawks are watching "sticky services" inflation

FT - High services inflation has some way to go and officials should be cautious about timing interest rate cuts. In February services prices in the Eurozone rose 3.9%, only a slight dip from the consecutive 4 per cent rises in each of the previous three months.

ING - Central banks will remain in a holding pattern for the coming months, and the slowing progress on bringing down inflation still exerts upward pressure more generally on rates for now to keep them in elevated ranges.

Nordea's Hawkish scenario: The forecasts show that inflation is still clearly above the target, while Lagarde virtually rules out an April move. She suggests that not even a summer cut is a done deal, unless Q1 labour market data confirm receding inflation pressures.

ING’s Decision Tree:

What's in the price?

Pepperstone (Forecasts in focus) - "EUR OIS prices no change of any shift this month, while pricing just 5bp of easing for the April meet, with the first 25bp cut fully priced for June; in all, the curve seems relatively accurately priced for the base case outlook, particularly after February’s hotter-than-expected CPI figures.... around 104bp of cuts in total this year"

👏 If you found this briefing helpful, please show the desk some appreciation by giving it a ‘Like’ or a ‘Comment’ at the bottom of the page.

Top Sources

Discovered on Harkster.com

ING - March’s ECB Cheat Sheet: Decoding rate cuts conditionality

Raiffeisen - Fragile optimism

Saxo Bank - ECB preview: European sovereign bond yields are likely to remain rangebound until the first rate cut.

Credit News - How the ECB lost $1.4 billion

Steno Research - MAJOR TRADEABLE GAP OPENING BETWEEN GERMANY AND THE US

Econostream - Exclusive: ECB Insider: Expect Forecasts for Inflation to Be Cut This Year and Maybe Next

Econostream - ECB’s Šimkus: ‘Don’t See Anything Wrong’ in Starting to Discuss Rate Cut Preconditions in March

BIS - Sectoral price dynamics in the last mile of post-Covid-19 disinflation

FT - Sticky services inflation emboldens ECB to resist calls for rate cuts

LiveSquawk - ECB Likely To Hold Rates At Least Twice As Decline In Inflation Slows

Stay informed throughout the day with our new commentary feed (‘Intraday Market Colour’) highlighting key notes, topics du jour, and HarksterHQ’s market updates around key data points and headlines.

Available on the Harkster Research Platform.

The information provided in this post is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.